PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683520

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683520

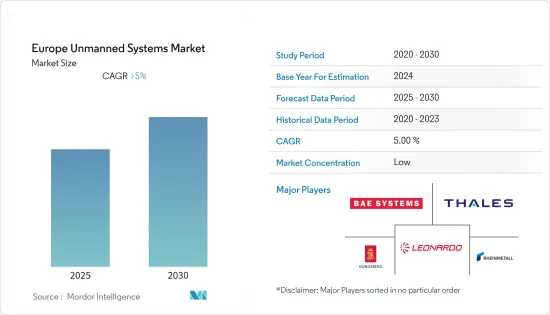

Europe Unmanned Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe Unmanned Systems Market is expected to register a CAGR of greater than 5% during the forecast period.

There is no considerable impact of the COVID-19 pandemic on the military segment of the Europe unmanned systems market in 2020 and 2021. However, the demand from the civil and commercial end-users has reduced, majorly in 2020 due to the COVID-19 pandemic. Nevertheless, as the situation improved and commercial and research activities resumed, the demand improved in 2021.

The focus on several militaries to field small but capable forces is driving the development and procurement of unmanned systems in the military segment. The growth in the defense expenditures of major military powerhouses is also driving the R&D of advanced military unmanned systems. In the civil and law enforcement sector, the growing demand for unmanned systems for various applications like agriculture, mining, research, and cargo delivery, among others is driving the market growth.

The integration of advanced technologies like artificial intelligence and machine learning, along with the use of better materials and power systems, is expected to make the unammed systems more reliable, and effective in the years to come.

Europe Unmanned Systems Market Trends

Military Segment Will Showcase Remarkable Growth During the Forecast Period

Countries in Europe have increased their investments in the procurement of military drones and UGVs in the past few years due to the growing militarization of the region by Russia. Due to the ongoing tension between Ukraine and Russia, it is expected that the defense spending by the European countries will further increase in the coming years. Also, the changing nature of warfare and the growing defense spending of the countries in the region is resulting in countries investing significantly in unmanned systems to protect their soldiers. Several projects on semi-autonomous surface ships and submarines, next-generation small drones, and advanced UGVs of various sizes and capabilities are being developed through partnerships among the countries in the region.

For instance, the European Medium Altitude Long Endurance Remotely Piloted Aircraft System (MALE RPAS), or Eurodrone, a twin-turboprop MALE UAV, is being developed by Airbus, Dassault Aviation, and Leonardo for the countries Germany, France, Italy, and Spain, with a first flight expected by mid-2027. In January 2022, Spain approved a total budget of USD 3.5 billion for its share of the development, production, and service of drones. Countries in the region are also procuring unmanned systems in huge quantities.

Furthermore, in June 2022, Germany announced that its Army will receive more than 120 PackBot 525 explosive ordnance disposal (EOD) robots, following a four-year dialogue between PackBot manufacturer Teledyne FLIR and the German Army. Such developments are expected to drive the growth of the segment during the forecast period.

United Kingdom Held the Largest Market Share in 2021

The United Kingdom was the largest market for unmanned systems in Europe in 2021. The United Kingdom government, in collaboration with the Civil Aviation Authority (CAA), is supporting the use of unmanned aerial vehicles to meet personal needs. The government has launched the UAV pathfinder program to enable private players to manufacture beyond the visual line of sight drones for various applications, such as agriculture, construction, and remote sensing. In April 2021, the Civil Aviation Authority (CAA) approved the Beyond-visual-line-of-sight Flights (BVLOS) operations of drones. The local startup sees.ai is the first company to obtain the United Kingdom's Civil Aviation Authority (CAA) authorization for trailing a concept for a routine beyond-visual-line-of-sight (BVLOS) command and control solution.

Furthermore, in the military sector, the United Kingdom's Ministry of Defense (MoD's) Defense, Science, and Technology Laboratory (Dstl) has also initiated a study on future UGVs for the British Army. The consortium led by Rheinmetall BAE Systems Land (RBSL) is exploring new approaches to UGVs as part of its wider Mounted Combat Systems research project. The country is also procuring several new UGVs. In January 2022, the Ministry of Defense (MoD) ordered seven Mission Master autonomous unmanned ground vehicles (A-UGVs) from Rheinmetall. Out of the seven, four UGVs will be procured in ISTAR configuration while three will be used as cargo vehicles for the Spiral 3 of the UK's Robotic Platoon Vehicle (RPV) experimentation programme, to be delivered by the end of August 2022.

Also, the United Kingdom Royal Navy is also incorporating unmanned underwater systems to conduct covert missions. Britain's Ministry of Defense is exploring options for the development of an Extra Large Unmanned Underwater Vehicle (XLUUV) to conduct missions at distances of up to ranges of 3,000 nautical miles for the Royal Navy. Such developments are expected to bolster the market prospects in the country during the forecast period.

Europe Unmanned Systems Industry Overview

The Europe unmanned systems market is highly fragmented, due to the presence of several players that provide several unmanned systems for military, law enforcement, and commercial applications. Rheinmetall AG, Thales Group, Leonardo SpA, Kongsberg Gruppen, and BAE Systems plc are some of the prominent players in the market. Several companies are investing in the R&D of advanced unmanned systems to attract customers. Companies are also collaborating with each other and with governments to develop new and advanced unmanned systems.

For instance, in June 2022, the Luxembourg Directorate of Defence, Leonardo and Skydweller Aero, the United States-Spanish aerospace startup, announced their partnership to develop a solar-powered UAV that will mainly focus on assessing ISR opportunities. Such partnerships are expected to provide growth opportunities for the market players during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Unmanned Aerial Vehicles

- 5.1.2 Unmanned Ground Vehicles

- 5.1.3 Unmanned Sea Systems

- 5.2 Application

- 5.2.1 Civil and Law Enforcement

- 5.2.2 Military

- 5.3 Country

- 5.3.1 United Kingdom

- 5.3.2 France

- 5.3.3 Germany

- 5.3.4 Spain

- 5.3.5 Italy

- 5.3.6 Russia

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Milrem Robotics

- 6.1.2 QinetiQ

- 6.1.3 Nexter Group

- 6.1.4 Rheinmetall AG

- 6.1.5 Thales Group

- 6.1.6 Leonardo SpA

- 6.1.7 Kongsberg Gruppen

- 6.1.8 BAE Systems plc

- 6.1.9 Saab AB

- 6.1.10 UAS Europe AB

- 6.1.11 Flyability SA

- 6.1.12 Parrot Drone SAS

- 6.1.13 DJI

- 6.1.14 Maritime Robotics AS

- 6.1.15 Telerob Gesellschaft fr Fernhantierungstechnik mbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS