PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849910

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849910

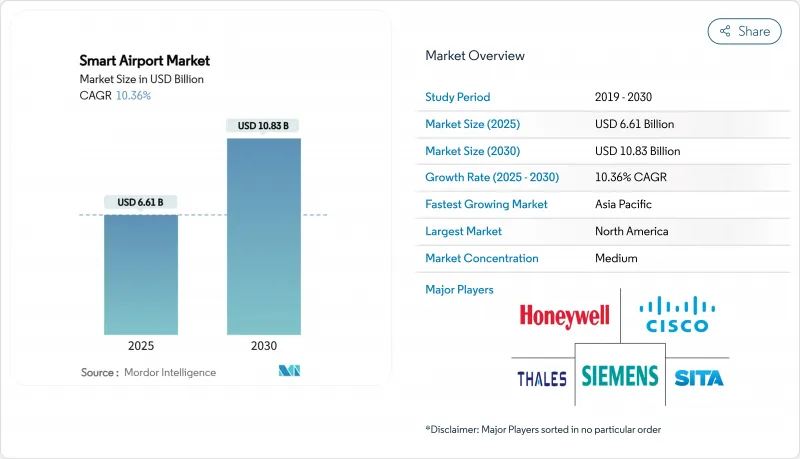

Smart Airport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The smart airport market reached USD 6.61 billion in 2025 and is forecasted to reach USD 10.83 billion by 2030, advancing at a 10.36% CAGR.

Growing passenger traffic, tighter security mandates, and the need for real-time operational visibility prompt airports to accelerate digital transformation. Biometric identity management, IoT-enabled asset tracking, and AI-driven analytics are core investment themes, helping operators raise throughput without costly physical expansion. Cyber-resilience has moved to the forefront as the aviation sector recorded a 74% jump in attacks since 2020, driving parallel growth in cybersecurity budgets. Large-scale roll-outs-such as Singapore Changi's plan to automate 95% of immigration lanes by 2026 and Dubai's biometric boarding at Al Maktoum International by 2025-underscore how smart technologies serve efficiency and passenger-experience objectives.

Global Smart Airport Market Trends and Insights

Rising passenger volumes boosting biometric and self-service rollouts

Pandemic recovery pushed passenger queues beyond pre-2020 levels, forcing airports to add biometrics that cut document checks by 40% while sustaining security standards. The TSA now runs credential authentication units across 25 major US hubs, and Changi targets 95% automated immigration by 2026. Europe's new Entry/Exit System, which starts in 2025, will require biometric capture for all non-EU travelers, turning regulation into a global catalyst. Although privacy concerns and system-to-system interoperability remain unresolved, the cost-benefit case strengthens as passenger volumes climb.

Growing airport IT spending pivoting to digital-first operations

Airports are re-architecting technology stacks to deliver predictive, real-time decision support. Amadeus reports that 94% of operators increased IT budgets for 2025, with digital customer experience and operational resilience as top priorities. Shenzhen Airport's tie-up with Huawei shows the upside: 30 smart projects, including AI stand-allocation, reduced aircraft assignment time from 4 hours to 1 minute. Cloud passenger platforms extend services beyond fixed counters, yet successful roll-outs demand heavy change-management investment.

High capital burden and complex integration

Integrating biometrics, IoT, and AI with legacy systems often exceeds budgets. A University of Zilina study on Central-European airports highlights financing gaps and limited tech staff that stall projects. Vendors such as Aerosimple price SaaS suites between USD 6,000 and USD 50,000 annually, reducing barriers yet not eliminating middleware complexity.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory security and border-control upgrades

- Proliferation of IoT and 5G for real-time operational data

- Escalating cybersecurity and data-privacy risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Security systems commanded 28.97% revenue in 2024, underlining how mandated screening drives early digital spend. Frankfurt Airport's AI scanners, installed in 2025, cut wait times while lifting detection accuracy. The smart airport market size for security platforms is projected to grow steadily as new regulations add biometric and cyber layers. Communication systems follow, powered by 5G backbone upgrades that support real-time situational awareness.

Smart retail and hospitality platforms, growing at a 13.20% CAGR, capture airports' push for non-aeronautical revenue. Hong Kong International's checkout-free "Travelwell" store showcases how data-rich shopping elevates spend per passenger. As analytics personalize offers, customer dwell time converts into margin, making retail tech the fastest-moving line in the smart airport market.

Physical assets-biometric kiosks, sensors, networking gear-held 41.89% of 2024 revenue. Higher-level software cannot function without this hardware layer, which explains sustained capital flows into scanners and edge devices. Cisco notes that 72% of IT leaders now look for cross-domain platform architectures, reinforcing hardware's foundational role.

Services, expanding at 12.76% CAGR, address skills shortages. Heathrow's five-year extension with SITA for network stewardship signals airports' preference to outsource lifecycle management. Cloud-delivered managed services let smaller facilities access best-in-class capabilities without building large IT teams.

The Smart Airport Market Report is Segmented by Technology (Security Systems, Communication Systems, Air and Ground Traffic Control, and More), Solution (Hardware, Software, and Services), Application (Landside, Airside, and Terminal Side), Airport Size (Large, Medium, and Small), Airport Technology (Airport 2. 0, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 26.57% of 2024 revenue, supported by TSA biometric deployments and the FAA's NextGen airspace overhaul. A construction wave slated through 2025 further modernizes terminals and expands smart infrastructure. The region's deep vendor ecosystem and stable funding pipeline sustain steady growth inside the smart airport market.

Asia-Pacific is the fastest-growing region with a 12.44% CAGR. Governments have earmarked USD 240 billion for airport builds and upgrades through 2035 to accommodate surging demand. Projects from Singapore to Vietnam and the Philippines adopt end-to-end digital designs from day one, embedding biometrics, private 5G, and digital-twin frameworks. India's DigiYatra roll-out highlights policy-driven biometric adoption. APAC's smart airport market size will overtake North America before 2030 if current funding stays on track.

Europe maintains a material share by aligning sustainability goals with technology adoption. Net-zero roadmaps push energy-efficient systems and robotic parking expansions such as Lyon's 2,000-unit rollout. Standardized EU privacy rules shape biometric deployments, ensuring passenger trust. The region's collaborative R&D projects-from Collins Aerospace's high-voltage distribution for hybrid-electric aircraft to Munich Airport's innovation hub-enrich a mature yet progressive smart airport market landscape.

- Honeywell International Inc.

- Cisco Systems, Inc.

- Amadeus IT Group, S.A.

- Siemens AG

- T-Systems International GmbH

- Thales Group

- SITA N.V.

- RTX Corporation

- NATS Holdings Limited

- Sabre GLBL Inc.

- IBM Corporation

- L3Harris Technologies, Inc.

- Huawei Technologies Co., Ltd.

- Indra Sistemas, S.A.

- Smiths Detection Group Ltd. (Smiths Group plc)

- VISION BOX - SOLUCOES DE VISAO POR COMPUTADOR, S.A.

- NEC Corporation

- Leonardo S.p.A

- Teledyne Technologies Incorporated

- Garrett Electronics Inc.

- Vanderlande Industries BV

- QinetiQ Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising passenger volumes accelerating demand for biometric screening and self-service technologies

- 4.2.2 Growing airport IT investments to support digital-first operational models

- 4.2.3 Mandatory compliance with upgraded security and border-control regulations

- 4.2.4 Proliferation of IoT and 5G enabling real-time visibility into airport operations

- 4.2.5 Data-driven retail analytics improving non-aeronautical revenue generation

- 4.2.6 Deployment of digital twins for predictive planning and maintenance optimization

- 4.3 Market Restraints

- 4.3.1 Significant capital investment and complex system integration requirements

- 4.3.2 Growing concerns over cybersecurity and passenger data protection

- 4.3.3 Limited availability of skilled professionals for OT-IT system convergence

- 4.3.4 Incompatibility with legacy aviation communication systems

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Security Systems

- 5.1.2 Communication Systems

- 5.1.3 Air and Ground Traffic Control

- 5.1.4 Passenger, Cargo, Baggage, and Ground Handling

- 5.1.5 Smart Retail and Hospitality Systems

- 5.1.6 Smart Transport and Parking

- 5.1.7 Airport Management Software (AMS) Platforms

- 5.2 By Solution

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Application

- 5.3.1 Landside

- 5.3.2 Airside

- 5.3.3 Terminal Side

- 5.4 By Airport Size

- 5.4.1 Large

- 5.4.2 Medium

- 5.4.3 Small

- 5.5 By Airport Technology

- 5.5.1 Airport 2.0

- 5.5.2 Airport 3.0

- 5.5.3 Airport 4.0

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Qatar

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Cisco Systems, Inc.

- 6.4.3 Amadeus IT Group, S.A.

- 6.4.4 Siemens AG

- 6.4.5 T-Systems International GmbH

- 6.4.6 Thales Group

- 6.4.7 SITA N.V.

- 6.4.8 RTX Corporation

- 6.4.9 NATS Holdings Limited

- 6.4.10 Sabre GLBL Inc.

- 6.4.11 IBM Corporation

- 6.4.12 L3Harris Technologies, Inc.

- 6.4.13 Huawei Technologies Co., Ltd.

- 6.4.14 Indra Sistemas, S.A.

- 6.4.15 Smiths Detection Group Ltd. (Smiths Group plc)

- 6.4.16 VISION BOX - SOLUCOES DE VISAO POR COMPUTADOR, S.A.

- 6.4.17 NEC Corporation

- 6.4.18 Leonardo S.p.A

- 6.4.19 Teledyne Technologies Incorporated

- 6.4.20 Garrett Electronics Inc.

- 6.4.21 Vanderlande Industries BV

- 6.4.22 QinetiQ Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment