PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683854

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683854

Spain Pharmaceutical Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

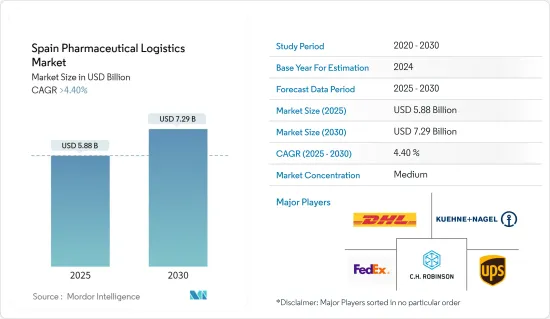

The Spain Pharmaceutical Logistics Market size is estimated at USD 5.88 billion in 2025, and is expected to reach USD 7.29 billion by 2030, at a CAGR of greater than 4.4% during the forecast period (2025-2030).

Spain is set to lead the world in 'pharma growth potential' in 2024, with Barcelona emerging as Europe's second-best hub for biotech investment.

With a growing number of international biotech startups and companies eyeing Barcelona and its metropolitan area, the Catalan capital is solidifying its position as a biotech stronghold. Reports indicate that by 2024, Spain will rank sixth globally and third in Europe for 'pharma growth potential.'

The booming pharmaceutical industry in Spain is poised to bolster the country's pharmaceutical logistics market, paving the way for lucrative opportunities in transporting and storing both temperature-sensitive and general pharmaceutical products.

Spain boasts 103 factories dedicated to producing medicines for human use, with 11 specializing in biologics. When factoring in 46 facilities for active ingredients and 24 for veterinary use, the total rises to 173 factories, spread across 122 distinct business groups. Collectively, they generate 183,000 jobs (encompassing direct, indirect, and induced employment), produce goods worth EUR 16 billion (USD 16.79 billion) (with 75% earmarked for export), and lead in both competitiveness and environmental sustainability.

In 2023, prescription medications dominated Spain's pharmaceutical market, accounting for nearly 70% of the revenue. Over-the-counter medications followed at 12.4%, while nutritional products made up about 3%. That year, Spain boasted approximately 22,261 pharmacies, translating to one pharmacy for every 2,130 residents.

In 2023, Spain's pharmaceutical imports were valued at around USD 22 billion, a slight dip from the USD 24 billion in 2022. Notably, over the analyzed period, imports surged by more than 4.2 times.

This robust growth of the pharmaceutical industry in Spain will support the advancement of the Spanish pharmaceutical logistics market by creating tremendous opportunities for the transport and storage of temperature-sensitive and general pharmaceutical products in the country.

The increasing demand for efficient logistics solutions will drive investments in infrastructure, technology, and services, ensuring the safe and timely delivery of pharmaceutical products. Consequently, the Spanish pharmaceutical logistics market is expected to experience significant growth, solidifying its position as a critical component of the global pharmaceutical supply chain.

Spain Pharmaceutical Logistics Market Trends

Expansion in Warehousing and Storage Market

In Spain's pharmaceutical logistics market, warehouses are pivotal, enhancing the supply chain's efficiency and reliability.

Strategically positioned, warehouses act as distribution hubs, ensuring the swift transportation of pharmaceuticals. Their optimal placement reduces transit times, allowing pharmaceutical companies to promptly serve healthcare providers, pharmacies, and patients. This timeliness is vital, especially for urgent medications and medical emergencies.

Healthcare entities, from hospitals to clinics, depend on warehouses for their pharmaceutical needs. These warehouses guarantee accurate and complete shipments, bolstering the healthcare system's smooth operation.

The pharmaceutical sector encompasses a broad spectrum, from common over-the-counter drugs to specialized, high-value medications. Warehouses adeptly manage this variety, offering tailored storage conditions, such as refrigerated spaces for vaccines and other temperature-sensitive items.

Warehouses offer the necessary flexibility to navigate market shifts, be it demand fluctuations, new product launches, or evolving distribution strategies. Such adaptability is vital in an industry where swift responses to market changes are paramount.

In collaboration with the VGP Group, a top pan-European firm specializing in cutting-edge logistics parks, a new warehouse is set to commence operations in the first quarter of 2023.

In January 2023, Bomi Group, a subsidiary of UPS, inaugurated its new storage and distribution hub in Madrid, backed by an EUR 18-million (USD 19.34 million)investment. Spanning 27,578m2, this GMP and GDP-compliant logistics center boasts a capacity for 60,000 pallets, positioning it among Europe's largest pharmaceutical warehouses and generating 150 skilled jobs.

With 80% of pharmaceutical products in Europe now needing temperature-controlled transport due to advancements in biologics, specialty drugs, and personalized medicine, the Madrid facility is equipped to cater to this demand.

It offers diverse temperature-controlled storage options (-30 °C, +2+8 °C, +15+25 °C) and features a cutting-edge automated order-picking system, boasting an impressive error rate of under 0.02%. Built to BREEAM standards, the facility emphasizes sustainable operations.

The increase in warehousing and storage capacity in Spain's pharmaceutical logistics market reflects the growing demand for efficient and reliable supply chain solutions. As the pharmaceutical industry continues to evolve with new product innovations and market dynamics, the role of warehouses becomes increasingly critical.

Enhanced warehousing capabilities ensure that pharmaceutical companies can meet the rising needs of healthcare providers and patients, ultimately contributing to the overall improvement of the healthcare system in Spain.

Increasing in Generic Drugs market

The Spanish government is relaxing certain regulations, contributing to the surge of generic drugs in Europe.

Low production costs of generic drugs, compared to branded counterparts, are luring manufacturers to invest in the industry. Additionally, logistics companies are rolling out new services, ensuring users stay updated on their orders, complemented by other value-added offerings.

Spain boasts one of the highest rates of generic drug penetration in Europe, underscoring robust backing from both healthcare providers and patients. A testament to Spain's dedication to biosimilars is its embrace of biosimilar versions of biologic drugs, such as infliximab and rituximab, pivotal in treating ailments like rheumatoid arthritis and specific cancers.

Leading this charge are companies like Kern Pharma and Cinfa Biotech. Kern Pharma's biosimilar, Remsima (infliximab), has seamlessly integrated into treatment protocols, offering patients a more economical choice.

Spain's generic drug landscape is vibrant, with Laboratorios Normon and Teva Pharmaceuticals at the helm. Laboratorios Normon boasts a diverse portfolio, catering to therapeutic areas from cardiovascular health to oncology. Meanwhile, Teva Pharmaceuticals is broadening its generic drug offerings, ensuring Spanish patients have access to affordable medications.

The Spanish Agency of Medicines and Medical Devices (AEMPS) oversees the regulation and approval of these drugs, upholding rigorous safety and efficacy benchmarks. As the landscape shifts, both biosimilars and generics are poised to play pivotal roles in bolstering Spain's healthcare system and enhancing patient outcomes.

In May 2024, Hikma Pharmaceuticals PLC (Hikma), a global pharmaceutical entity, proudly unveiled HIKMA ESPANA, S.L.U. (Hikma Spain). This strategic move marks Hikma's inaugural foray into Spain's lucrative generic injectable market, valued at around USD 860 million. With 36 product approvals under its belt, Hikma has successfully launched 25 products across diverse therapeutic domains in Spain, including cardiovascular, oncology, central nervous system, and anti-infectives.

The increasing penetration of generic drugs in Spain is significantly impacting the pharmaceutical logistics market. As demand for these cost-effective medications rises, logistics providers are enhancing their capabilities to manage the distribution efficiently.

This includes adopting advanced tracking systems, optimizing supply chains, and offering comprehensive value-added services. Consequently, the growth of the generic drugs market is not only transforming the pharmaceutical landscape but also driving innovation and efficiency within the logistics sector, ensuring that patients receive timely and reliable access to essential medications.

Spain Pharmaceutical Logistics Industry Overview

Spain's pharmaceutical Logistics industry is competitive and dynamic, but it still has a considerable margin to achieve a more relevant role in the national economy. A few existing major players in the market include DHL Supply Chain, FedEx, Kuehne + Nagel International AG, United Parcel Service, and CH Robinson. These companies are implementing next-generation logistics solution technologies into their services, such as automation, artificial intelligence, machine learning (AI and ML), blockchain, transportation management systems, and others, to increase supply chain productivity, reduce costs, and avoid errors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Drivers

- 4.2.1 Increase In Pharmaceutical Sales Is Driving The Market

- 4.2.2 Rise In Population Is Driving The Market

- 4.3 Marrket Restraints

- 4.3.1 Ensure The Safety Of Medications

- 4.3.2 Labor Shortage

- 4.4 Market Opportunities

- 4.4.1 Increase in Cold Storage Warehouses

- 4.5 Industry Supply Chain/Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Government Initiatives and Regulations in the Market

- 4.8 Technological Trends in the Market

- 4.9 Insights Into The 3PL Market in Spain

- 4.10 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Services

- 5.1.1 Transportation

- 5.1.1.1 Road

- 5.1.1.2 Rail

- 5.1.1.3 Air

- 5.1.1.4 Sea

- 5.1.2 Storage and Warehousing

- 5.1.3 Value Added Services

- 5.1.1 Transportation

- 5.2 By Temperature Control

- 5.2.1 Temperature Controlled/Cold Chain

- 5.2.2 Non-Temperature Controlled/Non-Cold Chain

- 5.3 By Product

- 5.3.1 Generic Drugs

- 5.3.2 Branded Drugs

- 5.4 By Application

- 5.4.1 Biopharma

- 5.4.2 Chemical Pharma

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 DHL

- 6.2.2 FedEx

- 6.2.3 Kuehne+Nagel International AG

- 6.2.4 United Parcel Service

- 6.2.5 C.H. Robinson

- 6.2.6 CEVA Logistics

- 6.2.7 DB Schenker

- 6.2.8 Movianto

- 6.2.9 Agility Logistics

- 6.2.10 Eurotranspharma

- 6.2.11 CSP*

- 6.3 Other Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy