Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1684001

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1684001

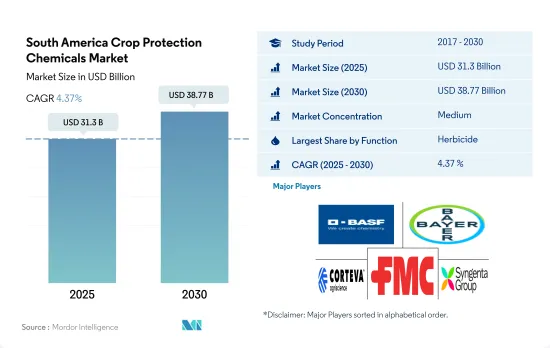

South America Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 230 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The South America Crop Protection Chemicals Market size is estimated at 31.3 billion USD in 2025, and is expected to reach 38.77 billion USD by 2030, growing at a CAGR of 4.37% during the forecast period (2025-2030).

The market for pesticides is driven by the excessive yield losses in economically important crops in the region

- Herbicides accounted for the highest share of 48.7% of the crop protection chemicals consumed in South America in 2022, with a market value of USD 13.41 billion. Weeds pose persistent challenges to crop cultivation, and the need to control weeds has emerged as a driving force behind the herbicide market to sustainably maximize crop productivity.

- Amaranthus palmeri is a prevalent weed species in soybean-producing regions of Brazil and Argentina. Studies have shown that soybean crops experience yield losses ranging from 20.28% in cases of minimal Amaranthus weed infestation to as high as 62.8% when facing severe infestations.

- Aphids, thrips, whiteflies, leafhoppers, black aphids, pod borers, and stem fly insects cause considerable damage to major pulses and oilseed crops grown in the region, leading to severe yield losses and reduced crop quality. Insecticides accounted for 28.4% of the South American crop protection chemicals market in 2022, with a market value of USD 7.82 billion in the same year.

- Fungal diseases are a major constraint in soybean production in South America, and it is estimated that between 8-10% of soybean production is lost to diseases. The main diseases that affect the foliage of soybean plants in this region are target spot, Cercospora leaf blight, and Asian soybean rust. Fungicides such asmepoxiconazole, fluxapyroxad, and azoxystrobin are highly effective against these diseases.

- Among nematodes, root-knot nematode is the most prevalent. Carrots are susceptible to considerable losses, averaging up to 20.0%, while potatoes can experience even higher losses of up to 33.0% due to infestations caused by these nematode species.

- Thus, the need to increase the yield of crops in South America is anticipated to drive the market for pesticides.

Demand for pesticides is driven by the increased pest and disease proliferation, and expansion of agricultural cultivation

- Pests, diseases, and weeds are emerging as a significant problem in the Brazilian agriculture sector. To counter these threats effectively, farmers predominantly depend on the application of pesticides, and the market was valued at USD 17.68 billion in 2022. Soybean cultivation in Brazil faces numerous pest challenges, with lepidopterans and stink bugs being the primary pests demanding special attention. Particularly, the southern armyworm is known to inflict a significant 17.0% yield loss on soybean production.

- Renowned for its expansive agricultural expanse, favorable climate, and agricultural proficiency, Argentina stands as a prominent global agricultural producer and exporter. The nation's agricultural domain prioritizes high-yield cultivation to address both domestic and global requisites. Pesticides play a pivotal part in augmenting yields through the mitigation of pest and disease-induced losses. In 2022, Argentina held the second-largest portion, accounting for 19.7% by value, within the South American crop protection chemicals market.

- Chile's diverse agricultural landscape, with a variety of crops grown throughout the country, creates a demand for a broad range of pesticides to control various pests and diseases. Additionally, the launch of innovative products with different modes of action in the market in recent years provides farmers with more choices for crop protection, contributing to the growth of the pesticide market. Chile accounted for a market share of 1.5% of the total crop protection chemicals market in 2022.

- The market is estimated to register a CAGR of 4.7% during the forecast period (2023-2029) due to factors like favorable climatic conditions for pest and disease proliferation and expansion of agriculture cultivation.

South America Crop Protection Chemicals Market Trends

Frequent climate changes like drought and heat waves and intensive agriculture practices raised the overall pesticide consumption per hectare

- Between 2017 and 2022, there has been a remarkable surge in pesticide consumption per hectare across South America, witnessing a growth of 5,277 grams per hectare. This significant increase highlights the region's escalating reliance on pesticides in agricultural practices, spurred by a combination of influential factors. These include the adverse effects of climate change, such as frequent droughts and heat waves, as well as the adoption of intensive farming techniques like no-tillage and monoculture practices.

- Consequently, the proliferation of weeds, pests, and diseases has become more frequent, necessitating the intensified utilization of pesticide products and their application rates to protect valuable crops. Countries like Brazil, Argentina, and Paraguay faced challenges from climate conditions with respect to agriculture yields.

- In the region, herbicides have become the predominant pesticides utilized per hectare, experiencing a substantial growth of 3,702 grams per hectare in 2022 compared to 2017. This remarkable increase can be mainly attributed to the rising prevalence of weed infestations in agricultural fields. Farmers in countries like Brazil and Argentina have increasingly adopted herbicide-resistant varieties for major crops such as soybeans, maize, and wheat. However, this widespread adoption has also led to a rise in weed species developing resistance to herbicides. In Argentina, more than 30 weed species have shown resistance to various herbicides, while in Brazil, the number has risen to 51. This could lead to higher utilization of herbicides per hectare. Thus, factors like climate change and other intensive agricultural practices increased the fungicides and insecticides consumption per hectare

Heavy pesticide usage and imports from European countries majorly fluctuate the active ingredient prices

- South America stands out as a prominent user of pesticides, primarily driven by intensive agricultural practices like monoculture, no-tillage, and the goal to increase food production. However, the region heavily relies on pesticide imports from European countries, as many products that are banned from use are permitted to export.

- In 2019, pesticide prices witnessed substantial growth attributed to the increased drought conditions, leading to higher pesticide usage, a surge in demand for pesticides, and the unavailability of certain pesticides. All these factors contributed to the rise in pesticide prices, which recorded growth of up to 5-10% from the prices in 2017.

- In 2022, cypermethrin took the lead as the extensively utilized insecticide, with the price of the active ingredient standing at USD 21,087.6 per metric ton. Its widespread adoption in the agricultural industry is due to its effectiveness in controlling a range of insects, including spotted ball worms, pink ball worms, early spot borers, and hairy caterpillars.

- In 2022, atrazine experienced a notable price hike, reaching USD 13,810.3 per metric ton. It finds application in both pre and post-emergence control of broadleaf and grassy weeds, with its highest usage in field corn, sweet corn, sorghum, and sugarcane crops. The use of atrazine is restricted in EU countries, but it is approved for exportation. As a result, South American countries serve as major importers of atrazine from EU countries.

- The price of mancozeb was approximately USD 7,810.9 per metric ton in 2022. This contact fungicide offers protection to a diverse array of crops, such as fruits, vegetables, and field crops, as well as turf management. Its versatility and effectiveness have earned it a valuable reputation among farmers.

South America Crop Protection Chemicals Industry Overview

The South America Crop Protection Chemicals Market is moderately consolidated, with the top five companies occupying 61.32%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, FMC Corporation and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001703

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Brazil

- 4.3.3 Chile

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits & Vegetables

- 5.3.3 Grains & Cereals

- 5.3.4 Pulses & Oilseeds

- 5.3.5 Turf & Ornamental

- 5.4 Country

- 5.4.1 Argentina

- 5.4.2 Brazil

- 5.4.3 Chile

- 5.4.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 American Vanguard Corporation

- 6.4.3 BASF SE

- 6.4.4 Bayer AG

- 6.4.5 Corteva Agriscience

- 6.4.6 FMC Corporation

- 6.4.7 Rainbow Agro

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.