Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686263

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686263

Industrial Demand Response Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 150 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

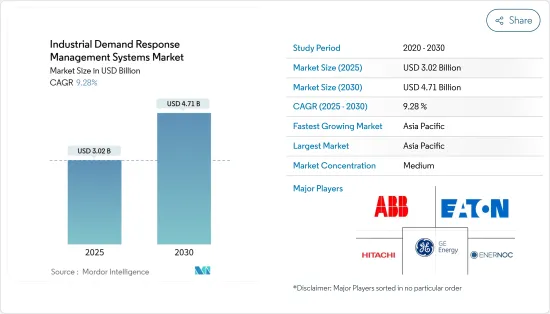

The Industrial Demand Response Management Systems Market size is estimated at USD 3.02 billion in 2025, and is expected to reach USD 4.71 billion by 2030, at a CAGR of 9.28% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the need for efficient energy management systems and the growing penetration of renewable energy sources are expected to drive the market

- On the other hand, privacy concerns about industrial demand response management systems are expected to hamper the market's growth.

- Nevertheless, the rising adoption of smart grid technologies is expected to be a significant opportunity for the market in the forecast period.

- Asia-Pacific is expected to have a significant share of the market due to the increasing adoption of renewable energy sources.

Industrial Demand Response Management Systems Market Trends

Automated Demand Response Management System is Expected to have Significant Share

- At a pivotal moment, the Automated Demand Response Management System (ADRMS) market is witnessing the initial deployment of ADRMS, albeit on a limited scale and incentivized for customers, all while relying on diverse communication systems. Looking ahead, these systems hold the potential to disrupt the electricity landscape. ADRMS not only promise cost optimization for both utilities and consumers but also empower policymakers and utilities. With ADRMS, they can craft intelligent strategies for grid modernization, set achievable targets, and devise robust solutions to counter global warming's impacts.

- Investment in grid modernization and smart grid systems is on the rise, signaling a pressing need for deployment in the near future. Developed markets, including the U.S., Japan, and Germany, alongside emerging giants like China, are becoming prime arenas for large-scale ADRMS implementation. This surge is driven by renewable integration programs and a concerted push towards efficient electricity systems.

- In a notable move, Tata Power, in partnership with AutoGrid, rolled out an AI-centric energy management initiative in Mumbai. This program, targeting Tata Power's diverse clientele, aims to tackle peak demand issues, resonate with India's clean energy ambitions, and bolster Net Zero objectives.

- In another significant collaboration, Honeywell and Enel, in May 2024, sought to enhance energy savings through automated demand response systems. Their partnership allows Enel North America's FlexUp solutions to seamlessly integrate with Honeywell's automation systems. Enel's FlexUp not only finances businesses' automation endeavors but also boosts their participation in demand response programs, rewarding them for reducing electricity use during peak times.

- As of March 2024, the U.S. led the world with 5,381 data centers, followed by Germany with 521 and the U.K. with 514. Many governments view energy efficiency as pivotal for demand response. By endorsing and financially backing energy efficiency efforts, they incentivize consumers, fostering active engagement in demand response initiatives.

- In December 2024, Energy Vault and RackScale Data Centers forged a strategic alliance, eyeing a 2GW power allocation for data centers. Their focus is on the B-Nest infrastructure, boasting a capacity of 2 GW/20 GWh. This collaboration not only accelerates their portfolio expansion but also opens avenues for revenue through demand response partnerships with local utilities. By engaging in these demand response events, particularly during peak periods, RackScale Data Centers bolster grid stability, aiding local utilities in their renewable energy integration endeavors.

- Given these developments, the Automated Demand Response Management System segment is poised to capture a substantial share of the Industrial Demand Response Management Systems Market.

Asia-Pacific to Witness a Significant Growth

- The market for industrial demand response management systems in the Asia-Pacific region is expected to witness significant growth during the forecast period.

- China is making increasing efforts to implement demand-side management (DSM) programs as a means of reducing peak electricity demand and matching renewable energy with demand. In addition to reducing emissions, integrating renewable energy sources, shaving peak power, improving load factor, and pursuing net zero energy, these efforts are motivated by the country's commitment to address multiple challenges.

- China also has one of the world's largest oil & gas refining capacities. In 2023, it had an oil refining capacity of about 18,484 thousand barrels per day, witnessed a 7% increase from 2022. Besides, China contributes to close to 18% of the global refining capacity. Further, the country has also been constructing new refineries and upgrading and adding capacity to older ones.

- Moreover, Power demand has increased in India owing to the economic growth, but the country's limited energy resources have resulted in overexploitation of these resources, resulting in a rise in power demand. The focus in India is shifting towards restructuring the power sector so that rather than generation adapting to demand, demand can be tailored to meet generation requirements to maintain demand-supply balance, thus reducing strain on power infrastructure.

- In February 2023, AutoGrid, a provider of virtual power plants and distributed energy management systems (DERMS), announced a collaborative initiative with Tata Power, one of India's largest integrated power companies. In addition to supporting India's clean energy transition, this pioneering program will help address peak demand in residential, commercial, and industrial areas.

- Also, by the summer of 2025, Tata Power plans to roll out a new Demand Response Management Program to serve its customers in Mumbai, India's largest city. The program will involve 6,000 large commercial and industrial customers to attain 75 MW of peak capacity decrease within the first six months and then continue to rise to 200 MW.

- Considering the development of the industrial sector in the region and the adoption of demand response programs, the region is expected to witness a massive demand for DRMS in the future.

Industrial Demand Response Management Systems Industry Overview

The industrial demand response system market is semi-fragmented. Some of the major players in the market (in no particular order) include Eaton Corporation PLC, Hitachi Ltd, EnerNOC Inc., General Electric Company, ABB Ltd., and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 51306

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, until 2030

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.1.1 Need for Efficient Energy Management Systems

- 4.4.1.2 Growing Penetration of Renewable Energy Sources

- 4.4.2 Restraints

- 4.4.2.1 Privacy Concerns on the Industrial Demand Response Management Systems

- 4.4.1 Drivers

- 4.5 Supply-Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Conventional Demand Response

- 5.1.2 Automated Demand Response

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Asia-Pacific

- 5.2.2.1 China

- 5.2.2.2 India

- 5.2.2.3 Japan

- 5.2.2.4 Australia

- 5.2.2.5 Malaysia

- 5.2.2.6 Thailand

- 5.2.2.7 Indonesia

- 5.2.2.8 Vietnam

- 5.2.2.9 Rest of Asia-pacific

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 France

- 5.2.3.3 United Kingdom

- 5.2.3.4 Italy

- 5.2.3.5 Spain

- 5.2.3.6 Nordic

- 5.2.3.7 Turkey

- 5.2.3.8 Russia

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Chile

- 5.2.4.4 Colombia

- 5.2.4.5 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Qatar

- 5.2.5.5 Egypt

- 5.2.5.6 Nigeria

- 5.2.5.7 Rest of Middle East & Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Schneider Electric SE

- 6.3.2 Siemens AG

- 6.3.3 Hitachi Ltd

- 6.3.4 Mitsubishi Electric Corporation

- 6.3.5 ABB Ltd.

- 6.3.6 Alstom SA

- 6.3.7 General Electric Company

- 6.3.8 Eaton Corporation PLC

- 6.3.9 Itron Inc

- 6.3.10 EnerNOC Inc.

- 6.3.11 Uplight, Inc.

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Adoption of Smart Grid Technologies

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.