PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906991

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906991

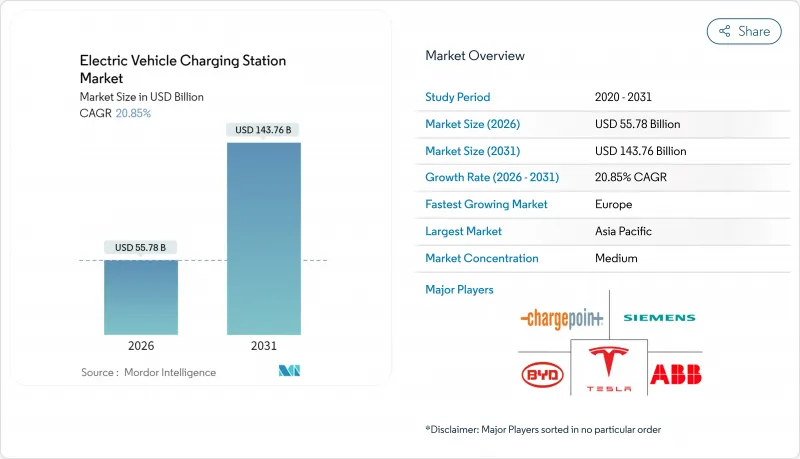

Electric Vehicle Charging Station - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Electric vehicle charging station market size in 2026 is estimated at USD 55.78 billion, growing from 2025 value of USD 46.13 billion with 2031 projections showing USD 143.76 billion, growing at 20.85% CAGR over 2026-2031.

Continuous policy pressure to phase out internal-combustion engines, steep battery cost declines that bring total ownership parity forward, and the roll-out of highway fast-charging corridors that neutralize range anxiety are the core forces keeping demand on a steep climb. Large fleet operators are locking in multi-year electrification targets, guaranteeing high charger utilization, while vehicle-to-grid business models create additional revenue layers that lift project returns. Asia-Pacific still accounts for most installations, but Europe now supplies the fastest incremental growth on the back of cross-border network alliances. In North America, the NEVI Formula Program and the opening of Tesla's Supercharger system to other brands accelerate deployment while raising baseline technology expectations. Meanwhile, energy majors like Shell are closing petroleum stations and reallocating capital toward high-power chargers, signaling a strategic shift that tightens competitive intensity.

Global Electric Vehicle Charging Station Market Trends and Insights

Government-backed Zero-emission Mandates and ICE-ban Timelines

Regulatory momentum accelerates charging infrastructure deployment as governments implement binding zero-emission vehicle mandates with specific charging capacity requirements. The EU's Alternative Fuels Infrastructure Regulation mandates that member states increase charging capacity proportionally to EV registrations. At the same time, California's Advanced Clean Fleets Rule requires public and private fleet operators to transition to zero-emission vehicles by sector-specific deadlines. China's National Development and Reform Commission expanded highway service area charging infrastructure by adding 3,000 charging piles and 5,000 parking spaces in 2024, supporting the country's 40.9% new energy vehicle market penetration. Saudi Arabia's commitment to 50,000 charging stations by 2025 and the UAE's target of 50% electric or hybrid vehicles by 2050 extend regulatory pressure to emerging markets. These mandates create predictable demand signals that justify private capital deployment in charging infrastructure, reducing investment risk and accelerating market expansion.

Falling Battery $/kWh Driving TCO Parity

Battery cost reductions approach the critical threshold where electric vehicles achieve total cost of ownership parity with internal combustion engines, catalyzing charging infrastructure demand. Lithium-ion pack prices now edge below USD 100/kWh in leading procurement contracts, helping electric cars reach cost parity with petrol equivalents in usage-heavy segments. Component innovations such as silicon-carbide inverters raise charging efficiency and lower energy losses, allowing operators to serve more vehicles per installed kilowatt. Cheaper batteries also enable swap-station models that spread capex across fleets, broadening service formats within the electric vehicle charging station industry. The convergence of falling battery costs and improved charging efficiency creates a compounding effect where reduced charging times and lower infrastructure utilization requirements accelerate deployment economics. Commercial fleet operators particularly benefit from this dynamic, as reduced battery costs enable smaller, more frequent charging sessions that optimize operational flexibility.

High Upfront CAPEX for More Than 150 kW Chargers

Capital expenditure requirements for high-power charging infrastructure create deployment barriers, particularly for independent operators and emerging markets. The P3 Group analysis of European eTruck charging infrastructure forecasts 45,000 public and 235,000 depot charging points needed by 2030, with high initial capital expenditures and lengthy approval processes for grid expansions identified as primary challenges. The California Energy Commission research demonstrated that DC fast charging stations face significant financing challenges, with potential annual savings of USD 4,300 from demand charge mitigation and USD 4,780 to USD 6,000 from solar integration required to improve viability. The deployment of megawatt charging systems, capable of delivering up to 3.75 MW for heavy-duty vehicles, requires substantial electrical infrastructure upgrades exceeding USD 1 million per installation site. High CAPEX requirements particularly constrain deployment in rural and underserved areas where utilization rates may not justify investment, creating geographic disparities in charging infrastructure availability.

Other drivers and restraints analyzed in the detailed report include:

- Global Build-out of Highway Fast-charging Corridors

- Surging Fleet-Electrification Commitments from Logistics Giants

- Uneven Permitting and Utility Interconnection Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars commanded 88.45% of the electric vehicle charging station market share in 2025, yet commercial vehicles exhibit the fastest growth at 52.20% CAGR through 2031, reflecting the infrastructure requirements for fleet electrification mandates. Buses represent a critical commercial segment where electrification accelerates due to urban air quality mandates and predictable route patterns that enable optimized charging infrastructure deployment. Two-wheelers gain traction in emerging markets where battery swapping models prove economically viable, particularly in India. Trucks require the most sophisticated charging infrastructure due to weight constraints and operational demands, driving innovation in high-power charging systems and depot-based solutions.

Commercial vehicle electrification creates anchor demand that justifies charging infrastructure investment, as fleet operators provide predictable utilization patterns and higher power requirements than passenger vehicles. CharIN officially launched the Megawatt Charging System at EVS35 in Oslo, establishing standards for charging capacities up to 3.75 MW that enable commercial vehicles to achieve operational parity with diesel counterparts. Passenger car infrastructure benefits from commercial vehicle deployment as shared charging corridors reduce per-unit infrastructure costs and improve network utilization rates across vehicle categories.

DC charging station maintained 77.95% of the electric vehicle charging station market share in 2025, while it accelerated at 53.10% CAGR during the forecast period, driven by operator strategies to reduce charging session duration and increase throughput. Oak Ridge National Laboratory achieved a breakthrough in wireless charging technology, demonstrating 100-kW power transfer to passenger vehicles with 96% efficiency across a five-inch air gap, potentially disrupting traditional connector-based charging. AC charging below 22 kW serves primarily residential and workplace applications where longer dwell times accommodate slower charging speeds, while maintaining cost advantages for installations with lower utilization requirements. The emergence of megawatt charging systems for commercial vehicles creates a distinct ultra-high-power category that requires specialized electrical infrastructure and cooling systems.

SAE International published new standards for wireless light-duty EV charging, including the Differential Inductive Positioning System that enables cross-compatibility among different suppliers' hardware with up to 93% efficiency. Wireless charging technology addresses user convenience concerns and reduces infrastructure maintenance requirements by eliminating physical connectors that experience wear and vandalism. The transition toward higher-power charging systems reflects operator economics. Reduced charging times enable higher station utilization and improved return on investment, particularly in high-traffic locations where land costs justify premium charging speeds.

The Electric Vehicle Charging Station Market Report is Segmented by Vehicle Type (Passenger Cars, Commercial Vehicles, and More), Charger Type (AC Charging Station, and DC Charging Station), Ownership Model (Public, and More), Installation Site (Home, and More), Connector Standard (CCS, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific leads the electric vehicle charging station market with a 60.10% share in 2025, supported by China's 12.82 million public connectors and a 25% annual installation increase. National programs now equip 6,000 highway service areas, ensuring long-distance coverage mirrors the country's 40.9% new-energy vehicle sales mix. Japan pioneers megawatt systems for heavy trucks, while India's two-wheeler battery-swapping hubs show how low-cost mobility needs can accelerate charger density. South Korea is positioning itself as an alternative battery-material supplier amid trade tensions, and Australia funds remote-area corridor sites to bridge its vast intercity distances.

