PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685786

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685786

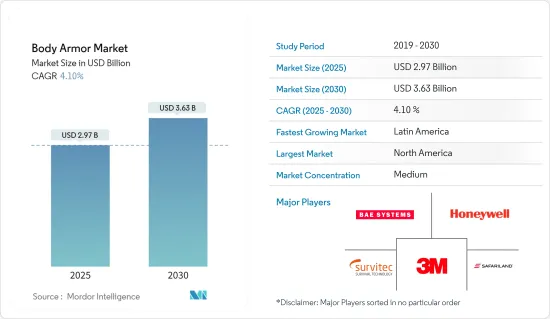

Body Armor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Body Armor Market size is estimated at USD 2.97 billion in 2025, and is expected to reach USD 3.63 billion by 2030, at a CAGR of 4.1% during the forecast period (2025-2030).

Geopolitical tensions and a surge in violence and terrorism have underscored the importance of body armor for military and law enforcement agencies, safeguarding their personnel in diverse scenarios. However, the level of protection varies, tailored to the specific threat assessments.

Military engagements, spanning counterinsurgency, counter-terrorism, and guerrilla warfare, pose significant risks, potentially leading to injuries or fatalities. Similarly, in law enforcement, officers face threats from criminals and felons, necessitating investments in personal body armor.

The body armor market's growth is not solely driven by military demand but increasingly by law enforcement and civilian sectors. Innovations like flexible, lightweight body armor, including Kevlar-based soft armor, prioritize protection and wearer comfort. This demand is fueling market expansion, particularly in regions facing heightened security challenges. Noteworthy advancements like DuPont and Point-Blank Enterprises' Kevlar EXO further propel market growth.

However, the market grapples with a significant hurdle: the integration costs of advanced materials, such as ultra-high-molecule weight polyethylene (UHMWPE) and advanced ceramics, significantly elevate production costs, limiting widespread adoption.

In recent years, there has been a notable increase in investments in advanced body armor, spurred mainly by governments aiming to bridge supply-demand gaps. Consequently, the market is witnessing heightened procurement and development activities, setting the stage for robust growth. Yet, stringent government regulations, especially in the civil sector, act as a counterbalance, impeding the market's full potential.

Body Armor Market Trends

Soft and Hard Armors to Dominate Market Share During the Forecast Period

The segment poised for the most robust growth within the body armor market encompasses both soft and hard armor. This surge can be attributed to advancements in materials, a rising need for personal protection, and substantial investments from entities like NATO and other defense organizations.

NATO is a pivotal force propelling the demand for cutting-edge body armor. Its member nations consistently bolster their defense arsenals to counter evolving threats, with a notable focus on upgrading to advanced soft and hard body armor. These investments underscore NATO's commitment to bolstering troop safety and effectiveness. Notably, NATO's ongoing modernization initiatives emphasize the adoption of lightweight, high-performance armor systems, further fueling the body armor market's growth. This trend is particularly pronounced in regions with robust defense expenditures, such as North America and Europe. For example, in April 2024, San Diego's Black Box Safety Inc., a defense solutions provider, clinched a significant 5-year contract worth USD 35 million for supplying cutting-edge ballistic protection gear from Point Blank Enterprises to various California law enforcement agencies, including CHP, Fish and Wildlife, State Parks, and Forestry and Fire Protection, thereby bolstering officer safety statewide.

North America to Dominate Market Share During the Forecast Period

The United States is the world's largest defense spender and is expected to allocate USD 842 billion for its defense budget in FY2024. This budget funds a wide array of programs designed to sustain and improve the combat capabilities of the armed forces. Crucial funding will be needed to research, develop, test, and procure protective gear and advanced and enhanced body armor. Integrated deterrence is highlighted within the budget as the primary focus regarding threats emanating from its strategic adversaries, which include China and Russia, and to continuously modernize the military gear, including PPE, for soldiers.

Materials science and manufacturing innovations have accelerated North America's body armor market. Advances in ultra-high-molecular-weight polyethylene (UHMWPE), advanced ceramics, and the latest composite materials have created lighter, stronger, and more effective body armor. Materials provide better ballistic resistance while substantially reducing the weight of armor worn by a soldier, greatly enhancing mobility and comfort. Exhibitions such as the Shot Show 2024 demonstrated these advancements and showcased the industry's dedication to developing next-generation body armor to meet the rigors of contemporary combat scenarios.

The US Department of Defense has initiated several programs to create new body armor systems. Among these are the Torso & Extremities Protection (TEP) and Warrior Web Program (WWP), concentrating on developing ultra-lightweight, high-performance body armor. Moreover, the cooperation among significant companies such as DuPont and Point Blank Enterprises has brought into the market the latest body armor solutions using Kevlar EXO aramid fiber, which allows for flexibility and protection without precedent and meets the latest NIJ standards to meet the new requirements of law enforcement and military personnel.

Recent strategic partnerships and acquisitions have further made North America the strongest player in the body armor market. DuPont, for instance, has been working with Point Blank Enterprises to offer law enforcement agencies some of the most progressive body armor solutions, which enhance protection without compromising comfort and mobility. The deal is emblematic of a more significant trend toward integrating innovative materials and technologies to meet growing calls for effective and reliable body armor.

Body Armor Industry Overview

The body armor market is semi-consolidated, with some local and global players holding significant shares. Some prominent players in the market are Safariland LLC, 3M, Honeywell International Inc., Survitec Group Limited, and BAE Systems PLC. The key players in the market are highly focused on developing advanced solutions for military forces.

Body armor OEMs, such as TenCate, manufacture products that cater to a broader spectrum of protective standards, such as the Association of Testing Agencies for Attack-Resistant Materials and Constructions (VPAM), which has a harder completion standard procedure for certificates.

For instance, in January 2024, Survitec Group Limited strategically acquired US-based Vinyl Technology, a contract manufacturer of custom plastic and industrial fabric products. The acquisition enhances Survitec's capabilities in producing pilot flight equipment, positioning it as the leading employer in highly skilled sewing capacity. Vinyl Technology will contribute to complex garment manufacturing, particularly in the Advanced Technology Anti-G Suit. The strategic moves will enhance and increase Survitec's product portfolio and manufacturing capabilities, streamlining access to trusted survival technology solutions and bolstering its market presence in the body armor market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Soft and Hard Armors

- 5.1.2 Clothing

- 5.1.3 Helmets

- 5.1.4 Accessories

- 5.2 End User

- 5.2.1 Military

- 5.2.2 Civil and Law Enforcement

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Israel

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ELMON SA

- 6.1.2 DuPont De Nemours Inc.

- 6.1.3 Honeywell International Inc.

- 6.1.4 U.S. Armor Corporation

- 6.1.5 Point Blank Enterprises Inc.

- 6.1.6 BAE Systems PLC

- 6.1.7 EnGarde BV

- 6.1.8 ArmorSource LLC

- 6.1.9 Bluewater Defense Inc.

- 6.1.10 Sarkar Tactical

- 6.1.11 Survitec Group Limited

- 6.1.12 Safariland LLC

- 6.1.13 3M

7 MARKET OPPORTUNITIES AND FUTURE TRENDS