PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645034

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645034

US Pharmaceutical Warehousing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

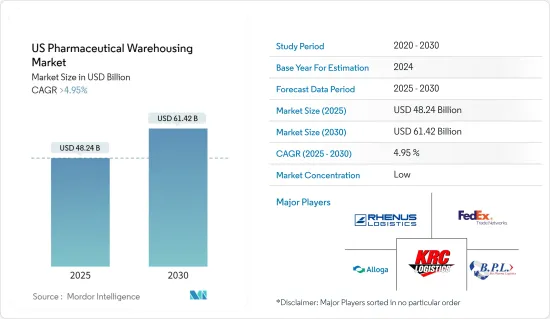

The US Pharmaceutical Warehousing Market size is estimated at USD 48.24 billion in 2025, and is expected to reach USD 61.42 billion by 2030, at a CAGR of greater than 4.95% during the forecast period (2025-2030).

The U.S. pharmaceutical industry, celebrated for its groundbreaking drug developments, plays a pivotal role in propelling the healthcare sector's growth. However, the introduction of many high-priced medications has led to surging healthcare costs, impacting both private entities and the federal government.

In response, policymakers are actively seeking strategies to curtail drug prices and diminish federal drug-related expenditures. These expenditures span a spectrum of activities, from the discovery and testing of novel drugs to incremental innovations like product extensions and clinical testing for safety and marketing.

Bolstered by a strong pipeline of specialty drugs and a rising count of brand-name manufacturers, the U.S. pharmaceutical market witnessed a 7.8% growth, reaching 2,325 businesses in 2023.

The FDA granted approvals to 55 new drugs in 2023, signaling a resurgence in approvals. This uptick coincides with strategic acquisitions by companies aiming to bolster their portfolios in anticipation of patent expirations. The sector's robust output and sales are buoyed by a global vaccination drive and a consistent demand for medical treatments.

By 2028, net spending on medicines is projected to surge by USD 127 billion from 2023 levels, driven primarily by volume growth. While the adoption of innovations will be a key growth driver, it will be tempered by factors like patent expirations and legislative impacts, which typically lead to lower prices.

Amidst pressures to hasten innovation and drug introductions, pharmaceutical manufacturers are capitalizing on emerging opportunities. Scientific breakthroughs are ushering in a fresh wave of innovations in manufacturing, a momentum further bolstered by the U.S. Food and Drug Administration's (FDA) pragmatic regulatory stance. This collaboration is expediting the market entry of lifesaving medicines and therapeutics.

The United States pharmaceutical warehousing market is also experiencing significant growth, driven by the increasing demand for efficient storage and distribution solutions. As the pharmaceutical industry expands, the need for advanced warehousing facilities that ensure the safe and compliant storage of drugs becomes paramount.

These facilities are equipped with state-of-the-art technology to maintain optimal conditions for pharmaceuticals, thereby supporting the industry's overall supply chain. The market is expected to continue its upward trajectory, aligning with the broader growth trends in the pharmaceutical sector.

US Pharmaceutical Warehousing Market Trends

Increase in Controlled Logistics Packaging

Pharmaceutical companies, healthcare facilities, and logistics providers are increasingly prioritizing cold chain logistics packaging due to a heightened emphasis on temperature-sensitive medications and vaccines. The efficacy of biologics and certain vaccines hinges on their storage and transportation at precise temperatures. This pivot towards controlled logistics packaging is vital to avert product degradation, solidifying cold chain packaging as an essential component of the pharmaceutical industry.

The surge in online medication ordering systems has further fueled the expansion of cold chain logistics packaging. With a growing number of consumers and healthcare providers turning to online platforms and direct-to-patient deliveries, the need for efficient temperature-controlled packaging solutions has escalated. By leveraging cold chain logistics for safe and reliable deliveries, providers can tap into a wider market while safeguarding the integrity of pharmaceutical products.

In November 2023, Cryopak Eco GelTM introduced a groundbreaking solution in cold chain logistics, presenting a sustainable and eco-friendly alternative to conventional refrigerants. This white paper delves into the product's standout attributes, including FDA approval, biodegradability, and recyclability, and underscores its potential to propel sustainable practices across diverse industries.

As a result, the United States pharmaceutical warehousing market has seen a significant increase in controlled logistics packaging. This trend reflects the industry's commitment to maintaining product efficacy and meeting the growing demand for temperature-sensitive medications and vaccines. The adoption of advanced cold chain solutions like Cryopak Eco GelTM further supports this growth, highlighting the market's shift towards more sustainable and reliable packaging methods.

The Rise in Development of Hospitals and Clinics

With around 6,120 hospitals, including academic medical centers and teaching hospitals, the U.S. boasts a diverse array of nonfederal, short-term facilities. These hospitals play a pivotal role in the nation's pharmaceutical consumption. Over 6,200 hospitals and 400 health systems across the country are key players, significantly influencing healthcare delivery.

As primary providers of acute and specialized care, these institutions shape trends in pharmaceutical procurement and usage. Their strong demand signals ongoing collaborations and strategic moves within the healthcare sector, all aimed at boosting patient outcomes and streamlining operations.

In the U.S., 31,748 clinics, spanning medical, mental health, and women's health services, are integral to the healthcare framework. These clinics not only deliver comprehensive medical care but also reinforce the nation's dedication to healthcare excellence.

Texas tops the list with 4,661 clinics, highlighting its robust healthcare infrastructure, while California closely follows with 4,584. Other states like Washington, Missouri, and Minnesota also stand out, emphasizing their commitment to meeting the healthcare needs of their residents. This expansion underscores the rising demand for medical services and the strategic significance of clinics in the broader healthcare delivery system.

The rise in the development of hospitals and clinics in the United States has significantly impacted the pharmaceutical warehousing market. As these healthcare facilities expand, the demand for efficient pharmaceutical storage and distribution solutions has grown.

This trend highlights the critical role of pharmaceutical warehousing in supporting the healthcare infrastructure, ensuring timely and safe delivery of medications to meet the increasing needs of hospitals and clinics nationwide.

US Pharmaceutical Warehousing Industry Overview

The United States Pharmaceutical Warehousing Market is a highly competitive market with the presence of several large players as well as small and medium-sized companies. Some of the key players are focusing on expanding their geographic presence, enhancing their service offerings, and investing in new technologies and automation to remain in the market.

Some of the major players are Alloga, BioPharma Logisics, Rhenus SE and Co. KG, ADAllen Pharma, WH BOWKER LTD, Pulleyn Transport Ltd, TIBA, Schenker AG, CEVA Logistics and DACHSER Group SE and Co. KG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of the pharmaceutical industry

- 4.2.2 Increasing demand for temperature-controlled storage

- 4.3 Market Restraints

- 4.3.1 Stringent FDA rules & regulations towards Pharmaceutical Warehousing

- 4.4 Market Opportunities

- 4.4.1 Rise in government initiatives to enhance Pharmaceutical Warehousing

- 4.4.2 Growing popularity of e-commerce

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Service Type

- 5.1.1 Storage

- 5.1.2 Distribution

- 5.1.3 Inventory Management

- 5.1.4 Packaging

- 5.1.5 Others

- 5.2 By Mode

- 5.2.1 Cold Chain Warehouse

- 5.2.2 Non-Cold Chain Warehouse

- 5.3 By End User

- 5.3.1 Pharmaceutical Companies

- 5.3.2 Hospital and Clinics

- 5.3.3 Research Institiutes and Government Agencies

- 5.3.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Alloga

- 6.2.2 Bio Pharma Logistics

- 6.2.3 Rhenus SE and Co. KG

- 6.2.4 ADAllen Pharma

- 6.2.5 DB Schenker

- 6.2.6 FedEx Corp.

- 6.2.7 GEODIS SA

- 6.2.8 CEVA Logistics

- 6.2.9 Hellmann Worldwide Logistics SE and Co KG

- 6.2.10 KRC Logistics

- 6.2.11 Kuehne Nagel Management AG

- 6.2.12 United Parcel Service Inc.

- 6.2.13 XPO Logistics Inc.*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, By Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy

- 8.3 Export and Import Statistics of Related Pharmaceutical Products