PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645156

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645156

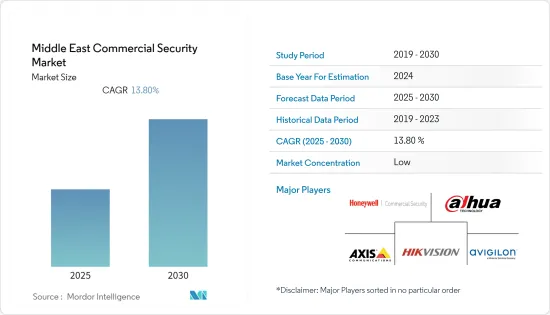

Middle East Commercial Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Middle East Commercial Security Market is expected to register a CAGR of 13.80% during the forecast period.

Key Highlights

- The commercial security adoption in the Middle East is being driven by increasing infrastructure investment, the growing risk of suspected threat activities, government regulatory mandates, and severe implementations.

- The need for commercial security has increased with the rise in tourism activities and the growth of businesses in the GCC. Also, the regulatory bodies have made compulsion of security surveillance cameras in every area with sufficient video storage capacity.

- The realization of the impact of security on the overall productivity of the organizations and end-users and the commitment of regional governments to protecting critical assets and people have been creating the demand for commercial security in the region.

- Furthermore, increasing awareness among several sectors about security, increasing adoption of new technological solutions, and availability of devices at a low price are further adding demand in the market studied in the region.

- The COVID-19 pandemic has slowed the demand for security systems due to supply chain disruption and delayed and canceled commercial projects in several countries such as Saudi Arabia and the UAE. The large investments underway in the sectors, including urban developments, power sectors, and transport, are expected to propel the demand for commercial security equipment in the forecast period.

Middle East Commercial Security Market Trends

Growing Investment in Infrastructure is Expected to Cater Market Growth

The Middle-East is continuously preparing for many infrastructure changes and smart city projects. High demand for advanced security solutions with streamlined video surveillance and access control integration will be the key emerging trend in this region.

Because of the huge volume of commercial development, the demand for security equipment is on the rise in the region. Furthermore, as infrastructure develops, the number of people in malls, hotels, and amusement parks will expand, resulting in a greater demand for different security devices.

In February 2022, the prime minister of UAE announced the USD 10 billion investment in Israeli companies in the field of energy, industry, infrastructure, water use, space, and health to benefit the people of the Middle-East and advance the whole region.

UAE is Expected to Grow Significantly During the Forecast Period

During the first quarter of 2022, the Dubai real estate market witnessed an increase in new project launches as the emirate emerged as a favorite destination for high-net-worth individuals, including millionaires and entrepreneurs, following the COVID-19 pandemic.

The number of new project announcements during the January-March quarter exceeded pre-pandemic levels, demonstrating the market's optimism. During the quarter, around 25 new projects totaling 6,677 residential units were announced to meet expanding demand in Dubai.

Furthermore, according to the Ministry of Industry and Advanced Technology, the rise in industrial export from UAE has surpassed the historical high in 2021 compared to 2020 to USD 32.6 billion as 220 factories opened across the country. This shows the growth of the industrial sector, which is expected to add to the demand for surveillance and security systems during the forecast period.

Middle East Commercial Security Industry Overview

The Middle-East Commercial Security market is highly competitive owing to the presence of domestic and international vendors operating in the market and coming with innovative technologically advanced solutions to remain competitive in the market. Dahua Technology Co., Axis Communications, Hikvision Digital Technology, and others are key players. Key developments in the market are -

March 2022 - Axis Communications announced a diverse array of new products and solutions that will be introduced at ISC West 2022. The offerings include video, audio, and analytics applications, many of which will be demonstrated in-booth at the event.

February 2022 - FLIR launched A50 and A70 thermal cameras to fit the needs of professionals in every industry. The new A50 and A70 thermal cameras come in three options: Smart, Streaming, and Research & Development to fit the needs of professionals across various industries, from manufacturing to utilities to science.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Introduction to Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Favorable Changes in Regulatory Standards have Prompted Agencies to put in Place Security Systems with Storage Capabilities

- 5.2.2 Dynamic Nature of the Security Threats

- 5.2.3 Strong Investments in the Infrastructural Sector in Emerging Markets such as Qatar

- 5.3 Market Challenges (Cost & Awareness-Based Issues)

- 5.4 Key Technological Innovations

- 5.5 Distribution Channel Analysis

6 COMPARTIVE ANALYSIS OF ADOPTION ACROSS VAROUS COUNTRIES IN THE MEA REGION

7 MARKET SEGMENTATION

- 7.1 By Security Type

- 7.1.1 Video Surveillance Systems (Cameras - IP & Analog, Video Management, Professional Services)

- 7.1.2 Access Control Systems (Biometric Readers, Access Cards & Controllers, Services & Software, Intruder Alarms, etc)

- 7.2 By End-user Type

- 7.2.1 Industrial (Industrial Establishments, Utilities, etc)

- 7.2.2 Residential

- 7.2.3 Commercial (Hospitality, Education, etc)

- 7.2.4 Other End-users

- 7.3 By Geography

- 7.3.1 United Arab Emirates

- 7.3.2 Saudi Arabia

- 7.3.3 Qatar

- 7.3.4 Oman

- 7.3.5 Kuwait

- 7.3.6 Rest of Middle East

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Honeywell Security

- 8.1.2 Dahua Technology Co.

- 8.1.3 Axis Communications

- 8.1.4 Hikvision Digital Technology

- 8.1.5 Avilgon (Motorola)

- 8.1.6 Tyco Security Products

- 8.1.7 FLIR Systems

- 8.1.8 Pelco, Inc.

- 8.1.9 Bosch Security & Safety

- 8.1.10 UTC

- 8.1.11 Sentinel