Europe shows the fastest regional growth at 40.50% CAGR to 2031. The Spark Alliance integrates 11,000 high-power connectors across 25 countries, offering transparent pricing and 100% renewable electricity. Germany's plan for more than 1 million new charging points by 2030 aligns with EU regulations that tie infrastructure quotas to EV registrations. Norway retains the world's highest per-capita charger count, while France uses low-interest loans to spur private deployments. UK policy bans sales of most new petrol cars from 2035 and now mandates payment-card interoperability at public chargers, further strengthening consumer confidence.

North America accelerates through the NEVI Formula's USD 5 billion funding, enabling 204,000 public ports. The seven-automaker IONNA venture will add 30,000 high-power connectors, and the retrofitting of Tesla Superchargers for multi-brand use could generate USD 6-12 billion in additional revenue by 2030. Cross-industry alliances link charging to retail amenities, mirroring European service-station strategies.

- ABB Ltd.

- ChargePoint Inc.

- Tesla Inc.

- Siemens AG

- Schneider Electric Corporation

- Shell Plc.

- ENGIE SA (EVBox)

- BYD Motors Inc.

- Tritium Charging Inc.

- Blink Charging o.

- Delta Electronics Inc.

- Kempower Oyj

- Electrify America, LLC

- IONITY GmbH

- Leviton Manufacturing Co. Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government-backed zero-emission mandates and ICE-ban timelines

- 4.2.2 Falling battery $/kWh driving TCO parity

- 4.2.3 Global build-out of highway fast-charging corridors

- 4.2.4 Surging fleet-electrification commitments from logistics giants

- 4.2.5 Grid-services monetisation (V2G/V2X) business models

- 4.2.6 AI-optimised charger siting improving utilisation rates

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX for More Than 150 kW chargers

- 4.3.2 Uneven permitting and utility interconnection timelines

- 4.3.3 Raw-material bottlenecks for SiC MOSFETs

- 4.3.4 Cyber-security vulnerabilities in networked chargers

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.1.3 Buses and Coaches

- 5.2 By Charger Type

- 5.2.1 AC Charging Station

- 5.2.2 DC Charging Station

- 5.3 By Ownership Model

- 5.3.1 Public

- 5.3.2 Private - Residential

- 5.3.3 Private - Fleet/Workplace

- 5.4 By Installation Site

- 5.4.1 Home

- 5.4.2 Destination/Retail

- 5.4.3 Highway/Transit

- 5.4.4 Fleet Depot

- 5.5 By Connector Standard

- 5.5.1 CCS

- 5.5.2 CHAdeMO

- 5.5.3 GB/T

- 5.5.4 Tesla NACS

- 5.5.5 Wireless

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Chile

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Norway

- 5.6.3.5 Italy

- 5.6.3.6 Spain

- 5.6.3.7 Netherlands

- 5.6.3.8 Poland

- 5.6.3.9 Austria

- 5.6.3.10 Russia

- 5.6.3.11 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Indonesia

- 5.6.4.6 Vietnam

- 5.6.4.7 Philippines

- 5.6.4.8 Australia

- 5.6.4.9 New Zealand

- 5.6.4.10 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Egypt

- 5.6.5.4 Turkey

- 5.6.5.5 South Africa

- 5.6.5.7 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 ChargePoint Inc.

- 6.4.3 Tesla Inc.

- 6.4.4 Siemens AG

- 6.4.5 Schneider Electric Corporation

- 6.4.6 Shell Plc.

- 6.4.7 ENGIE SA (EVBox)

- 6.4.8 BYD Motors Inc.

- 6.4.9 Tritium Charging Inc.

- 6.4.10 Blink Charging o.

- 6.4.11 Delta Electronics Inc.

- 6.4.12 Kempower Oyj

- 6.4.13 Electrify America, LLC

- 6.4.14 IONITY GmbH

- 6.4.15 Leviton Manufacturing Co. Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment