Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683928

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683928

South America Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 330 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

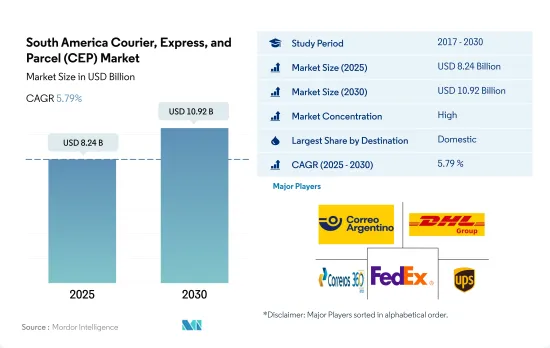

The South America Courier, Express, and Parcel (CEP) Market size is estimated at 8.24 billion USD in 2025, and is expected to reach 10.92 billion USD by 2030, growing at a CAGR of 5.79% during the forecast period (2025-2030).

B2C e-commerce segment leading the market

- One of the major demand generators for the courier, express, and parcel market is B2C e-commerce. Although B2C e-commerce in Latin America had a slow start, it has a penetration rate of over 50% in multiple countries in the region. Brazil was estimated to rank the highest in total e-commerce sales in 2021, followed by Mexico, Colombia, and Argentina. MercadoLibre, an online marketplace headquartered in Argentina, dominates the B2C e-commerce market In Latin America by being the top seller in several countries, including Argentina, Mexico, and Chile and account for more than two-thirds of Argentina's e-commerce market in 2022. In the 2022, Mercado Libre reached retail e-commerce sales worth over USD 12 billion. With e-commerce projected to touch USD 134.3 billion by 2027, CEP market is expected to grow significantly.

- E-commerce growth is expected to significantly boost the CEP market in the region. The e-commerce user penetration is projected to touch 56.5% in 2023 owing to rising domestic and cross-border e-commerce in the region. It is further expected to have a 258.10 million users by 2027, accounting for 61.4% user penetration by 2027.

Expansion of parcel distribution centres, low-cost air cargo service, among drivers of regional market demand

- The CEP market in the region is driven mainly by a surge in e-commerce-led parcel shipments along with demand from other end users such as manufacturing, BFSI sector among others. Brazil, Chile, Argentina, along with other countries, comprise the CEP market in the region. In Brazil, Magazine Luiza, Casabahia, and Americanas accounted for 36.5% of Brazil's top 100 online stores' revenue, which drove domestic CEP demand in 2022. In Argentina, Mercado Libre has almost 27 million online consumers. By 2025, buyer penetration is expected to touch approximately 62%, significantly impacting domestic CEP demand during the forecast period.

- One of the major demand generators for the courier express and parcel market is B2C e-commerce. Although B2C e-commerce in Latin America had a slow start, it has a penetration rate of over 50% in multiple regional countries. Brazil ranked the highest in e-commerce sales in 2021, followed by Mexico, Colombia, and Argentina. MercadoLibre, an online marketplace headquartered in Argentina, dominated the B2C e-commerce segment in Latin America by being the top seller in several countries, including Argentina, Mexico, and Chile, and accounted for more than two-thirds of Argentina's e-commerce segment in 2022.

South America Courier, Express, and Parcel (CEP) Market Trends

South American countries are investing heavily in infrastructure development to improve the transportation sector

- In June 2024, Argentina's federal government transferred 914 infrastructure projects to provincial authorities, creating a tough financial challenge for the provinces. Despite wanting to resume public works, provinces have faced deep cuts to federal transfers, their main source of income. Federal tax transfers (CFI) to provinces dropped 20% YoY in June 2024 and have decreased by double digits in five out of the six months of 2024. Other federal transfers (RON) also fell 24.1% in June.

- In 2023, the Brazilian government allocated USD 2.59 billion to infrastructure logistics, encompassing highways, railways, ports, and airports. A significant portion, approximately USD 2.42 billion, was funneled into highways, while railways received a modest allocation of USD 30.25 million. Looking ahead, by June 2024, the government is set to launch a major national initiative aimed at amplifying investments in freight rail projects, leveraging a blend of public and private sector funding. With an ambitious vision, the government plans to inject a substantial USD 4 billion into these rail projects.

Crude oil prices in the region rose significantly owing to the impact of the Russia-Ukraine War on global crude oil

- In March 2024, seasonal fluctuations and signs of an economic slowdown led to a decline in Diesel demand in Brazil. Petrobras' decision to reduce Diesel prices, coupled with the mandated increase in biodiesel blending from 12% to 14%, further fueled this drop in demand for conventional fossil Diesel. The domestic market was also swayed by global fluctuations in crude oil prices and government efforts to stabilize them. Even with an excess of 3.2 million barrels of Russian Diesel on hand, Brazil maintained its shipments without a complete halt.

- By 2030, Chile plans to launch large-scale production of sustainable aviation fuel (SAF) and aims for these biofuel sources derived from oils, fats, and both biological and municipal waste to satisfy half of its aviation fuel needs by 2050. With projections of air traffic doubling by 2040, Chile views SAF as a pivotal element in its decarbonization strategy. Moreover, SAF can be blended with traditional jet fuel to reduce emissions by up to 80% without engine modifications. It is expected to contribute over half of Chile's targeted carbon emissions reductions, playing a key role in the country's net-zero goals.

South America Courier, Express, and Parcel (CEP) Industry Overview

The South America Courier, Express, and Parcel (CEP) Market is fairly consolidated, with the major five players in this market being Correo Argentino, DHL Group, Empresa Brasileira de Correios e Telegrafos, FedEx and United Parcel Service of America, Inc. (UPS) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001618

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Argentina

- 4.12.2 Brazil

- 4.12.3 Chile

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

- 5.7 Country

- 5.7.1 Argentina

- 5.7.2 Brazil

- 5.7.3 Chile

- 5.7.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Aramex

- 6.4.2 Chilexpress

- 6.4.3 Correo Argentino

- 6.4.4 Correos de Chile

- 6.4.5 DHL Group

- 6.4.6 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.7 Empresa Brasileira de Correios e Telegrafos

- 6.4.8 FedEx

- 6.4.9 La Poste Group

- 6.4.10 United Parcel Service of America, Inc. (UPS)

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.