PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683126

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683126

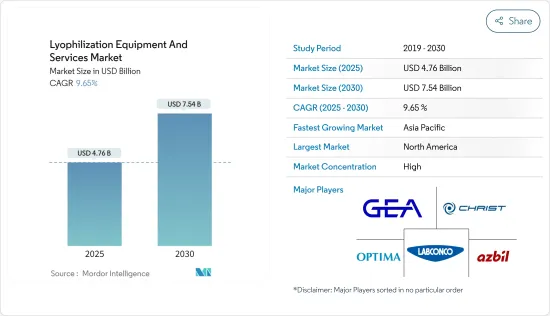

Lyophilization Equipment And Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Lyophilization Equipment And Services Market size is estimated at USD 4.76 billion in 2025, and is expected to reach USD 7.54 billion by 2030, at a CAGR of 9.65% during the forecast period (2025-2030).

Megatrends Driving Market Growth: The Lyophilization Equipment and Services Market is experiencing significant growth, propelled by key megatrends across pharmaceutical, biotechnology, and food processing industries. These drivers include the rising demand for biopharmaceuticals, the shift toward personalized medicine, and the growing consumer preference for convenience foods with extended shelf lives. The increasing use of lyophilization in these industries, combined with technological advancements, supports these trends, fostering innovation and market expansion.

Rising Demand for Lyophilized Products: The demand for lyophilized products has risen sharply, especially within the pharmaceutical and biotech sectors. Lyophilization offers extended shelf life, stability, and ease of use, which are critical for modern drug development. This trend is particularly relevant for injectable biopharmaceuticals, which play an increasingly prominent role in managing chronic diseases. Moreover, lyophilized products eliminate the need for cold chain logistics, reducing transportation and storage costs, making them a valuable solution in global healthcare.

Technological Advancements in Lyophilization Methods: Innovations in lyophilization technology are transforming the market, driving enhanced efficiency, scalability, and safety. Continuous freeze-drying processes, which outperform traditional batch systems, allow for greater throughput and lower operating costs. Aseptic lyophilization technologies further enhance the sterility of pharmaceuticals and biologics, incorporating advanced isolator systems to minimize contamination risks. This technological progress is particularly significant in industries requiring precise control and sterile conditions.

Expanding Applications and Industry Adoption: While traditionally dominated by pharmaceuticals and food processing, lyophilization is finding new applications in cosmetics, nutraceuticals, and industrial enzymes. In cosmetics, lyophilization enhances the stability and potency of active ingredients, extending product shelf life. In the nutraceutical industry, it helps preserve the integrity of vitamins and minerals, meeting consumer demand for high-quality health supplements. The expansion of lyophilization into these sectors indicates its growing importance across a broader range of industries.

Continuous Innovation and Customization: There is a growing trend toward customized lyophilization solutions tailored to specific industry needs. Manufacturers are enhancing freeze-dryer designs, integrating features like advanced automation and energy efficiency. The development of specialized equipment for niche applications, such as personalized medicine and biologics, is also on the rise. This demand for customization and continuous innovation is shaping the future of the market, as companies seek to meet the unique challenges posed by sensitive materials and small-batch production.

Lyophilization Equipment & Services Market Trends

Dryer Type Segment: Dominating the Lyophilization Equipment Landscape

Segment Overview: The dryer type segment, encompassing tray, manifold, and rotary freeze dryers, commands nearly 45% of the market. Each dryer type serves specific industry needs, from pharmaceutical manufacturing to food processing. Freeze-drying equipment plays a crucial role in preserving sensitive materials, making it indispensable across multiple sectors. The versatility and efficiency of modern freeze dryers underscore their dominance, ensuring their continued prominence in the lyophilization equipment market.

Growth Drivers and Future Expectations: The rise in demand for lyophilized products is fueling the growth of the dryer type segment. Advances in lyophilization technology are making freeze dryers more efficient, thus playing a critical role in meeting the preservation needs of complex pharmaceuticals and biotech products. This trend is set to continue as biopharmaceuticals and personalized medicine become more prevalent, driving further demand for sophisticated freeze-drying equipment.

