PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1684012

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1684012

Southeast Asia Health And Fitness Club - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

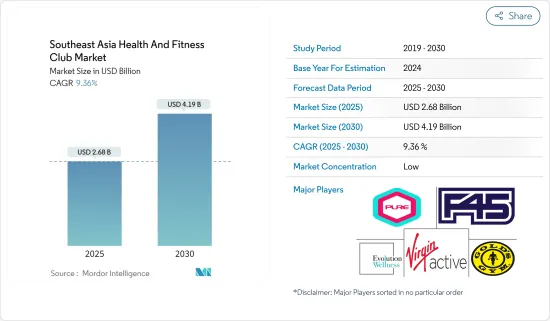

The Southeast Asia Health And Fitness Club Market size is estimated at USD 2.68 billion in 2025, and is expected to reach USD 4.19 billion by 2030, at a CAGR of 9.36% during the forecast period (2025-2030).

Consumers increasingly engage in rigorous physical workouts that aid in weight control, boost stamina, and improve overall health. The rising number of health clubs and gyms with personal training, the latest fitness equipment, and rising health consciousness encourage individuals to indulge in workouts, impacting the market growth positively. Key players are launching facility spaces with yoga studios, high-altitude training rooms, and medical exercise areas to gain the attention of fitness enthusiasts. For instance, in May 2023, Anytime Fitness launched Les Mills classes and opened a new club in Malaysia. The new fitness club provides state-of-the-art equipment, expert trainers, and spacious workout areas to help achieve fitness goals.

With increasing disposable income, customers are willing to pay more for the convenience of higher-end fitness facilities. Therefore, players in the market are focused on launching luxury fitness clubs to meet customer needs. For instance, in October 2023, Kinetix Plus launched a luxury Boutique Gym in Makati, Philippines, which has fitness, training, relaxation, socializing, and recovery facilities. The members can sign up for PHP 800 monthly per the club's statement.

Southeast Asia Health And Fitness Club Market Trends

Inclination Toward a Healthy Lifestyle

With rising incidences of lifestyle diseases, Southeast Asian consumers recognize the importance of preventive health measures. Therefore, individuals are taking proactive steps to prioritize physical well-being and actively seek avenues like fitness clubs to incorporate structured workout routines into their daily lives. For instance, according to Sport Singapore, a survey showed that 74% of Singapore consumers exercised at least once a week in 2022, a jump from 54% in 2015. Fitness campaigns at workplaces and fitness centers by sports authorities encourage individuals to workout, supporting the growth of the health and fitness club market. For instance, in June 2022, 3M partnered with the Sports Authority of Thailand (SAT) to premier its "3M Moves" initiative in Thailand to encourage Thai consumers to focus on their health and exercise more under the concept "Move More, Give More."

Singapore Dominates the Market

Growing awareness about the importance of a healthy lifestyle and preventive healthcare is driving individuals in Singapore to join fitness clubs to maintain and improve their overall well-being. According to the World Bank, the per capita spending on healthcare in Singapore is estimated to reach USD 2,202.1 by 2028 compared to USD 1,681.8 in 2023. With the rising disposable incomes, more people can afford gym memberships and wellness services, contributing to the growth of health and fitness clubs. For instance, according to the Singapore Department of Statistics, the average monthly household income per household member in Singapore accounted for SGD 4,478 in 2022 compared to SGD 4,115 in 2019. This data reflects the increased spending power of the consumer, of which healthcare expenditure is a focal part, leading to an increase in the health and fitness market.

Southeast Asia Health And Fitness Club Industry Overview

The Southeast Asian health and fitness club market is competitive and comprises various domestic and international players offering premium and affordable fitness services across the region. Players in the market are focused on providing innovative and functional training across the outlets. They also rely on expanding outlets across the region to cater to the increasing demand for quality-based fitness training. For instance, in January 2024, Virgin Active invested nearly USD 5 million in Singaporean clubs, transforming them into holistic wellness havens with new equipment, specialist programs, and exclusive Fitness Therapy Zones. Some key players in the market include Gold's Gym (RSG Group), Virgin Active (Virgin Group), Evolution Wellness, F45 Training Holdings Inc., and Pure International.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Inclination Toward Healthy Lifestyle

- 4.1.2 Strategic Expansion by Health & Fitness Clubs

- 4.2 Restraints

- 4.2.1 Rise in Popularity of Outdoor Activities

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Service Type

- 5.1.1 Membership Fees

- 5.1.2 Personal Training and Instruction Services

- 5.1.3 Other Service Types

- 5.2 By Outlet

- 5.2.1 Chained Outlet

- 5.2.2 Independent Outlet

- 5.3 By Geography

- 5.3.1 Singapore

- 5.3.2 Malaysia

- 5.3.3 Thailand

- 5.3.4 Indonesia

- 5.3.5 Philippines

- 5.3.6 Vietnam

- 5.3.7 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Company Profiles

- 6.2.1 Self Esteem Brands

- 6.2.2 Pure International

- 6.2.3 Virgin Group

- 6.2.4 Evolution Wellness

- 6.2.5 RSG Group LLC

- 6.2.6 Slimmers World

- 6.2.7 Elite Fitness

- 6.2.8 Saigon Sports Club

- 6.2.9 F45 Training Holdings Inc.

- 6.2.10 Believe Fitness

7 MARKET OPPORTUNITIES AND FUTURE TRENDS