PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683472

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683472

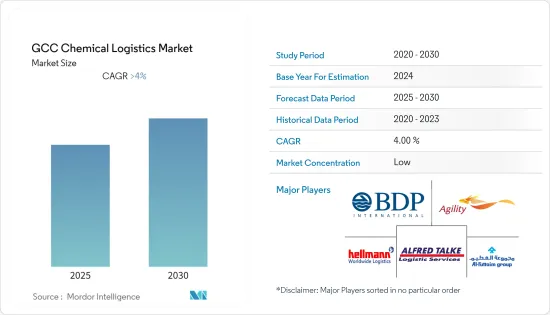

GCC Chemical Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The GCC Chemical Logistics Market is expected to register a CAGR of greater than 4% during the forecast period.

On an economic level, the contribution of the chemical industry toward the growth of the region has been predominant over the years. The chemical industry in the GCC is consistently scaling new heights in terms of production, portfolio diversification, and job creation, which is demanding the requirement for state-of-the-art logistics. The government's policies and investments and recent M&As for economic diversification that is focused on developing the non-oil sector are major reasons for the growth of the chemical industry over the years.

This is supported by several government initiatives, such as Oman's National Program for Diversification. Saudi Vision 2030 is also playing a role in supporting economic diversification. In the United Arab Emirates, the chemical sector is situated mostly in Abu Dhabi, where the industry is developed in line with Abu Dhabi's Economic Vision 2030, which, in turn, is creating new employment opportunities.

GCC Chemical Logistics Market Trends

Saudi Arabia Chemical Sector Occupies the Major Share in the GCC Region

Saudi Arabia has maintained its exceptional standing in 2019, retaining its spot in the top 15 exporters of chemicals globally. It was also the GCC regions' powerhouse, with the largest volume output and chemical sales revenue. Over the last few decades, China and Saudi Arabia have emerged as key chemical production hubs, reshaping the balance in the global chemical industry.

The Kingdom of Saudi Arabia (KSA) is considered one of the leading countries in the manufacture of many major chemical products and investing its data as one of the most suitable environments for low-cost chemical industries. KSA sits alongside the United States as the largest petrochemical manufacturer in the world, with 14 Saudi companies producing an average of 95 million metric ton of petrochemicals, accounting for nearly 9% of global production as reported in September 2020.

The volume of the kingdom's business is expected to double by 2030, based on the increase in global demand for the chemicals industry and because of the relentless work of the Kingdom of Saudi Arabia to push the wheel of investment in this sector.

The Kingdom is also characterized by its abundance of raw materials and easy access to it, in addition to its possession of a high level of infrastructure that is constantly being improved, and the companies of the Kingdom of Saudi Arabia also have access to a solid and wide logistics network, which puts the Kingdom in a prime position that serves the growing demand of Africa, Europe, and Asia.

Increasing Investments in the GCC Chemical Industry

The chemicals industry in the GCC is expected to attract new investments, as the region explores more higher-value downstream opportunities amid continued volatility in oil prices and as benefits from cheap feedstocks ease. Future investments in the GCC are being led by Saudi Arabia, which has been trying to get in investors into its petrochemical sector as part of its Vision 2030 program to diversify its economy.

The energy giant 'Aramco' is undertaking two massive projects in Saudi Arabia - a crude oil-to-chemicals (CTC) project in Yanbu to produce 9 million tonnes/year of chemicals and base oils by 2025 and the Amiral 1.5 million tonnes/year cracker joint venture project with France-based Total which is slated for start-up in 2024 in Jubail.

The developments in the market may result in greater competitiveness in the regional chemical industry by enabling it to leverage economies of scale and accelerate innovation, which will be a major driving factor for logistics in the chemical sector.

GCC Chemical Logistics Industry Overview

The GCC chemical logistics market is fiercely competitive and fragmented in nature, with the presence of many international and too many small domestic companies. Some of the top companies in the GCC region include Agility Logistics, BDP International, and Talke Group (RSA Talke and S.A. Talke). The region has been observing many innovative and digital trends in the past few years to meet the chemical output requirements and bring efficiency in handling and transportation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Trends

- 4.3 Government Regulations and Initiatives - Key Countries

- 4.4 Industry Value Chain/Supply Chain Analysis

- 4.5 Investment Scenarios

- 4.6 Insights into the 3PL Market (Market Size and Forecast)

- 4.7 Impact of COVID-19 on the Chemical Logistics Market

5 MARKET DYNAMICS

- 5.1 Marjet Drivers

- 5.2 Market Restriants

- 5.3 Market Oppurtunities

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing, Distribution, and Inventory Management

- 6.1.3 Other Value-added Services

- 6.2 By End User

- 6.2.1 Pharmaceutical Industry

- 6.2.2 Cosmetic Industry

- 6.2.3 Oil and Gas Industry

- 6.2.4 Specialty Chemicals Industry

- 6.2.5 Other End Users

- 6.3 By Country

- 6.3.1 Saudi Arabia

- 6.3.2 Kuwait

- 6.3.3 United Arab Emirates

- 6.3.4 Qatar

- 6.3.5 Bahrain

- 6.3.6 Oman

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Agility Logistics

- 7.2.2 BDP International

- 7.2.3 Al-Futtaim Logistics

- 7.2.4 Talke Group (RSA Talke and SA Talke)

- 7.2.5 Bertschi AG

- 7.2.6 GAC Logistics

- 7.2.7 AAA Freight Services LLC

- 7.2.8 Hellmann Worldwide Logistics (Hellmann Indu Chemical)

- 7.2.9 Petrochem Middle East (PME)

- 7.2.10 Al Ghazal Logistics *

- 7.3 Other Companies (International Chemical Logistics (ICL), JSL Global (Jassim Shipping & Logistics), Gulf Warehousing Company (GWC), and Den Hartogh Logistics*)

8 FUTURE OUTLOOK OF THE MARKET

9 APPENDIX