PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849989

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849989

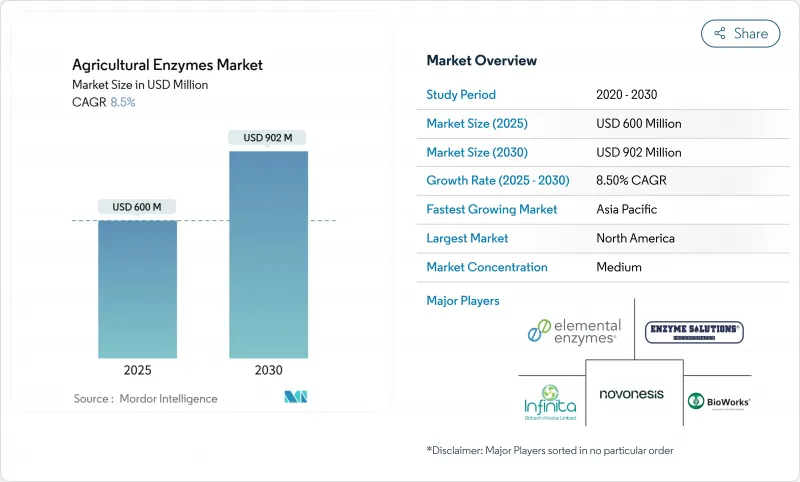

Agricultural Enzymes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Agricultural Enzymes Market size is estimated at USD 600 million in 2025, and is anticipated to reach USD 902 million by 2030, at a CAGR of 8.5% during the forecast period.

This growth reflects the tightening of regulations on synthetic chemicals, a greater consumer appetite for residue-free food, and steady advances in enzyme formulation and delivery technologies. Commercial growers in mature markets are replacing a share of conventional inputs with enzyme-based biologicals, while smallholders in Asia-Pacific are moving toward yield-boosting biologicals supported by targeted subsidy programs. Parallel advances in precision fermentation and AI-driven protein design are reducing product-development cycles, while long-term carbon-credit programs are generating new revenue streams for farmers who deploy regenerative enzyme solutions. Competitive intensity is rising as agrochemical majors strengthen biological portfolios through partnerships and acquisitions, and specialized biotechnology firms race to commercialize next-generation multi-enzyme cocktails.

Global Agricultural Enzymes Market Trends and Insights

Organic and Residue-free Food Demand

Global spending on organic produce is climbing as retailers tighten residue thresholds, and the EU Farm to Fork Strategy mandates a 50% cut in chemical pesticide use by 2030. Farmers gain 20-30% price premiums in certified organic channels, offsetting the transition costs of adopting enzymes that mobilize nutrients without chemical residues. Enzyme-embedded programs help close yield gaps in organic systems by enhancing phosphorus and nitrogen availability, fortifying plant defense pathways, and improving soil microbiome balance. Commercial orchard operators in Spain reported a 9% yield uplift after switching from phosphate fertilizers to a blended phosphatase-urease granule in 2024, demonstrating clear economic returns. Similar outcomes are now driving uptake in greenhouse vegetables across Canada, where liquid cellulase blends shorten crop cycles by improving biomass breakdown between rotations.

Biological Input Adoption Surge

Brazil now applies biological crop-protection solutions on more than 60% of cultivated land, significantly ahead of adoption rates in the EU and USA. Mounting resistance to synthetic herbicides and fungicides is accelerating the search for new modes of action, positioning agricultural enzymes as synergistic companions to biocontrol microbes. Row-crop growers in Mato Grosso logged a 4.6% corn-on-corn yield gain in the 2024/25 season after integrating a seed-treatment cocktail containing lipase and mannanase enzymes. Similar momentum is unfolding in India, where state-level subsidy programs cover up to 30% of enzyme input costs, catalyzing smallholder adoption and fueling double-digit market growth.

Fragmented Regulatory Approvals

Biological input developers still navigate divergent approval timelines, with the EU requiring multiple dossiers depending on product classification. The new US Unified Website for Biotechnology Regulation improves domestic transparency, yet global harmonization remains distant.Delays add 18-24 months to average commercialization cycles, inflating compliance costs and prompting some firms to prioritize fewer, high-value markets. Smaller innovators struggle most, often partnering with larger agrochemical companies for regulatory support, which can limit independent go-to-market strategies.

Other drivers and restraints analyzed in the detailed report include:

- Intensified Research and Development, and Product Innovation

- Seed-coating Micro-dose Delivery

- Cold-chain Gaps in Tropical Regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Phosphatases captured 37% of the agricultural enzymes market in 2024 by unlocking immobilized soil phosphorus that otherwise reaches 80% of applied fertilizer. As fertilizer prices remain volatile, demand for phosphorus-mobilizing solutions stays strong across cereals and oilseeds. The agricultural enzymes market size for phosphatases is, therefore, set to maintain a dominant revenue position through 2030. Cellulases, propelled by CelOCE and related innovations, top the growth chart at a 13.8% CAGR. These enzymes deconstruct crop residues, releasing sugars that fuel beneficial microbes and improve soil structure. Ureases, lyases, and proteases round out the portfolio, with cocktail products increasingly combining complementary activities to match complex field conditions.

The shift toward multi-enzyme blends is pronounced in high-value horticulture, where growers demand precise nutrient mobilization and stress-response enhancement in one pass. Start-ups are developing on-farm fermentation kits that allow growers to brew fresh cellulase-rich mixes, avoiding shelf-life concerns and reducing costs. Larger players integrate phosphatase-urease synergies to improve nitrogen use efficiency and mitigate volatilization in paddy fields, reflecting a broadening solution set within the agricultural enzymes market.

Liquid products retained 46.2% of the agricultural enzymes market size in 2024, primarily due to their compatibility with existing spraying equipment and efficient foliar absorption. Yet logistics costs and cold-chain dependency are steering product managers toward more temperature-tolerant technologies. Granular products, advancing at 12.4% CAGR, now embed "bioreactor-in-a-granule" architectures that stabilize enzymes for up to 24 months while enabling timed release after soil contact.

Powder formulations occupy a cost-efficient middle ground, but require dedicated mixing equipment. Hybrid water-dispersible granules blur these lines, providing liquid-like convenience with granular durability. Expect competitive differentiation to hinge on formulation versatility, particularly for companies pursuing growth in the Asia-Pacific and African tropics where cold-chain gaps persist.

The Agricultural Enzymes Market is Segmented by Enzyme Type (Phosphatases and More), by Formulation (Liquid and More), by Application (Crop Protection and More), by Mode of Application (Seed Treatment and More), by Crop Type (Cereals and Grains, Oil Seeds and Pulses, and More), and by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America, holding about 35% of the agricultural enzymes market in 2024, benefits from robust distribution infrastructure and rapid regulatory clearance for biological inputs. Canadian growers planted 11.8 million hectare of genetically engineered crops last season, creating a receptive environment for complementary enzyme programs. The US biostimulant segment is equally vibrant, with enzyme-infused foliar sprays gaining traction among almond and tomato producers.

Asia-Pacific is the fastest-growing region, on track for a 10% CAGR through 2030. India's BioAgri segment reached USD 12.4 billion in 2023, and state subsidies now cover up to 30% of enzyme costs, accelerating adoption among smallholders. Cold-chain gaps remain a material hurdle; 80% of the required capacity is still absent across India's dairy sector, prompting manufacturers to emphasize granular products. China's land-transfer reforms encourage larger farm units, improving the business case for enzyme technologies that can be applied at scale.

Europe retains a strong foothold thanks to stringent pesticide-reduction goals under the Green Deal. Biocontrol active substances climbed from 120 in 2011 to almost 220 in 2022, doubling revenue to EUR 1.549 billion in that period. South America, led by Brazil's trail-blazing 60% biological adoption, remains a mature yet expanding arena, particularly for enzyme-enhanced seed treatments in soy and corn. The Middle East and Africa show emerging promise, though growth hinges on regulatory clarity and cold-chain investment, with South Africa and the Gulf states spearheading early adoption.

- Novonesis

- Elemental Enzymes

- Enzyme Solutions Inc.

- Bioworks Inc.

- Infinita Biotech Pvt. Ltd.

- Biocatalysts Ltd

- Enzyme Development Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Organic and Residue-free Food Demand

- 4.2.2 Biological Input Adoption Surge

- 4.2.3 Intensified Research and Development, and Product Innovation

- 4.2.4 Seed-coating Micro-dose Delivery

- 4.2.5 Regenerative-Ag Carbon-Credit Programs

- 4.2.6 On-farm Enzyme Fermentation Units

- 4.3 Market Restraints

- 4.3.1 Fragmented Regulatory Approvals

- 4.3.2 Soil and Climate based Performance Variability

- 4.3.3 Cold-chain Gaps in Tropical Regions

- 4.3.4 Invisible Short-term ROI vs Chemicals

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Enzyme Type

- 5.1.1 Phosphatases

- 5.1.2 Dehydrogenases

- 5.1.3 Ureases

- 5.1.4 Proteases

- 5.1.5 Lyases

- 5.1.6 Cellulases

- 5.1.7 Other Enzyme Types

- 5.2 By Formulation

- 5.2.1 Liquid

- 5.2.2 Powder

- 5.2.3 Granular

- 5.3 By Application

- 5.3.1 Crop Protection

- 5.3.2 Fertility Enhancement

- 5.3.3 Plant Growth Regulation

- 5.4 By Mode of Application

- 5.4.1 Seed Treatment

- 5.4.2 Foliar Spray

- 5.4.3 Soil Treatment

- 5.5 By Crop Type

- 5.5.1 Cereals and Grains

- 5.5.2 Oilseeds and Pulses

- 5.5.3 Fruits and Vegetables

- 5.5.4 Turf and Ornamentals

- 5.5.5 Other Crops

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Kenya

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Novonesis

- 6.4.2 Elemental Enzymes

- 6.4.3 Enzyme Solutions Inc.

- 6.4.4 Bioworks Inc.

- 6.4.5 Infinita Biotech Pvt. Ltd.

- 6.4.6 Biocatalysts Ltd

- 6.4.7 Enzyme Development Corporation

7 Market Opportunities and Future Outlook