Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686531

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686531

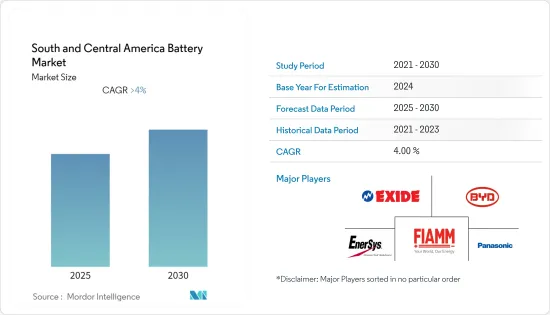

South and Central America Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The South and Central America Battery Market is expected to register a CAGR of greater than 4% during the forecast period.

The COVID-19 outbreak negatively impacted the market in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, major factors driving the South and Central American battery market include declining lithium-ion battery prices, increasing adoption of electric vehicles, and the growing renewable energy sector. Increasing demand from data centers is also likely to drive the market as data centers are evolving digital infrastructures for cloud services. The next generation of cloud service may be adopted to incorporate a blockchain network.

- On the other hand, the demand-supply mismatch of raw materials is likely to hinder the market's growth.

- Increasing the growth in data centers and economic development in countries like Brazil and Argentina for commercial infrastructure are expected to create immense opportunities for the South and Central American battery market.

- Brazil is expected to dominate the market in South and Central America due to the rising demand for consumer goods and increasing investments in the country.

South and Central America Battery Market Trends

Lithium-ion Batteries to Dominate the Market

- In the early stages of the lithium-ion battery industry, the consumer electronics sector was the major consumer of batteries. However, in recent years, electric vehicle (EV) manufacturers have become the biggest consumers of lithium-ion batteries due to the growing sales of EVs.

- EVs do not emit CO2, NOX, or any other greenhouse gases and, hence, have a lower environmental impact compared to conventional internal combustion engine (ICE) vehicles. Due to this advantage, many countries are encouraging the use of EVs by introducing subsidies and government programs.

- In July 2022, the Brazilian government issued an executive order to relax the rules on lithium export. Currently, Brazil accounts for 1.5% of global production of lithium-ion, and two companies are operational in the region, i.e., CBL and AMG Brazil.

- In November 2022, Argentina announced its plans to begin operations at its first lithium battery plant after the necessary equipment arrived in the city of La Plata from China. The plant will be constructed by Universidad Nacional de La Plata (UNLP), YPF-Tecnologia (Y-TEC), and the National Scientific and Technical Research Council (CONICET), with the support of the Ministry of Science, Technology, and Innovation.

- Owing to such factors, lithium-ion batteries are expected to dominate the South and Central American battery market during the forecast period.

Brazil to Dominate the Market

- Brazil is one of the largest markets for consumer batteries, mainly due to the high demand for consumer goods. The demand for consumer electronics in Brazil is increasing, which may offer a significant boost for the market studied.

- In Brazil, the major supplier countries for primary batteries include China, the United States, and Germany. The import value of primary batteries in Brazil is way higher than the export, which signifies the high dependency on imports to meet the requirements of primary batteries. Distributor networks and channel partners of overseas manufacturing firms cater to the demand for primary batteries in Brazil.

- The battery demand in Brazil is boosted by the demand for electricity, which is anticipated to register a growth rate of about 2.7% during 2014-2024, leading to an increasing requirement of standby sources of electricity.

- The Rota 2030 program is aimed at improving energy efficiency in the transportation sector, which is a major boost for the Brazilian electric vehicle market. The surge in the deployment of electric vehicles is likely to provide a significant impetus to the Brazilian battery market during the forecast period.

- As of February 2022, AMG Mineracao, a Brazilian subsidiary of Dutch Advanced Metallurgical Group (AMG), had an annual lithium production capacity of 130 thousand metric ton of concentrate in Brazil. Meanwhile, Sigma Mineracao, part of Canada-based Sigma Lithium Resources, had planned a capacity of 220 thousand ton of concentrate in its complex at Grota do Cirilo.

- In April 2022, Brazilian mining company CBMM announced its plans to start using technology it developed with Toshiba to supply niobium battery cells for fast-charging electric motorcycles. Toshiba is planning to produce 4,000 battery cells to validate the technology with the end user.

- Therefore, due to such factors, Brazil is expected to have a positive impact on the battery market in South and Central America during the forecast period.

South and Central America Battery Industry Overview

The South and Central American battery market is moderately fragmented. Some of the major players (in particular order) include Exide Industries Ltd, BYD Company Ltd, FIAMM Energy Technology SpA, Panasonic Corporation, and EnerSys.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 52300

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Battery

- 5.1.2 Secondary Battery

- 5.2 Technology

- 5.2.1 Lead-acid Battery

- 5.2.2 Lithium-ion Battery

- 5.2.3 Other Technologies

- 5.3 Application

- 5.3.1 Automotive

- 5.3.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.3.3 Consumer Electronics

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Colombia

- 5.4.4 Rest of South and Central America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 BYD Company Ltd

- 6.4.2 Duracell Inc.

- 6.4.3 EnerSys

- 6.4.4 Panasonic Corporation

- 6.4.5 Saft Groupe SA

- 6.4.6 Exide Industries Ltd

- 6.4.7 Clarios

- 6.4.8 FIAMM Energy Technology SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.