PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907234

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907234

North America Food Flavor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

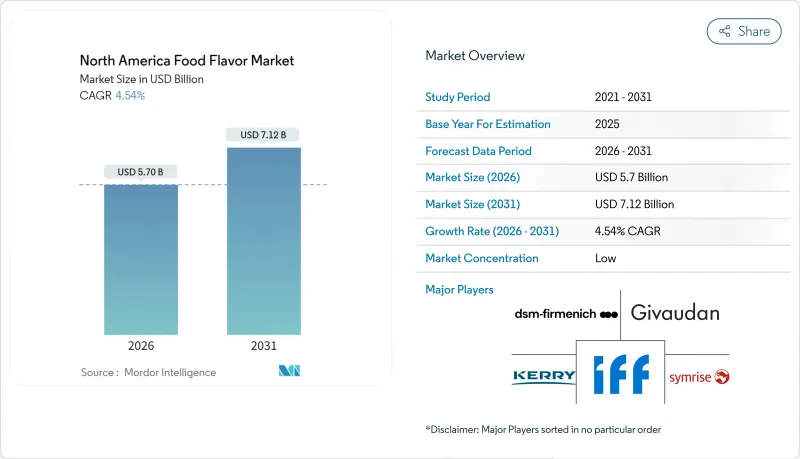

The North America food flavor market is expected to grow from USD 5.45 billion in 2025 to USD 5.70 billion in 2026 and is forecast to reach USD 7.12 billion by 2031 at 4.54% CAGR over 2026-2031.

This steady rise shows how consumer migration toward natural ingredients, AI-enabled formulation tools, and increasing label scrutiny are reshaping purchasing priorities. Synthetic products, while still dominant, face tightening regulation and slowing adoption, whereas natural variants gain momentum through shorter approval cycles and widening clean-label demand. Beverage manufacturers anchor volume because liquid matrices carry complex flavor payloads, yet savory snack makers spark incremental growth through ethnic and heat-forward profiles. Across the value chain, supply security for botanical extracts, new encapsulation methods, and cross-border trade optimization under USMCA create additive tailwinds. As a result, the North American food flavors market is transitioning from maturation to innovation-led expansion.

North America Food Flavor Market Trends and Insights

Rising Demand for Natural and Clean-Label Ingredients

Consumer preference shifts toward natural flavoring accelerate as regulatory pressure mounts against synthetic additives. FDA's announcement of Red 3 prohibition by January 2027 exemplifies this trend, forcing manufacturers to reformulate products with natural alternatives. Clean-label positioning becomes a competitive necessity rather than premium differentiation, with major food manufacturers investing heavily in natural flavor sourcing and processing capabilities. This transition creates supply-demand imbalances for key botanical extracts, driving price premiums that smaller manufacturers struggle to absorb. The regulatory momentum suggests similar restrictions on other synthetic additives will follow, making natural ingredient procurement a strategic imperative for sustained market access.

Expansion of Processed Food and Beverage Industry

In North America, particularly in Mexico, the processed food sector is witnessing significant growth, which is driving an increased demand for cost-effective flavoring solutions. The USMCA trade agreement plays a pivotal role in supporting Mexico's food processing industry by reducing tariff barriers for ingredient imports from the United States and Canada. This reduction facilitates the incorporation of more sophisticated and diverse flavor profiles into products that were traditionally simpler in nature. Flavor companies with well-established supply chains and regulatory approvals across the three countries are well-positioned to capitalize on this geographic expansion. Additionally, the growing trend of premiumization in Mexican food products is accelerating the adoption of more intricate and complex flavor systems. This evolving market dynamic creates substantial opportunities for mid-tier flavor houses to establish strategic regional partnerships and expand their presence in the region.

Volatility in Prices and Availability of Key Raw Materials

Natural flavor costs are heavily influenced by fluctuations in agricultural commodity prices. Vanilla, citrus oils, and spice extracts, in particular, have experienced significant price volatility, primarily due to climate disruptions and geopolitical tensions. The concentration of essential flavor raw materials in specific geographic regions exacerbates supply chain vulnerabilities, making it difficult for manufacturers to implement effective hedging strategies. For instance, recent drought conditions in Mexico and extreme weather events across North America have disrupted established sourcing patterns. These disruptions have compelled flavor companies to adopt more diversified supplier networks to mitigate risks, as noted by the USDA. However, this volatility disproportionately impacts smaller flavor houses, which often lack the procurement scale, financial resources, and capacity to maintain adequate strategic inventory levels, leaving them more exposed to supply chain challenges.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Functional Foods, Beverages, and Wellness Products

- Growing Interest in Vegan and Cruelty-Free Ingredients

- Stringent Regulatory and Customer-Specific Compliance Requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Synthetic flavoring maintains commanding market leadership with 54.21% share in 2025, reflecting cost advantages and consistent supply availability that appeal to price-sensitive food manufacturers. However, natural flavoring emerges as the growth champion with 5.76% CAGR through 2031, driven by consumer clean-label preferences and regulatory pressure against artificial additives. Nature-identical flavoring occupies a middle position, offering cost-performance balance for manufacturers transitioning from synthetic to natural formulations. The synthetic segment's dominance stems from established manufacturing infrastructure and regulatory approvals that create switching costs for food producers.

Advanced encapsulation technologies enable natural flavor stability improvements that historically favored synthetic alternatives, reducing the performance gap between categories. DSM-Firmenich's investment in natural flavor processing capabilities exemplifies how major players are repositioning for the clean-label transition. FDA compliance frameworks treat natural and synthetic flavoring differently, with natural ingredients facing less stringent pre-market approval requirements that accelerate product development timelines. The cost premium for natural flavoring continues narrowing as production scales increase and synthetic alternatives face regulatory restrictions.

The North America Food Flavor Market Report is Segmented by Type (Synthetic, Natural, Nature-Identical), Application (Dairy, Bakery, Confectionery, Savory Snack, Meat, Beverage, Other Applications), and Geography (United States, Canada, Mexico, Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Givaudan SA

- DSM-Firmenich AG

- International Flavors & Fragrances Inc. (IFF)

- Symrise AG

- Kerry Group plc

- Archer Daniels Midland Company (ADM)

- Sensient Technologies Corporation

- Takasago International Corporation

- Synergy Flavors

- Bell Flavors & Fragrances

- Flavorchem Corporation

- Blue Pacific Flavors

- Robertet SA

- Mane SA

- T. Hasegawa Co., Ltd.

- Corbion N.V.

- Carbery Group (incl. FONA, Tastepoint)

- Cargill, Incorporated

- Dohler GmbH

- Ingredion Incorporated

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for natural and clean-label ingredients

- 4.2.2 Growth of functional foods, beverages, and wellness products

- 4.2.3 Expansion of processed food and beverage industry

- 4.2.4 Growing interest in vegan and cruelty-free ingredients

- 4.2.5 Technological advances in flavor encapsulation and modulation

- 4.2.6 AI-driven flavor development and innovation

- 4.3 Market Restraints

- 4.3.1 Volatility in prices and availability of key raw materials

- 4.3.2 Stringent regulatory and customer-specific compliance requirements

- 4.3.3 Supply chain disruptions and logistic constraints

- 4.3.4 Rising health concerns over the use of artificial additives

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECAST

- 5.1 Type

- 5.1.1 Synthetic

- 5.1.2 Natural

- 5.1.3 Nature-Identical

- 5.2 Application

- 5.2.1 Dairy

- 5.2.2 Bakery

- 5.2.3 Confectionery

- 5.2.4 Savory Snack

- 5.2.5 Meat

- 5.2.6 Beverage

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Givaudan SA

- 6.4.2 DSM-Firmenich AG

- 6.4.3 International Flavors & Fragrances Inc. (IFF)

- 6.4.4 Symrise AG

- 6.4.5 Kerry Group plc

- 6.4.6 Archer Daniels Midland Company (ADM)

- 6.4.7 Sensient Technologies Corporation

- 6.4.8 Takasago International Corporation

- 6.4.9 Synergy Flavors

- 6.4.10 Bell Flavors & Fragrances

- 6.4.11 Flavorchem Corporation

- 6.4.12 Blue Pacific Flavors

- 6.4.13 Robertet SA

- 6.4.14 Mane SA

- 6.4.15 T. Hasegawa Co., Ltd.

- 6.4.16 Corbion N.V.

- 6.4.17 Carbery Group (incl. FONA, Tastepoint)

- 6.4.18 Cargill, Incorporated

- 6.4.19 Dohler GmbH

- 6.4.20 Ingredion Incorporated

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK