PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906920

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906920

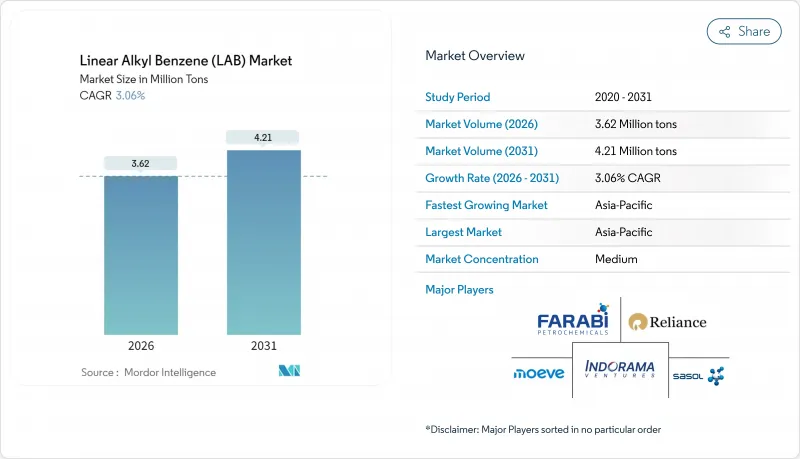

Linear Alkyl Benzene (LAB) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Linear Alkyl Benzene Market was valued at 3.51 Million tons in 2025 and estimated to grow from 3.62 Million tons in 2026 to reach 4.21 Million tons by 2031, at a CAGR of 3.06% during the forecast period (2026-2031).

Steady demand for linear alkyl benzene as the key precursor to linear alkyl benzene sulfonate underpins this growth as consumers and regulators favor biodegradable anionic surfactants over legacy branched-chain detergents. Rising detergent penetration across populous emerging economies, a sustained post-pandemic focus on household and institutional hygiene, and continued investments in upgraded Detal units collectively widen the linear alkyl benzene market opportunity set. Producers with secure benzene and paraffin integration deepen cost leadership, while ongoing Detal retrofits provide dual benefits of lower carbon intensity and improved process safety. Meanwhile, the pursuit of value-added niche applications such as coolant additives augments incremental volume growth and reduces reliance on the relatively mature detergent value chain.

Global Linear Alkyl Benzene (LAB) Market Trends and Insights

Rising Detergent Penetration in Emerging Economies

Emerging economies continue to close the detergent consumption gap with industrialized regions, adding millions of new wash-day users each year. Household upgrade cycles favor packaged synthetic detergents over traditional soap bars because LAS-based formulations excel in hard-water conditions that prevail in rural and peri-urban zones. Packaged detergents also leverage smaller sachet formats that align with low-income purchasing habits, creating a stable volume pull for the linear alkyl benzene market. In India, government sanitation campaigns and expanded retail access raise detergent adoption rates across rural districts. Similar dynamics in sub-Saharan Africa and selected Middle Eastern economies further enlarge the prospective customer base. Together these trends embed a structural growth floor that supports linear alkyl benzene market expansion over the medium term.

Regulatory Push for Biodegradable LAS Surfactants

Environmental regulators tighten degradability benchmarks for cleaning agents, accelerating the shift toward LAS derived from linear alkyl benzene. The European Union's REACH framework highlights faster breakdown of straight-chain LAS compared with branched analogs, making linear alkyl benzene a compliance-friendly feedstock. Water-stressed regions adopt similar discharge norms as wastewater treatment costs climb. Brand owners translate compliance into marketing premiums by labeling laundry and dishwashing detergents as biodegradable, supporting higher average selling prices. Certification bodies reference ISO 14852 and ASTM D-2667 methods when vetting surfactant choices, reinforcing the demand advantage enjoyed by linear alkyl benzene. As countries align with Paris-aligned chemical strategies, bio-favored surfactants become indispensable for multinationals, cementing the long-term demand outlook.

Feedstock Price Volatility Pressures Margins

Linear alkyl benzene producers rely on benzene and paraffin, whose price trajectories remain tethered to global crude oil swings. Quarter-to-quarter price variability tends to compress conversion spreads for non-integrated manufacturers. Inventory holding strategies mitigate but do not eliminate exposure, especially when forward curves invert. Integrated refiners fare better, yet they still confront hedging costs and occasional supply disruptions linked to refinery turnarounds. Emerging Asian players bear the additional challenge of currency fluctuations against the U.S. dollar when settling feedstock imports. Persistent input turbulence undermines planning visibility, discourages discretionary capital spending, and introduces a drag on short-term linear alkyl benzene market growth momentum.

Other drivers and restraints analyzed in the detailed report include:

- Post-COVID Hygiene and Cleaning Intensity

- Detal-2 Retrofits Cutting LAB Carbon Footprint

- HF-Route Environmental Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surfactant production accounted for 96.78% of the 2025 volume, reinforcing the linear alkyl benzene market position as an essential building block for everyday cleaning agents. This overwhelming share is anchored in the proven performance of LAS in powder and liquid detergent formulations, particularly under hard-water conditions that prevail across vast consumption territories. Other Applications outpace the headline market at 4.48% CAGR as formulators explore coolant additive packages and select industrial cleaners. From a profitability standpoint, surfactant demand ensures high asset utilization; however, diversification into specialty uses offers margin accretion and shields producers from cyclical detergent swings.

Process specifications dictate narrow C10-C13 chain-length distributions, encouraging producers to invest in feedstock purification to meet premium LAS requirements. Recent studies show that sulfuric acid wash treatments cut olefinic contaminants, thereby raising detergent brightness scores and reducing formulation stabilizer loadings. Producers supplying automotive coolant blends emphasize high oxidative stability, injecting new technical parameters into what was once a volume-driven market. These evolving performance criteria extend the life cycle of Detal plants that consistently deliver purer cuts than their HF predecessors. Taken together, these trends reinforce the primacy of surfactants while simultaneously cultivating a measured growth path for niche outlets, ensuring balanced expansion for the linear alkyl benzene market.

The Linear Alkyl Benzene Report is Segmented by Application (Surfactant and Other Applications), End-User Industry (Laundry Detergents, Light-Duty Dishwashing Liquids, Industrial Cleaners, Household Cleaners, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific dominates with a 53.72% share in 2025 and is set to grow at a 4.12% CAGR through 2031. Consumer demographics combine with urbanization to expand packaged detergent usage, while integrated aromatics complexes in China, India, and the Middle East ensure secure benzene supply at competitive cost. Recent paraffin dehydrogenation projects further reinforce regional self-sufficiency, lowering import dependence and freight exposure. Industry clusters in coastal China reduce last-mile logistics costs for both raw materials and finished goods, rapidly converting local gasoline-range olefins into high-purity linear alkyl benzene.

Europe registers modest volume growth but plays a pivotal role in setting best-practice environmental norms. The European Commission's Large Volume Organic Chemicals reference document strengthens effluent and emissions guidelines, accelerating Detal retrofits across legacy plants. Producers in Spain and Belgium have already completed capacity upgrades that boost high-purity yields while trimming energy intensity. Consumer brands headquartered in the region adopt cradle-to-gate life-cycle assessments, solidifying procurement preferences for Detal-produced surfactants.

North America benefits from ample shale-derived feedstock streams that offer structurally low benzene and paraffin costs. Competitive pressure nevertheless mounts as HF compliance costs climb, prompting debate over capital redeployment toward Detal lines. Gulf Coast producers weigh the merits of downstream LAS integration to capture additional value and mitigate volatility at the intermediate stage. Regulatory visibility provided by the U.S. Inflation Reduction Act paves the way for carbon-credit monetization of energy-efficient retrofits. Collectively, these factors produce a steady but strategically significant contribution to the linear alkyl benzene market.

- CNPC (Fushun Petrochemical)

- Egyptian Petrochemicals Holding Company (ECHEM)

- Farabi Petrochemicals Company

- Formosan Union Chemical Corp.

- Indian Oil Corporation Ltd

- Indorama Ventures Public Company Limited

- ISU Chemical

- JINTUNG Petrochemical Co., Ltd

- Kinef

- Moeve

- NIRMA

- PT Unggul Indah Cahaya Tbk

- QatarEnergy

- Reliance industries Limited

- S.B.K HOLDING

- Sasol

- Tamilnadu Petroproducts Limited

- Thai Oil Public Company Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising detergent penetration in emerging economies

- 4.2.2 Regulatory push for biodegradable LAS surfactants

- 4.2.3 Post-COVID hygiene and cleaning intensity

- 4.2.4 Detal-2 retrofits cutting LAB carbon footprint

- 4.2.5 LAB use in EV coolant additive packages

- 4.3 Market Restraints

- 4.3.1 Feedstock (benzene and paraffin) price volatility

- 4.3.2 HF-route environmental compliance costs

- 4.3.3 ASEAN shift to palm-based MES detergents

- 4.4 Value Chain Analysis

- 4.5 Price Overview

- 4.6 Trade Analysis

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Surfactant

- 5.1.2 Other Applications

- 5.2 By End-User Industry

- 5.2.1 Laundry Detergents

- 5.2.2 Light-Duty Dishwashing Liquids

- 5.2.3 Industrial Cleaners

- 5.2.4 Household Cleaners

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 CNPC (Fushun Petrochemical)

- 6.4.2 Egyptian Petrochemicals Holding Company (ECHEM)

- 6.4.3 Farabi Petrochemicals Company

- 6.4.4 Formosan Union Chemical Corp.

- 6.4.5 Indian Oil Corporation Ltd

- 6.4.6 Indorama Ventures Public Company Limited

- 6.4.7 ISU Chemical

- 6.4.8 JINTUNG Petrochemical Co., Ltd

- 6.4.9 Kinef

- 6.4.10 Moeve

- 6.4.11 NIRMA

- 6.4.12 PT Unggul Indah Cahaya Tbk

- 6.4.13 QatarEnergy

- 6.4.14 Reliance industries Limited

- 6.4.15 S.B.K HOLDING

- 6.4.16 Sasol

- 6.4.17 Tamilnadu Petroproducts Limited

- 6.4.18 Thai Oil Public Company Limited

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment