PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683221

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683221

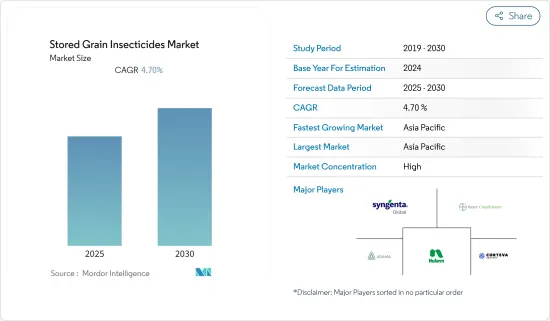

Stored Grain Insecticides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Stored Grain Insecticides Market is expected to register a CAGR of 4.7% during the forecast period.

Sustaining market pressure for better prices during the post-harvest stage and increasing focus on the reduction of post-harvest losses are the major factors driving the market growth. Lack of storage facilities in many small scale farms across various countries led to the inability to store surplus grains resulting in increased post harvest losses. Additionally, the respective governments are increasingly focusing toward keeping pace with its looming food storage crises and has increased the contribution toward the construction of high-tech grain storage silos. This is likely to augment the demand for insect grain protectants. The prevailing pandemic across the globe has resulted in increased stocking and storage of grains due to the disruption of supply chain. In order to protect the stored grains from pest infestation, farmers tend to demand the stored grains insecticide at an increasing level. Hence apart from logistics sector, the impact of COVID-19 if extended to the third quarter of 2021,the market is further observed to grow across the globe.

Stored Grain Insecticide Market Trends

Stored grain pest- per capita loss

Owing to the infestation of pests, mites, rodents, and birds, around 1,300 million metric ton of food grains are being wasted annually. The use of insecticides is a very effective method to control insects and pests in silos, grain bins, and warehouses. According to Food and Agricultural Organization (FAO), the average production loss of the post-harvest produce is estimated to be around 5% in the developed countries, 7% in industrialized countries, and around 7% in developing countries, annually. The increasing concerns toward reducing post-harvest losses, especially from the emerging economies, such as India and China, seems to be an opportunity, which can enhance the sales of warehouse insecticides during the study period. Insecticides are mandatory for trade processes and are important for the quarantine process, as elimination of toxic substances from few crops, especially horticulture crops, is essential to increase the quality of produce in the export market. In such cases, chemical treatment with insecticides is only the technique available, which works with high efficiency.

Asia Pacific Dominates the Market

According to a report by FAO, insect activity is on the rise because of the increasing temperature in the temperate crop-growing regions of India. This, in turn, is leading to the nationwide losses in the cultivation of crops, such as rice, corn, and wheat, by about 10-25% with per degree Celsius rise in mean surface temperature. The most common insects damaging grain storages in India are the rice weevil, the khapra beetle, the grain moth, and the lesser grain/ hooded-grain/ paddy borer. These affect a host of stored grains ranging from rice, wheat, maize, jowar, barley, and other grains. The increase in infestation of stored grains by such insects is further enhancing the market for stored grain insecticides in the country. However, according to reports by IRRI, the overuse and misuse of stored grain insecticides in India is disrupting the natural control mechanisms of rice and other grains, and hence, the FSSAI has set a maximum regulatory limit to the usage of such insecticides. This is going to deter the growth of the market to some extent in the said forecast period.

Stored Grain Insecticide Industry Overview

The storage grain insecticide market is highly competitive, with various small- and medium-sized companies coining reasonable shares in the world. This has resulted in a very stiff competition. The increasing merger and acquisition activities by the major players in different parts of the world is one of the major factors for the consolidated nature of the market. North America and the Asia-Pacific are the two regions showing maximum competitor activities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions and Market Definition

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Organophosphate

- 5.1.2 Pyrethroids

- 5.1.3 Bio-Insecticides

- 5.1.4 Others

- 5.2 By Application type

- 5.2.1 On Farm

- 5.2.2 Off Farm

- 5.2.3 Export shipments

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adapted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Bayer CropScience AG

- 6.3.2 Degesch America Inc.

- 6.3.3 Syngenta AG

- 6.3.4 Corteva AgriScience

- 6.3.5 Nufarm Ltd

- 6.3.6 Douglas Products

- 6.3.7 Adama Agricultural Solutions Ltd.

- 6.3.8 UPL Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 AN ASSESSMENT OF THE IMPACT OF COVID-19