PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851942

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851942

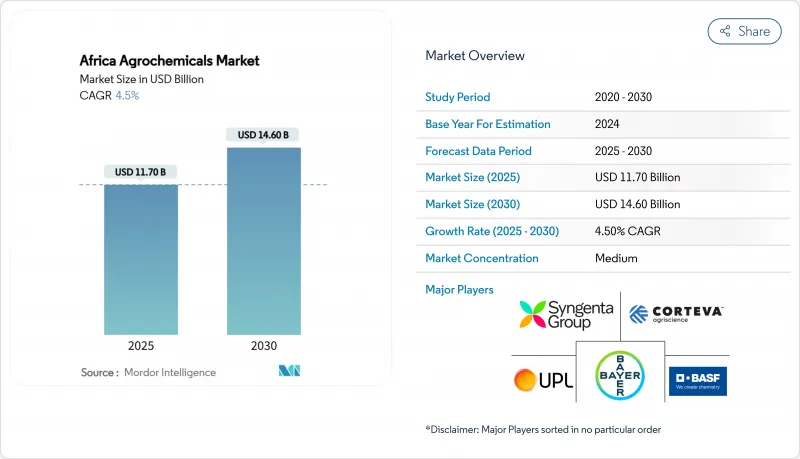

Africa Agrochemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Africa agrochemicals market size reached USD 11.7 billion in 2025 and is projected to grow at a CAGR of 4.5% to USD 14.6 billion by 2030.

Fertilizers dominated the market with a 51% share in 2024, driven by widespread soil nutrient depletion across Africa. Plant growth regulators exhibited the highest growth rate at 6.90% CAGR, as farmers adopt precision application methods. The market growth is supported by increasing pest challenges, growing food demand from population expansion, and government subsidy programs that improve access for smallholder farmers. High input costs and inconsistent regulations across regions limit efforts to close the agricultural yield gap. Market participants are establishing local manufacturing facilities, developing innovative distribution networks, and creating sustainable product lines with precision chemical solutions. Additionally, governments are expanding warehouse-receipt financing systems and mechanization support programs, which drive increased demand in the agrochemicals market.

Africa Agrochemicals Market Trends and Insights

Climate-driven Rise in Pest and Disease Pressure

Variable weather patterns have increased the spread of invasive pests like fall armyworm across multiple African nations, significantly impacting maize yields. Striga weed infestations in cereal-growing regions continue to affect harvests, leading farmers to implement integrated chemical control programs. Kenya, Ghana, and Ethiopia have established emergency response protocols, while regional organizations coordinate pest surveillance networks. Agricultural companies have accelerated the development of precision insecticides targeting pest larvae, and digital monitoring platforms provide real-time alerts to farmers. These factors drive sustained growth in the Africa agrochemicals market. The market gains additional momentum through investments in seed treatment chemicals and farmer education programs. Public-private partnerships are improving farmer access to new crop protection solutions.

Population Growth Accelerating Food-demand Gap

Agricultural productivity remains limited as smallholder farmers use agrochemicals below recommended levels. Nigeria, Ethiopia, and Tanzania experience significant constraints due to urban migration, reducing the agricultural workforce. Government initiatives include investments in domestic fertilizer production and irrigation infrastructure to improve yields. Ethiopia's irrigation expansion program focuses on increasing lowland productivity and decreasing import dependence. Growing food demand continues to drive the African agrochemicals market for fertilizers, pesticides, and plant growth regulator products. The expansion of agricultural dealer networks and mobile advisory services helps improve farmers' access to inputs and knowledge. Farmers increasingly adopt climate-resilient agrochemical solutions to address changing weather conditions.

High Agrochemical Prices Unaffordable to Smallholders

Transport costs in landlocked countries account for up to 50% of final retail prices, while Ethiopia experienced significant increases in fertilizer prices in recent years. Kenya's proposed 16% VAT on agrochemicals through the 2025 Finance Bill may substantially increase production costs. Nigeria's record-high food inflation in mid-2024 forced households to spend most of their income on food, reducing funds available for farm investments. Farmers often turn to informal lenders charging high weekly interest rates, creating debt cycles that limit growth in the Africa agrochemicals market. The resulting affordability issues reduce the adoption of effective crop protection products, leading to suboptimal yields and continued food security challenges.

Other drivers and restraints analyzed in the detailed report include:

- Government Subsidy Programs for Fertilizer and Pesticide Adoption

- Expansion of Warehouse-receipt Financing Unlocking Working-capital for Inputs

- Fragmented and Stringent Regulatory Approval Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fertilizers held 51% of the Africa agrochemicals market share in 2024, addressing widespread soil nutrient deficiencies and supporting agricultural productivity across various agroecological zones. Nitrogen-based formulations remain essential for cereal production, while phosphatic and potassic fertilizers gain adoption through balanced nutrition programs. Digital subsidy e-vouchers and warehouse-receipt credit systems reduce financial barriers and enable timely fertilizer application.

Plant growth regulators demonstrate a 6.9% CAGR, driven by increased adoption of nutrients that improve stress tolerance, root development, and yield potential. Pesticides maintain significant volume across Africa, with herbicides dominating due to labor shortages and resistant weed populations. Insecticide demand increases in response to climate-related pest outbreaks, while fungicide use expands in horticultural regions. Adjuvants, though a smaller segment, grow in importance as precision spraying equipment requires advanced formulations for improved leaf coverage and simplified tank mixing.

The African Agrochemicals Market Report is Segmented by Product Type (Fertilizers, Pesticides, Adjuvants, and Plant Growth Regulators), by Application (Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, and Commercial Crops), and by Geography (Egypt, Morocco, Tanzania, South Africa, and More). The Report Offers the Market Size and Forecasts in Terms of Value (USD).

List of Companies Covered in this Report:

- Bayer AG

- Syngenta Group

- Corteva Agriscience

- BASF SE

- FMC Corporation

- UPL Limited

- Yara International ASA

- Sumitomo Chemical Co., Ltd.

- Gowan Company (Isagro S.r.l.)

- Rovensa S.A (Partners Group)

- Sasol Limited

- Twiga Chemical Industries Ltd. (AJ Group)

- OCP Group

- Indorama Corporation

- Albaugh LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Climate-driven Rise in Pest and Disease Pressure

- 4.2.2 Population Growth Accelerating Food-demand Gap

- 4.2.3 Government Subsidy Programs for Fertilizer and Pesticide Adoption

- 4.2.4 Mechanizsation and Precision-ag Adoption Boosting Input Efficiency

- 4.2.5 Expansion of Warehouse-receipt Financing Unlocking Working-capital for Inputs

- 4.2.6 Emergence of Private-label Agro-retail Chains Improving Last-mile Distribution

- 4.3 Market Restraints

- 4.3.1 High Input Prices Unaffordable to Smallholders

- 4.3.2 Fragmented and Stringent Regulatory Approval Timelines

- 4.3.3 Proliferation of Counterfeit Agrochemicals Eroding Farmer Trust

- 4.3.4 Organic and Residue-free Export Crop Programs Curbing Synthetic Usage

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Fertilizers

- 5.1.1.1 Nitrogenous

- 5.1.1.2 Phosphatic

- 5.1.1.3 Potassic

- 5.1.2 Pesticides

- 5.1.2.1 Herbicides

- 5.1.2.2 Insecticides

- 5.1.2.3 Fungicides

- 5.1.3 Adjuvants

- 5.1.4 Plant Growth Regulators

- 5.1.1 Fertilizers

- 5.2 By Application

- 5.2.1 Grains and Cereals

- 5.2.2 Pulses and Oilseeds

- 5.2.3 Fruits and Vegetables

- 5.2.4 Commercial Crops (Sugarcane, Cotton, and Others)

- 5.3 By Geography

- 5.3.1 Egypt

- 5.3.2 Morocco

- 5.3.3 Algeria

- 5.3.4 Kenya

- 5.3.5 Tanzania

- 5.3.6 Ethiopia

- 5.3.7 South Africa

- 5.3.8 Zambia

- 5.3.9 Zimbabwe

- 5.3.10 Nigeria

- 5.3.11 Ghana

- 5.3.12 DR Congo

- 5.3.13 Rest of Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Bayer AG

- 6.4.2 Syngenta Group

- 6.4.3 Corteva Agriscience

- 6.4.4 BASF SE

- 6.4.5 FMC Corporation

- 6.4.6 UPL Limited

- 6.4.7 Yara International ASA

- 6.4.8 Sumitomo Chemical Co., Ltd.

- 6.4.9 Gowan Company (Isagro S.r.l.)

- 6.4.10 Rovensa S.A (Partners Group)

- 6.4.11 Sasol Limited

- 6.4.12 Twiga Chemical Industries Ltd. (AJ Group)

- 6.4.13 OCP Group

- 6.4.14 Indorama Corporation

- 6.4.15 Albaugh LLC

7 Market Opportunities and Future Outlook