Competitive Strategies and Future Disruptions: Companies are focusing on enhancing freeze dryer capabilities with energy-efficient designs, increased automation, and integration of IoT for real-time process monitoring. The drive for innovation is pushing manufacturers to create compact, versatile dryers that cater to a wide range of applications. However, potential disruptions, such as new drying technologies or regulatory changes, could challenge the dominance of traditional freeze-drying methods, requiring companies to remain agile.

Asia-Pacific: The Epicenter of Lyophilization Market Growth

Regional Growth Dynamics: The Asia-Pacific region is emerging as the fastest-growing market for lyophilization equipment and services, with a projected CAGR of 10% between 2024 and 2029. By 2029, the market is expected to exceed USD 2.2 billion, driven by rapid adoption across industries such as pharmaceuticals and biotechnology. The region's growth is led by countries like China and India, which are investing heavily in domestic pharmaceutical manufacturing and research capabilities.

Driving Forces and Market Expectations: China and India are leading the charge with growth rates of 10.2% and 11%, respectively. Factors driving this growth include expanding pharmaceutical production, increased biotech research, and rising demand for high-quality food products. Government initiatives aimed at boosting local manufacturing and the burgeoning middle class's demand for quality healthcare products are also critical drivers of market expansion in the region.

Strategic Imperatives and Potential Disruptions: To capture the growth opportunities in Asia-Pacific, companies are establishing local manufacturing plants, forming partnerships with regional players, and tailoring products to meet local regulatory requirements. However, varying levels of economic development and technology adoption across countries pose challenges. Companies need to craft region-specific strategies to remain competitive and navigate potential disruptions, such as shifting regulatory frameworks or emerging local competitors.

Lyophilization Equipment & Services Industry Overview

Global Players Dominate the Market Landscape: The global lyophilization equipment and services market is dominated by large, multinational players with specialized expertise. Market leaders such as GEA Group, Optima Packaging Group, and Martin Christ Gefriertrocknungsanlagen GmbH maintain significant market shares due to their continuous investment in R&D, comprehensive product portfolios, and global reach. These companies focus heavily on innovation to maintain their competitive edge.

Market Leaders Leverage Technological Expertise: Key players are driving market innovation by integrating automation, IoT, and continuous processing technologies. For instance, GEA Group's significant investment in R&D (2.3% of revenue) highlights the industry's commitment to advancing lyophilization technology. These companies also offer a range of services, including maintenance and process optimization, enhancing their value propositions and strengthening customer relationships.

Strategies for Future Market Success: Future success will depend on advancements in continuous processing and automation, as well as the ability to meet the growing demand for biologics and personalized medicine. For example, Biopharma Group's new GMP freeze-drying facility for small-batch production demonstrates the importance of niche capabilities in personalized medicine. Strategic collaborations with biotech and pharmaceutical firms will also be crucial for maintaining competitiveness in this evolving landscape.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Lyophilized Products

- 4.2.2 Technological Advancements in Lyophilization Methods

- 4.3 Market Restraints

- 4.3.1 Increasing Utilization of Alternative Drying Techniques in the Pharmaceutical and Biotechnology Industries

- 4.3.2 High Setup and Maintenance Cost of Freeze-Drying Equipment

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Modality

- 5.1.1 Dryer Type

- 5.1.1.1 Tray-style Freeze Dryers

- 5.1.1.2 Manifold Freeze Dryers

- 5.1.1.3 Rotary Freeze Dryers

- 5.1.1.4 Other Products

- 5.1.2 Accessories

- 5.1.2.1 Vacuum Systems

- 5.1.2.2 CIP (Clean-in-place) Systems

- 5.1.2.3 Drying Chamber

- 5.1.2.4 Other Accessories

- 5.1.3 Services

- 5.1.1 Dryer Type

- 5.2 By Application

- 5.2.1 Food Processing and Packaging

- 5.2.2 Pharmaceutical and Biotech Manufacturing

- 5.2.3 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AZBIL KIMMON CO., LTD. (AzbilTelstar, SLU)

- 6.1.2 GEA Group Aktiengesellschaft

- 6.1.3 Labconco Corporation

- 6.1.4 Martin Christ Gefriertrocknungsanlagen GmbH

- 6.1.5 Millrock Technology Inc

- 6.1.6 Optima Packaging Group GmbH

- 6.1.7 ATS (SP Industries)

- 6.1.8 Tofflon Science and Technology Co. Ltd

- 6.1.9 Lyophilization Technology Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS