PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683209

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683209

Middle East & Africa Flavors & Fragrances - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

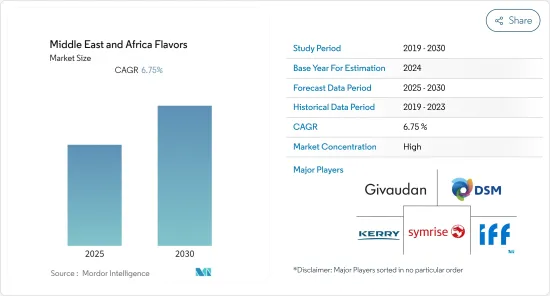

The Middle East & Africa Flavors & Fragrances Market is expected to register a CAGR of 6.75% during the forecast period.

Middle-East food manufacturing and processing sector witnessed rapid growth in the past ten years. The strong support from the government, direct subsidies, long-term interest-free loans, duty-free imports of raw materials, and highly subsided utilities are the factors that prompted the industries to enter the food ingredients market. Moreover, the increase in demand for different flavorings, high demand for authentic and natural flavorings, change in lifestyle, and increased demand for healthy and natural food flavorings coupled with an increase in the research and innovation by the manufacturers and expansion of the food industry is driving the flavor and fragrance market.

The rapid growth of the food processing sector provides good export opportunities for the U.S. suppliers of bulk and intermediate products, as most of these Middle-East companies rely heavily on imported raw materials and food ingredients, including food flavors. As some flavors are country and region-specific, the manufacturers are constantly innovating to introduce new products in the market to capture the major market share. However, due to the presence of limited natural resources to extract flavors, new entrants often face challenges in the flavor industry.

Middle East and Africa Flavors & Fragrances Market Trends

Growing Demand for Natural Ingredients in the Region

The population of the Middle East and Africa is at high risk of obesity, which is one of the leading avoidable causes of death in the region. Many are opting for healthy options, such as vegetarianism and veganism, to avoid obesity. The unceasing innovation and developments in the flavor market have been tapping the emerging food and beverage industries. Plant-derived vegan flavors in the food ingredients market have emerged as a boon for businesses dedicating operations to vegan products. Moreover, the rising vegan population in the countries remains the primary factor boosting the market studied. Growing consumer preference for natural flavors over artificial flavors due to associated health risk with artificial flavors as it contains chemicals.

Moreover, RTE (ready-to-eat) products such as instant noodles, ice creams, and soups are a few of the most vulnerable food cuisines to be experimented with based on flavors. For instance, the key player in the market, Symrise offers distinct culinary flavors for products like soups and bouillons, ready meals, sauces and dressing, processed meat, instant noodles, and alternative protein products. In October 2020, International Flavoursand Fragrance announced the opening of a new Dubai Taste Creation Centre, application and innovation center for its Taste division in Dubai, UAE, to serve its customers' unique needs better and drive growth in the African Middle Eastern, Turkish and Indian markets. The new lab will support all key categories' creation and application needs, including snacks, beverages, savory, sweet, and dairy.

Saudi Arabia Holds a Prominent Share in the Market

The growth in the food and beverage industry and the technological innovations in flavor manufacturing are the major factors driving the flavors industry in the region. In addition, introducing functional food products and the increasing demand for recognizable and authentic flavors in various end-user industries, such as dairy and frozen products, boosts the industry's growth. According to the Saudi Dairy and Foodstuff Company, in 2021, the sales volume of ice cream reached around 48 million liters.

Saudi Arabia is among the region's largest confectionery markets, indicating a potential market growth for flavors and fragrances in the country. Further, the change in consumer preference for confectioneries is primarily led by experiential consumer demand, as consumers want to discover something new and different is leading to more unusual and often bolder flavors and blends, surprise textures, and a greater focus on visual appeal in the sweets, and snacks products, hence encouraging confectionery manufacturers to innovate in the flavor ingredients category to more consumer base. Consumer opting for a healthy diet like vegan or vegetarian in the Middle East region has a risk of obesity, diabetes, and cardiovascular problems, so companies are using natural flavors in food and beverages. These are some drivers that boost the natural flavor market.

Middle East and Africa Flavors & Fragrances Industry Overview

Middle-East and African flavor and fragrance markets are consolidated, with major players holding a major market share. Major players in the market are International Flavors & Fragrances Inc., Symrise AG, Givaudan SA, Kerry Group PLC, and Koninklijke DSM N.V. Companies have focused on increasing demand for packaged food products with varied flavor profiles. Emphasis is given to the companies' merger, expansion, acquisition, partnership, and new product development as strategic approaches adopted by the leading companies to boost their brand presence in the market. Players in the market are expanding their product offerings by bringing innovations in their products to cater to a broader consumer base.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Synthetic

- 5.1.2 Natural

- 5.2 Application

- 5.2.1 Food

- 5.2.1.1 Savory Food

- 5.2.1.2 Dairy Products

- 5.2.1.3 Bakery and Confectionery

- 5.2.1.4 Meat and Meat Products

- 5.2.1.5 Others

- 5.2.2 Beverages

- 5.2.3 Beauty and Personal Care

- 5.2.4 Perfumes

- 5.2.5 Others

- 5.2.1 Food

- 5.3 Country

- 5.3.1 United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 Egypt

- 5.3.4 South Africa

- 5.3.5 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies adopted by Key players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Givaudan SA

- 6.3.2 Koninklijke DSM N.V.

- 6.3.3 International Flavors & Fragrances Inc.

- 6.3.4 Symrise AG

- 6.3.5 The Archer Daniels Midland Company

- 6.3.6 Sensient Technologies Corporation

- 6.3.7 MANE SA

- 6.3.8 Takasago International Corporation

- 6.3.9 Kerry Group PLC

- 6.3.10 Solvay SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS