PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851167

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851167

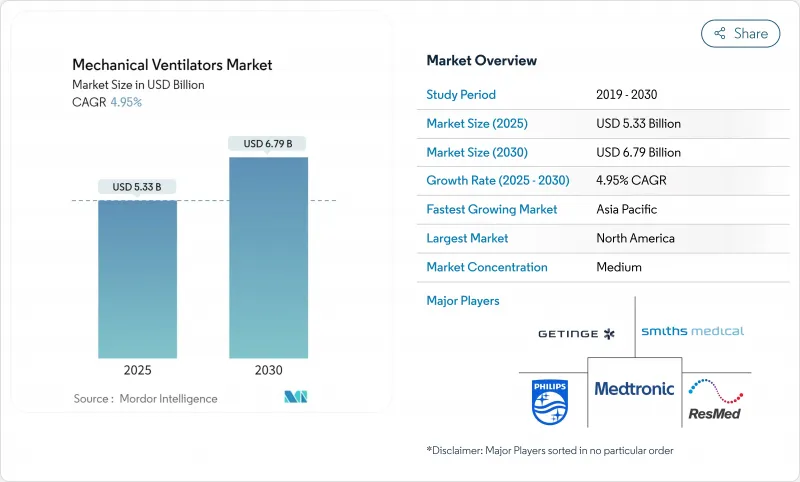

Mechanical Ventilators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The mechanical ventilator market is valued at USD 5.33 billion in 2025 and is forecast to reach USD 6.79 billion by 2030, advancing at a 4.95% CAGR.

Growth is shifting from pandemic-driven surges to steady expansion supported by aging populations that demand longer ICU stays and by rising chronic respiratory conditions such as COPD. Artificial-intelligence features now automate closed-loop ventilation, cut clinician workload, and reduce complications, encouraging hospitals to refresh fleets despite tighter capital budgets. Home care is emerging as a parallel growth engine because updated Medicare rules cover non-invasive ventilation for chronic respiratory failure, enabling patients to avoid repeat admissions. Regional imbalances in critical-care infrastructure, especially in Asia-Pacific, create white-space opportunities for cost-effective devices that meet lower-acuity needs.

Global Mechanical Ventilators Market Trends and Insights

Rising COPD prevalence

Global COPD cases continue climbing, reinforcing baseline demand across invasive and non-invasive devices. The Centers for Medicare & Medicaid Services broadened 2025 coverage for home ventilation when PaCO2 remains at or above 52 mmHg, which expands the treated COPD population.Overlap with obesity hypoventilation syndrome and obstructive sleep apnea has produced a 1.560% prevalence pool that often requires domiciliary ventilatory support. Home therapy lowers readmissions and improves blood-gas exchange, even though daytime dyspnea persists. These outcomes underpin payer acceptance and spur manufacturers to tailor compact, low-maintenance non-invasive models. As the disease burden skews older, demand also converges with the broader demographic shift toward chronic comorbidity management.

Aging population and ICU capacity expansion

Older adults already make up 22% of Australia's population and similar trajectories exist across Europe and North America. Hospital associations project 170 million inpatient days in the United States by 2030 as chronic conditions rise. Longer ventilation courses drive equipment turnover, while persistent intensivist shortages prompt hospitals to invest in smarter modes that reduce hands-on adjustments. In France, two-thirds of ICUs now report at least one physician vacancy, magnifying the value of automation. Nations such as China plan large expenditure increases that could lift per-capita health spending more than 10-fold by mid-century, signaling sustained capacity buildouts. The COVID-19 pandemic exposed geographic imbalances that technology suppliers can help correct through modular, rapidly deployable units.

High device and maintenance costs

Total supply-chain expenses absorb up to 20% of device revenue as geopolitical shocks raise component prices. Ventilators fall under Medicare's Frequent and Substantial Servicing category, obligating regular upkeep that inflates ownership costs. Compliance with the FDA's 2026 quality rule will further increase documentation and validation spending, particularly for AI software updates. Emerging hospitals with below-average ICU bed density struggle to finance premium models, steering them toward refurbished or locally assembled units. Suppliers respond with modular designs that share parts across acuity tiers to curb logistics overhead.

Other drivers and restraints analyzed in the detailed report include:

- Government pandemic-preparedness stockpiles

- AI-driven closed-loop ventilation adoption

- Home NIV growth for obesity hypoventilation

- Micro-turbine and battery efficiency advances

- Ventilator-associated pneumonia

- Semiconductor supply-chain volatility

- Reimbursement cuts for long-term home use

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Intensive care units dominate with 54.91% mechanical ventilator market share. Their purchasing decisions steer supplier R&D, producing adaptive closed-loop modes and low-noise turbines that then migrate into transport variants. The mechanical ventilator market size for ICU models is projected to continue outpacing overall revenue because hospitals refresh fleets faster than lower-acuity sites when software advances push measurable quality gains. Portable devices, though starting from a smaller base, accelerate on 5.34% CAGR as emergency services and disaster-response teams prioritize battery runtime and rugged housings. The HAMILTON-C6 illustrates cross-segment technology transfer by packaging ICU-grade algorithms in a moveable chassis that weighs under 10 kg. Transport adoption also rises when reimbursement codes permit billing during inter-facility transfers, particularly in North America.

A hybrid product class for sub-acute wards has emerged, blending weaning tools with moderate flow capabilities to avoid full-price ICU hardware. Fleet managers appreciate common consumables across chassis families, which lowers inventory. Suppliers that design shared user interfaces across mobility classes simplify training and cut user error. These value propositions help defend premium pricing even as public tenders emphasize lowest cost compliant bids.

Invasive ventilation accounts for 64.25% of revenue in 2024 because severe ARDS and surgical procedures still require endotracheal access. The mechanical ventilator market size linked to invasive systems will expand modestly, while non-invasive lines post 5.71% CAGR thanks to domiciliary uptake and early intervention protocols. Leakage-compensation software such as IntelliTrig enhances patient synchrony, reducing escalation to intubation. Hospitals increasingly deploy dual-mode devices so clinicians can switch without swapping hardware, which lowers capital intensity.

Non-invasive gains also stem from growing pediatric and neonatal applications. Interfaces tailored to small airways and facial structures reduce skin injuries while enabling prolonged therapy. Helmets and mouthpiece ventilation deliver alternatives where masks trigger claustrophobia. Regulatory approvals for high-flow nasal cannula add competitors to conventional NIV by covering mild hypoxemia cases. Manufacturers balance portfolio breadth with inventory complexity through modular manifold connectors and sensor arrays.

The Mechanical Ventilators Market Report is Segmented by Mobility (Intensive Care Ventilators, Portable Ventilators, and More), Interface (Invasive Ventilation and Non-Invasive Ventilation), Patient (Adult, Pediatric, and Neonatal) End User (Hospitals, Home Healthcare, and Ambulatory Surgical Centers), and Geography. The Market Size and Forecasts are Provided in Terms of Value (USD) for the Above Segments.

Geography Analysis

North America, with 42.91% mechanical ventilator market share, benefits from extensive ICU infrastructure, federal stockpiles, and supportive reimbursement frameworks . Public procurement policy now blends centralized reserve purchases with hospital fleet refresh subsidies, smoothing order patterns after the 2020-2022 demand spike. Adherence to FDA cybersecurity guidance also favors domestic suppliers with validated software lifecycles.

Europe follows as a mature yet innovative buyer. The region enforces strict eco-design and data-protection rules that push vendors toward energy-efficient turbines and encrypted cloud connectors. Several countries roll out national AI roadmaps for critical care, making funding available for pilot deployments. Market volume remains steady; revenue growth arises from higher average selling prices and software subscriptions.

Asia-Pacific records the fastest 6.71% CAGR, powered by health infrastructure initiatives that aim to lift critical-care bed density above 5 per 100,000 population in middle-income nations . Variance within the region is high. High-income economies such as Japan sustain upgrade cycles every five years, whereas low-income countries rely on grant financing. Suppliers succeed by offering scalable platforms that accept both wall and compressor oxygen sources.

China's recognition of intensive care as a specialty in 2009 ignited a network of professional societies that standardize protocols and accelerate equipment tendering. Local firms co-licensed western turbine technology to bypass import tariffs, putting price pressure on multinationals. India and Indonesia prioritize Make-in-Country schemes that favor domestic value addition above 30%.

Latin America saw emergency manufacturing booms during COVID-19. Governments now convert some pop-up facilities into permanent critical-care wards, sustaining baseline demand for mid-tier ventilators. Currency volatility nevertheless complicates capital imports, so lease models gain popularity.

The Middle East and Africa trail in penetration yet hold long run potential. Oil-rich Gulf states fund high-spec ICUs, demanding premium devices with integrated nitric oxide delivery. Resource-poorer nations depend on donor funding and require rugged units capable of dusty environments and variable power supply. Suppliers partner with NGOs to bundle training, easing adoption.

The United States dominates the North American mechanical ventilators market, accounting for approximately 45% of the regional ventilator market share in 2024. The country's market leadership is supported by its extensive healthcare network comprising over 5,000 hospitals with advanced intensive care facilities. The presence of leading manufacturers, robust healthcare infrastructure, and high healthcare expenditure further strengthen its market position. The US market is characterized by strong demand for both intensive care ventilators and portable ventilation solutions, driven by the rising incidence of chronic respiratory diseases and an aging population requiring long-term ventilation support.

Canada emerges as the fastest-growing market in North America, with a projected growth rate of approximately 7% during 2024-2029. The country's market growth is driven by increasing healthcare expenditure, growing adoption of home healthcare solutions, and rising awareness about respiratory care management. Canadian healthcare facilities are increasingly investing in advanced ventilation technologies to improve patient outcomes. The government's supportive healthcare policies and focus on enhancing critical care infrastructure contribute to market expansion. The country also shows strong demand for portable ventilators, particularly in remote healthcare settings and home care applications.

The European mechanical ventilators market demonstrates significant strength, supported by well-established healthcare systems across Germany, the United Kingdom, France, Italy, and Spain. The region's market is characterized by high adoption rates of advanced medical technologies and a strong presence of major ventilator manufacturers. European countries maintain strict regulatory standards for medical devices while continuously investing in healthcare infrastructure improvement. The market benefits from an increasing focus on home healthcare solutions and rising demand for portable ventilation devices.

Germany leads the European mechanical ventilators market, holding approximately 20% of the regional ventilator market share in 2024. The country's market leadership is attributed to its robust healthcare system, substantial healthcare spending, and strong domestic manufacturing capabilities. German hospitals maintain high standards of intensive care facilities and demonstrate consistent demand for advanced ventilation solutions. The presence of major manufacturers and research institutions contributes to continuous innovation in ventilation technologies, while the country's aging population drives sustained market growth.

The United Kingdom represents a significant market in Europe, with a projected growth rate of approximately 7% during 2024-2029. The UK's healthcare system continues to invest in modernizing its critical care infrastructure and expanding access to advanced respiratory care solutions. The country shows increasing adoption of portable and home ventilation solutions, driven by a growing emphasis on home healthcare services. British healthcare facilities are actively incorporating new ventilation technologies to improve patient care outcomes and operational efficiency.

The Asia-Pacific mechanical ventilators market demonstrates robust growth potential, encompassing diverse healthcare markets across China, Japan, India, South Korea, and Australia. The region experiences increasing healthcare infrastructure development, rising healthcare expenditure, and growing awareness about respiratory care. Rapid urbanization, increasing pollution levels, and rising incidence of respiratory diseases drive market expansion across these countries. The region also benefits from growing domestic manufacturing capabilities and increasing adoption of advanced medical technologies.

China maintains its position as the largest market for mechanical ventilators in the Asia-Pacific region. The country's extensive healthcare system modernization, large patient population, and growing domestic manufacturing capabilities drive market growth. Chinese healthcare facilities continue to expand their critical care capabilities, while increasing focus on home healthcare solutions creates new market opportunities. The country's investment in healthcare infrastructure and emphasis on medical device manufacturing self-sufficiency strengthens its market position.

South Korea emerges as the fastest-growing market in the Asia-Pacific region. The country's advanced healthcare system, strong technological capabilities, and increasing focus on healthcare innovation drive market expansion. Korean healthcare facilities demonstrate high adoption rates of advanced ventilation technologies, while the country's aging population creates sustained demand. The market benefits from strong domestic manufacturing capabilities and continuous investment in healthcare infrastructure development.

The Middle East & Africa mechanical ventilators market shows promising growth potential, with significant variations across different regions. The GCC countries lead the regional market, benefiting from substantial healthcare investments and modern medical facilities. South Africa represents another key market, with growing healthcare infrastructure development and increasing adoption of advanced medical technologies. The region demonstrates an increasing focus on improving critical care facilities and expanding access to advanced respiratory care solutions, with the GCC emerging as both the largest and fastest-growing market in the region.

The South American mechanical ventilators market continues to evolve, with Brazil and Argentina representing key markets in the region. The market benefits from ongoing healthcare infrastructure development, increasing healthcare expenditure, and rising awareness about respiratory care. Brazil maintains its position as the largest market in the region, while Argentina shows the fastest growth potential. The region demonstrates increasing adoption of both intensive care and portable ventilation solutions, supported by growing healthcare investments and expanding access to advanced medical technologies.

List of Companies Covered in this Report:

- Medtronic

- Getinge

- GE HealthCare Technologies Inc.

- Dragerwerk

- Koninklijke Philips

- Smiths Group

- Resmed

- Mindray Medical Intl.

- Nihon Kohden Corp.

- Zoll Medical Corp.

- Fisher & Paykel Healthcare

- Hamilton Medical

- Allied Healthcare Products

- Vyaire Medical

- Bunnell Inc.

- Airon Corp.

- Shenzhen SiareSys

- Lowenstein Medical

- Magnamed

- Bio-Med Devices

- Timpel S/A

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising COPD prevalence

- 4.2.2 Aging population & ICU capacity expansion

- 4.2.3 Government pandemic-preparedness stockpiles

- 4.2.4 AI-driven closed-loop ventilation adoption

- 4.2.5 Home NIV growth for obesity hypoventilation

- 4.2.6 Micro-turbine & battery efficiency advances

- 4.3 Market Restraints

- 4.3.1 High device & maintenance costs

- 4.3.2 Ventilator-associated pneumonia (VAP)

- 4.3.3 Semiconductor supply-chain volatility

- 4.3.4 Reimbursement cuts for long-term home use

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value & Units)

- 5.1 By Mobility

- 5.1.1 Intensive-Care (ICU) Ventilators

- 5.1.2 Transport / Portable Ventilators

- 5.1.3 Sub-acute & Long-term Care Ventilators

- 5.2 By Interface

- 5.2.1 Invasive Ventilation

- 5.2.2 Non-Invasive Ventilation (NIV)

- 5.3 By Patient Age

- 5.3.1 Adult

- 5.3.2 Pediatric

- 5.3.3 Neonatal

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Home Healthcare

- 5.4.3 Ambulatory Surgical Centers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 Getinge AB

- 6.3.3 GE HealthCare Technologies Inc.

- 6.3.4 Dragerwerk AG & Co. KGaA

- 6.3.5 Koninklijke Philips N.V.

- 6.3.6 Smiths Medical (ICU Medical)

- 6.3.7 ResMed Inc.

- 6.3.8 Mindray Medical Intl.

- 6.3.9 Nihon Kohden Corp.

- 6.3.10 Zoll Medical Corp.

- 6.3.11 Fisher & Paykel Healthcare

- 6.3.12 Hamilton Medical AG

- 6.3.13 Allied Healthcare Products

- 6.3.14 Vyaire Medical

- 6.3.15 Bunnell Inc.

- 6.3.16 Airon Corp.

- 6.3.17 Shenzhen SiareSys

- 6.3.18 Lowenstein Medical

- 6.3.19 Magnamed

- 6.3.20 Bio-Med Devices

- 6.3.21 Timpel S/A

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment