PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849920

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849920

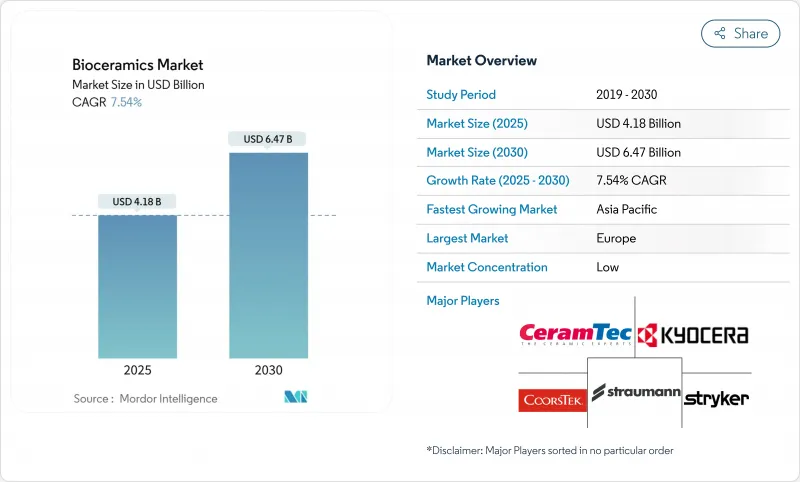

Bioceramics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Bioceramics Market size is estimated at USD 4.18 billion in 2025, and is expected to reach USD 6.47 billion by 2030, at a CAGR of 7.54% during the forecast period (2025-2030).

Rising musculoskeletal and dental procedures, wider adoption of patient-specific implants produced through 3D printing, and an aging population that demands durable and biocompatible materials are pushing the bioceramics market forward. Regulatory support for advanced orthopedic and dental interventions in Europe and Asia Pacific, and hospital investments in digital workflows, further accelerate demand. Competitive intensity remains high as industry leaders pursue acquisitions, process innovation, and co-development programs with research institutions to secure material superiority and production efficiencies.

Global Bioceramics Market Trends and Insights

Rapid Adoption of 3D-Printed Custom Bioceramic Implants in North America

Hospitals across the United States and Canada now integrate high-density ceramic additive manufacturing lines that deliver patient-matched shapes with optimized porosity. Layer-by-layer control improves osseointegration and allows weight-saving lattice geometries that previously required costly machining. Clinical feedback indicates reduced revision rates for craniofacial and spinal implants that employ these structures.

Accelerated Dental Implant Penetration in Europe Boosting Zirconia Demand

Metal-free protocols are growing swiftly in Germany, France, and Italy as patients request aesthetics that mimic natural dentition. Two-piece zirconia systems solve earlier issues related to prosthetic flexibility, enabling broader clinical indications without sacrificing soft-tissue response. Five-year survival studies register 94-98.4% success for zirconia-based fixtures, almost equaling titanium outcomes while offering lower bacterial adhesion. Laboratories that invested early in chairside milling units for translucent zirconia now benefit from faster turnaround times. Titanium-focused OEMs are adjusting through licensing deals and acquisitions to regain competitive parity.

Stricter FDA Nanoceramic Dispersion Guidelines Delaying Approvals

The United States regulator now requires exhaustive data on particle migration and agglomeration behavior for devices that incorporate nanoscale ceramics. Average review time has lengthened by up to 14 months, raising capital requirements for small innovators. Larger incumbents with in-house toxicology labs leverage this hurdle to reinforce competitive moats, often entering joint-development agreements only after prototypes reach late-stage testing. Industry consortia are working on reference standards that may shorten validation cycles, yet tangible relief is unlikely before 2027.

Other drivers and restraints analyzed in the detailed report include:

- Government Spine-Surgery Expansion Fuelling Calcium Phosphate Use

- Increasing Demand for Hard and Soft Tissue Replacement

- Threat of Substitutes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The aluminum oxide segment is equal to 49% of the bioceramics market size. Alumina's compressive strength and wear resistance underpin its dominance in hip and knee bearings. High-purity grades with sub-micron grain size are gaining traction because they withstand cyclic loads without micro-cracking, extending prosthesis service life. Concurrent surface-coating research aims to add bioactivity, positioning alumina implants as dual-function components. From 2025 to 2030, the material posts a 7.89% CAGR, supported by emerging demand in spinal cages and suture anchors.

Powder products captured 48% of the bioceramics market share in 2024. Granule flowability improvements allow continuous-feed presses and binder jet printers to deliver near-net-shape parts with minimal post-processing. Innovations in spray drying and granulation techniques have enhanced the flowability and compaction of bioceramic powders, making them more compatible with automated manufacturing and cutting production costs. Injectable liquids rise at 7.75% CAGR by offering surgeons fast-setting pastes that conform to irregular defects.

The Bioceramics Market Report Segments the Industry by Material Type (Aluminum Oxide, Zirconia, Calcium Phosphate, and More), Form (Powder, Liquid (Injectable), and More), Type (Bio-Inert, Bio-Active, Bio-Resorbable), Application (Orthopedics, Dental, and Biomedical), End-User Industry (Hospitals and Surgical Centers, Dental Clinics and Laboratories, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Europe accounted for 43% of global revenue in 2024, underlining mature reimbursement frameworks and deep material science capabilities. Germany champions hip arthroplasty innovation; the United Kingdom advances bioactive glass research for periodontal regeneration.

Asia Pacific registers the highest 8.01% CAGR during 2025-2030. China's centralized procurement policies now favor local content, spurring investment in sintering furnaces and spray-drying lines. Japan leverages its ceramic heritage to pioneer gradient structures that mimic cortical-trabecular transitions. India and South Korea expand dental tourism, motivating clinics to adopt zirconia implants that meet global accreditation standards.

North America remains an innovation crucible. Leading hospitals integrate additive manufacturing suites adjacent to operating theaters, condensing design-to-implant cycles to under seventy-two hours. Latin America and the Middle East offer emerging revenue pools as insurance coverage widens, though supply-chain challenges involving sterilization logistics require localized distribution hubs.

- Berkeley Advanced Biomaterials

- BoneSupport AB

- CAM Bioceramics

- CeramTec GmbH

- CGbio

- CoorsTek Inc.

- CTL Amedica

- Dentsply Sirona

- dsm-firmenich

- FKG Dentaire Sarl

- Himed

- Institut Straumann AG

- Jyoti Ceramic

- KYOCERA Corporation

- Medical Device Business Services, Inc.

- Morgan Advanced Materials

- Sagemax

- Shandong Sinocera Functional Materials Co., Ltd.

- Stryker

- TOSOH CERAMICS CO., LTD.

- Zimmer Biomet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Adoption of 3D-Printed Custom Bioceramic Implants in North America

- 4.2.2 Accelerated Dental Implant Penetration in Europe Boosting Zirconia Demand

- 4.2.3 Government Spine-Surgery Expansion Fuelling Calcium Phosphate Use

- 4.2.4 Increasing Demand for Hard and Soft Tissue Replacement

- 4.2.5 OEM Shift from Metal to Bio-inert Ceramic Bearings in Joint Replacements

- 4.3 Market Restraints

- 4.3.1 Stricter FDA Nanoceramic Dispersion Guidelines Delaying Approvals

- 4.3.2 Threat of Subsitutes

- 4.3.3 High Sintering Energy Costs Compressing Manufacturer Margins

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Aluminum Oxide

- 5.1.2 Zirconia

- 5.1.3 Calcium Phosphate

- 5.1.3.1 General Purpose

- 5.1.3.2 Hydroxyapatite

- 5.1.4 Calcium Sulfate

- 5.1.5 Carbon

- 5.1.6 Glass

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Liquid (Injectable)

- 5.2.3 Other Forms

- 5.3 By Type

- 5.3.1 Bio-inert

- 5.3.2 Bio-active

- 5.3.3 Bio-resorbable

- 5.4 By Application

- 5.4.1 Orthopedics

- 5.4.2 Dental

- 5.4.3 Biomedical

- 5.5 By End-user Industry

- 5.5.1 Hospitals and Surgical Centers

- 5.5.2 Dental Clinics and Laboratories

- 5.5.3 Research and Academic Institutes

- 5.5.4 Biotechnology and Pharmaceutical Companies

- 5.6 By Geography

- 5.6.1 Asia Pacific

- 5.6.1.1 China

- 5.6.1.2 India

- 5.6.1.3 Japan

- 5.6.1.4 South Korea

- 5.6.1.5 Rest of Asia

- 5.6.2 North America

- 5.6.2.1 United States

- 5.6.2.2 Canada

- 5.6.2.3 Mexico

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 South Africa

- 5.6.5.4 Egypt

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Berkeley Advanced Biomaterials

- 6.4.2 BoneSupport AB

- 6.4.3 CAM Bioceramics

- 6.4.4 CeramTec GmbH

- 6.4.5 CGbio

- 6.4.6 CoorsTek Inc.

- 6.4.7 CTL Amedica

- 6.4.8 Dentsply Sirona

- 6.4.9 dsm-firmenich

- 6.4.10 FKG Dentaire Sarl

- 6.4.11 Himed

- 6.4.12 Institut Straumann AG

- 6.4.13 Jyoti Ceramic

- 6.4.14 KYOCERA Corporation

- 6.4.15 Medical Device Business Services, Inc.

- 6.4.16 Morgan Advanced Materials

- 6.4.17 Sagemax

- 6.4.18 Shandong Sinocera Functional Materials Co., Ltd.

- 6.4.19 Stryker

- 6.4.20 TOSOH CERAMICS CO., LTD.

- 6.4.21 Zimmer Biomet

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Developing Methods to Produce Customized Nano-ceramics