PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685899

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685899

Optogenetics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

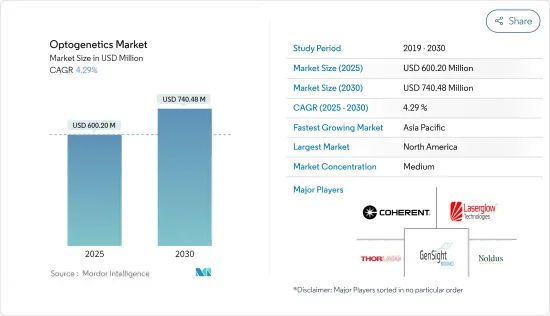

The Optogenetics Market size is estimated at USD 600.20 million in 2025, and is expected to reach USD 740.48 million by 2030, at a CAGR of 4.29% during the forecast period (2025-2030).

The major factors driving the market's growth include the scope of optogenetics as a potential diagnostic tool in neurosciences, the rapid development of advanced technologies, and the increasing use of multimodal imaging. Optogenetics technology has revolutionized neuroscience in recent years by allowing researchers to control specific neurons in experimental animals. The ability to control neurons has revealed information about brain pathways involved in diseases such as depression, obsessive-compulsive disorders, Parkinson's disease, and other conditions.

In neural research, optogenetic methods for monitoring synaptic activity have proven to be extremely useful in several neurological diseases. It allows researchers to study how the neurological activity patterns within specific brain cells give rise to thoughts, behaviors, and memories at unprecedented precision. Thus, optogenetics help in finding cures and treatments for neurological and psychiatric disorders like depression, addiction, schizophrenia, and Parkinson's disease, and is expected to drive market growth. For instance, according to the article published in the CellPress Journal in December 2023, mentioned about the protocol for the optogenetic induction of a-synuclein aggregation in human midbrain dopaminergic (mDA) neurons, which allows for an in-depth study of Parkinson's disease (PD) pathology. The aggregation of alpha-synuclein (a-syn) is a key contributor to the onset of Parkinson's disease (PD). Thus, the use of optogenetics in the studies of Parkinson's disease proved a potent tool for developing therapies for neurological diseases.

Additionally, rising cases of neurological disorders such as Parkinson's, Alzheimer's, epilepsy, and Huntington's disease may boost the market. For instance, according to the systematic review and meta-analysis published in the Lancet Healthy Longevity in July 2024, highlighted that the worldwide prevalence of Parkinson's disease was 1.51 cases per 1,000 individuals during 2023, with a higher rate observed in males (1.54 cases per 1,000) as compared to females (1.49 cases per 1,000). Additionally, according to the data published by the World Health Organization in July 2024, around 10 million individuals across the worldwide are identified with dementia every year. Thus, the high burden of neurological disorders such as Parkinson's disease and dementia are expected to boost the usage of optogenetics.

The increasing research studies conducted by the researchers for the developement of new technqiues associated with optogenetics to treat neurologica disorders is expected to bolster the market growth. For instance, in October 2024, researchers at the University of Rochester, United States developed a noninvasive approach utilizing BL-OG, or bioluminescent optogenetics, which employed light to stimulate neurons in the brain. This innovative technique holds the potential to revolutionize treatment options for neurological disorders such as Parkinson's disease by providing a safer alternative to deep brain stimulation. Thus, such advancements in neurological disorder treatments are expected to boost the adoption of optogenetics technology, thereby driving the market growth.

The rising developments by major players are also expected to boost the market's growth. For instance, in February 2023, GenSight Biologics announced the 1-Year safety data and efficacy signals from the PIONEER phase I/II clinical trial of GS030, an optogenetic treatment candidate for retinitis pigmentosa. Thus, such developments are expected to increase the adoption of optogenetics and drive market growth.

Hence, factors such as the increasing use of optogenetics for the treatment of neurological disorders, the rising prevalence of neurological diseases, the increasing research activities, and the increasing developments by key players are expected to boost the market's growth. However, a lack of awareness and the high costs of technology may restrain this growth over the forecast period.

Optogenetics Market Trends

Light-emitting Diode (LED) Segment is Expected to Hold a Significant Share in the Optogenetics Market

Light-emitting diodes (LED) surpass lasers in every aspect, as they are cheaper, smaller, more reliable, and easier to control. They are being incorporated into implants, allowing untethered light delivery. Factors such as investment in technology, product launches, and research studies in the segment are expected to drive the segment's growth.

