Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685707

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685707

India Energy Drinks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 201 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

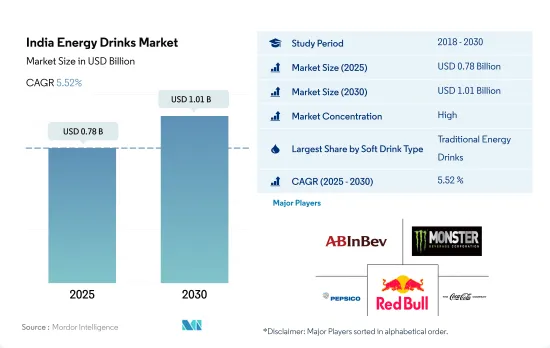

The India Energy Drinks Market size is estimated at 0.78 billion USD in 2025, and is expected to reach 1.01 billion USD by 2030, growing at a CAGR of 5.52% during the forecast period (2025-2030).

The rising prevalence of diabetes and perennially favorite flavors expected to drive the demand for the energy drinks market in the future

- Energy drinks hold a significant market share, registering a growth rate of 16.08% by value from 2020 to 2023. While perennial flavor favorites like lemon, lime, orange, and berry continue to be preferred choices among traditional energy drink consumers, major energy drink brands like Red Bull and Monster Energy have been taking chances on new flavors, with watermelon and mango being the top flavors for new product development.

- Sugar-free energy drinks hold a significant market share in the Indian energy drinks market. The segment registered a growth rate of 17.05% by value from 2020 to 2023. The increasing diabetic population is inclining toward sugar-free energy drinks in the market. In India, an estimated 77 million people above the age of 18 years are suffering from diabetes, and nearly 25 million are prediabetics in the country. Low-carb energy drinks are designed to provide sustained energy and help accelerate the metabolic state. Therefore, this factor is driving the growth of the Indian energy drinks market.

- Natural and organic energy drinks are the fastest-growing energy drink types consumed in the country. They are projected to register a CAGR of 6.94% by value during the forecast period. Consumers, particularly millennials and the younger generation, are becoming more conscious of their dietary choices and actively seeking organic and natural alternatives across the energy drink categories. India has the largest youth population in the world, with more than 65% of its population aged under 35 years old. These health-focused energy drinks often rely on natural, botanical sources of caffeine like guarana, yerba mate, and green tea extract. Functional ingredients are expected to appeal to consumers and expand the reach of energy drinks over 2024-2030.

India Energy Drinks Market Trends

The increasing demand for energy drinks is driven by the growing need for immediate energy and alertness, particularly among young people

- Energy drinks tend to be more popular among the urban population. Young adults and college students are often drawn to these beverages due to their association with a modern, active lifestyle.

- Attractive packaging may catch consumers' attention, and different sizes can cater to various consumption needs. Health-conscious consumers may pay attention to the sugar content of energy drinks. Lower sugar or sugar-free options are preferred by those looking to reduce their sugar intake.

- Consumers may opt for energy drinks that fit within their budget, and promotions or discounts can encourage purchases. Government taxation and regulation on energy drinks impact the price and availability of energy drinks.

- Energy drinks contain caffeine and high consumption of caffeine may increase the risk of a wide range of health problems, such as diabetes, poor mental health, etc. Hence, players operating in the industry are regulating the use of few concerning ingredients from their products.

India Energy Drinks Industry Overview

The India Energy Drinks Market is fairly consolidated, with the top five companies occupying 96.35%. The major players in this market are Anheuser-Busch InBev SA/NV, Monster Beverage Corporation, PepsiCo, Inc., Red Bull GmbH and The Coca-Cola Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 46545

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumer Buying Behaviour

- 4.2 Innovations

- 4.3 Brand Share Analysis

- 4.4 Regulatory Framework

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Soft Drink Type

- 5.1.1 Energy Shots

- 5.1.2 Natural/Organic Energy Drinks

- 5.1.3 Sugar-free or Low-calories Energy Drinks

- 5.1.4 Traditional Energy Drinks

- 5.1.5 Other Energy Drinks

- 5.2 Packaging Type

- 5.2.1 Glass Bottles

- 5.2.2 Metal Can

- 5.2.3 PET Bottles

- 5.3 Distribution Channel

- 5.3.1 Off-trade

- 5.3.1.1 Convenience Stores

- 5.3.1.2 Online Retail

- 5.3.1.3 Supermarket/Hypermarket

- 5.3.1.4 Others

- 5.3.2 On-trade

- 5.3.1 Off-trade

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Anheuser-Busch InBev SA/NV

- 6.4.2 BPI Sports, LLC

- 6.4.3 Ghodawat Consumer Limited

- 6.4.4 Hector Beverages Private Limited

- 6.4.5 Hell Energy Magyarorszag Korlatolt Felelossegu Tarsasag

- 6.4.6 Monster Beverage Corporation

- 6.4.7 Ocean Drinks Private Limited

- 6.4.8 PepsiCo, Inc.

- 6.4.9 Radiohead Brands Private Limited

- 6.4.10 Red Bull GmbH

- 6.4.11 Tata Consumer Products Ltd

- 6.4.12 The Coca-Cola Company

7 KEY STRATEGIC QUESTIONS FOR SOFT DRINK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.