The significant advantages and applications of LEDs are anticipated to boost their adoption for retinal disease treatment, and hence strengthening the segment growth. For instance, an article published in the Journal of Clinical Ophthalmology in January 2024, mentioned that LEDs offer several advantages over lasers, including the ability to cover larger areas at a lower cost, a reduced likelihood of causing tissue damage in humans, and a smaller risk of eye-related accidents. Photobiomodulation (PBM) is a form of phototherapy that utilizes light-emitting diodes (LEDs) to target specific wavelengths of visible light, ranging from 500 to 1000 nm and this method is considered a promising new strategy for addressing various retinal disorders, such as age-related macular degeneration, retinitis pigmentosa, and diabetic retinopathy, among others. The research studies expanding the scope of light-emitting diode (LED) may also contribute to the market's growth.

Additionally, optogenetic techniques can be applied to the peripheral nervous system through light emitting diodes, which in turn, supports the segment growth. For instance, an article published in the Journal of Smart Medicine in November 2023 stated that scientists can surgically implant light-emitting diodes around the bladders of mice to manipulate the activation of specific bladder nerves and help restore normal voiding function.Thus, due to such applications of light-emitting diodes, they are likely to be adopted and therefore contributing to the segment growth,

Therefore, factors such as the rising number of clinical trials, and the increasing R&D in neurological diseases are anticipated to boost the segment's growth during the forecast period.

North America is Expected to Hold a Significant Market Share Over the Forecast Period

North America is expected to lead the market due to the increasing use of optogenetic devices, primarily in academic and research labs, the high burden of chronic diseases in the region, and the collaborations and new product launches by key market players.

The rising prevalence of neurological diseases is also expected to boost the North American market. For instance, according to the data published by the Alzheimer Society of Canada in July 2024, more than 1.7 million Canadians will have Alzheimer's dementia by 2050. In addition, according to the above-mentioned source, more than 20,000 Canadians were expected to develop dementia every month in 2040. This shows the high burden of the disease, which is expected to increase the demand for optogenetics products.

The rising applications of optogenetics leads to increase in research studies and boosting the market's growth. For instance, in May 2024, researchers from the Massachusetts Institute of Technology created an innovative optogenetics technique that provides better muscle control and reduces fatigue. In this study, muscle contraction was controlled by optical molecular machines through optogenetics. Thus, the increase in research activities boost the adoption of optogenetics and drives the market growth in the region.

Similarly, in January 2024, researchers from the University of Massachusetts Amherst developed the dual-color optoelectronic neural probe, which is based on optogenetics and can be used to control neural activity. This device can improve and inhibit the electrical activities of the same neurons within particular brain cortical layers and enables the scientisist to invetigate the origin of brain diseases. Such studies improve the advantages of optogenetics.

Hence, factors such as the rising investment in neurological disease research and the increasing prevalence of neurological disorders along with the development of new products are likely to boost the market's growth in the region.

Optogenetics Industry Overview

The optogenetics market is semi-consolidated due to the presence of various small and large players. In terms of market share, a few of the major players are currently dominating the market. Most of these companies are involved in strategies such as investing in research and development, acquisitions, and collaborations. Some players include Hubner Group (Cobolt Inc.), Coherent Inc., Gensight Biologics, Laserglow Technologies, Noldus Information Technology, Shanghai Laser & Optics Century Co. Ltd, and Thorlabs Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Potential Diagnostic Tool in the Field of Neurosciences

- 4.1.2 Rapid Growth of Advanced Technology

- 4.1.3 Increasing Use of Multimodal Imaging

- 4.2 Market Restraints

- 4.2.1 High Cost of Technology

- 4.2.2 Lack of Awareness

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Light Equipment

- 5.1.1 Laser

- 5.1.2 Light-emitting Diode (LED)

- 5.2 By Actuator

- 5.2.1 Channelrhodopsin

- 5.2.2 Halorhodopsin

- 5.2.3 Archaerhodopsin

- 5.3 By Sensor

- 5.3.1 Calcium (Aequorin, Cameleon, and Other Calcium Sensors)

- 5.3.2 Chloride (Clomeleon)

- 5.3.3 Membrane-gated (Mermaid)

- 5.3.4 Other Sensors

- 5.4 By Application

- 5.4.1 Neuroscience

- 5.4.2 Behavioral Tracking

- 5.4.3 Retinal Disease Treatment

- 5.4.4 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Hubner Group (Cobolt Inc.)

- 6.1.2 Coherent Inc.

- 6.1.3 Gensight Biologics

- 6.1.4 Laserglow Technologies

- 6.1.5 Noldus Information Technology

- 6.1.6 Judges Scientific PLC (Scientifica)

- 6.1.7 Shanghai Laser & Optics Century Co. Ltd

- 6.1.8 Bruker Corporation

- 6.1.9 Thorlabs Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS