PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645033

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645033

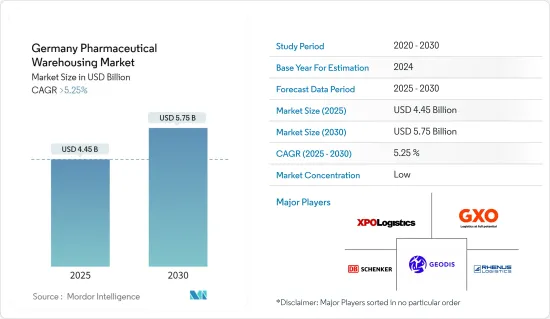

Germany Pharmaceutical Warehousing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Germany Pharmaceutical Warehousing Market size is estimated at USD 4.45 billion in 2025, and is expected to reach USD 5.75 billion by 2030, at a CAGR of greater than 5.25% during the forecast period (2025-2030).

Germany's pharmaceutical warehousing industry plays a pivotal role in the nation's pharmaceutical logistics network. The demand for specialized warehouses, particularly for temperature-sensitive items like vaccines and biologics, has surged. In 2024, the cold chain market is expanding swiftly, with an average year-on-year growth rate nearing 6%. This growth encompasses facilities like temperature-controlled storage units and refrigerated transportation networks, as highlighted in a report by Germany Trade & Invest (GTAI). This growth is bolstered by Germany's robust logistics infrastructure, which caters to both domestic and international demands, especially with facilities meeting stringent EU GDP standards.

Technological advancements, including automation and artificial intelligence, are transforming pharmaceutical storage in Germany. The integration of robotics and automated systems not only boosts operational efficiency but also enhances cost-effectiveness. The German Logistics Association reports that, in response to increasing demand for medicines, pharmaceutical warehouses are projected to see a 15% annual rise in automation adoption, beginning in 2024. Furthermore, significant investments are being channeled to enhance the speed and consistency of warehouse operations, with major logistics centers leveraging state-of-the-art technologies to better cater to the sector.

Germany's regulatory landscape for pharmaceutical warehousing is a crucial catalyst for market expansion. The government enforces stringent standards, as delineated in the German Medicines Act (Arzneimittelgesetz) and EU regulations like GDP. These regulations emphasize the safety of pharmaceutical products, meticulous temperature control, and robust traceability. Cold chain compliance poses a significant challenge, especially with temperature-sensitive pharmaceuticals projected to occupy over 20% of total warehouse capacity by 2024. Given the heightened temperature control mandates for vaccines and biologics, the demand for such specialized facilities is anticipated to grow by 8% annually.

Germany Pharmaceutical Warehousing Market Trends

Adoption of Automation and AI in Pharmaceutical Warehousing

The pharmaceutical warehouse sector witnessed a significant surge in the adoption of automation and AI, marking it as a prominent trend in the industry. At the same time, the rising intricacies of pharmaceutical supply chains, coupled with a heightened demand for efficient and precise operations, are prompting German logistics firms to invest heavily in robotics and AI technologies. These advancements not only curtail labor costs but also enhance stock management, order fulfillment, and adherence to regulations.

Many leading pharmaceutical warehouses now utilize AGVs and robotic arms for sorting and picking tasks, leading to quicker turnaround times and heightened order accuracy. Numerous major pharmaceutical logistics firms in Germany have pledged investments in AI systems aimed at warehouse optimization, particularly emphasizing inventory tracking and predictive maintenance.

In Germany's pharmaceutical warehousing sector, AI has been reshaping operations in recent years. In January 2024, Boehringer Ingelheim harnessed machine learning algorithms to forecast demand, streamline inventory management, and curtail wastage, especially for temperature-sensitive medications. Likewise, in early 2024, Merck KGaA employed AI-driven predictive analytics for immediate stock oversight and storage predictions, guaranteeing adherence to pharmaceutical regulations and cutting down operational expenses. These developments highlight AI's expanding influence in boosting efficiency and ensuring regulatory compliance in Germany's pharmaceutical supply chain.

Stringent regulatory requirements, especially concerning temperature-sensitive products like vaccines and biologics, significantly drive the push for automation. AI and automation play a pivotal role in ensuring compliance by providing precise control over storage conditions and real-time monitoring of environmental factors such as temperature and humidity. Moreover, by minimizing human error, these technologies ensure the proper handling and transportation of medications. Industry sources indicate that automated pharmaceutical warehouses are expanding at an annual rate of 15%, driven by the increasing adoption of these advanced technologies by German firms. Given the escalating demand for high-efficiency operations, this trend is expected to persist.

Growth in Cold Chain Logistics for Pharmaceuticals

Cold chain logistics emerges as a pivotal trend in Germany's pharmaceutical storage landscape. The surging demand for biologic pharmaceuticals, vaccines, and other temperature-sensitive medications underscores the urgent need for specialized cold storage facilities. By 2024, cold chain storage has claimed over 20% of Germany's total pharmaceutical warehouse capacity, with the sector witnessing rapid growth. This surge is predominantly fueled by the increasing volume of vaccines and biologics, both of which demand stringent temperature controls. While certain vaccines necessitate storage at a frigid -80°C, the majority of biologics are maintained within a 2 to 8°C range.

The urgency for these facilities was amplified by the pressing demands of COVID-19 vaccine distribution, a trend that has not only persisted into 2024 but has also been bolstered by the introduction of new biologics and even more temperature-sensitive products. The expansion of cold chain logistics is heavily influenced by the prevailing regulatory landscape. For instance, both the European Union's Good Distribution Practice standards and Germany's Arzneimittelgesetz mandate that pharmaceutical companies ensure the safe storage and transport of temperature-sensitive goods.

In late 2023, Kuehne + Nagel strengthened its cold chain logistics capabilities in Germany by opening a new temperature-controlled warehouse in Frankfurt. This facility addresses the rising demand for temperature-sensitive pharmaceuticals, notably vaccines and biologics. The expansion aligns with Germany's commitment to the EU Good Distribution Practice (GDP) guidelines, ensuring the secure storage and transportation of these essential products. This initiative highlights Germany's focus on bolstering its pharmaceutical logistics expertise.

German pharmaceutical warehouse providers are investing in advanced cold chain facilities with real-time temperature monitoring and data recording to meet stringent standards. Logistics companies are increasing cold storage capacities to meet rising demand.

Germany Pharmaceutical Warehousing Industry Overview

The Germany Pharmaceutical Warehousing market is fragmented in nature, with a mix of global and local players. Most of the imports and exports products need to be monitored in refrigerated transports. Vendors are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. Major players include XPO Logistics Inc., CDS Hackner GmbH, GXO Logistics, and Wagner Group GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased focus on quality and product sensitivity in the pharma industry

- 4.2.2 Automation at warehouses to increase efficiency and accuracy

- 4.3 Market Restraints

- 4.3.1 Lack of efficient logistics support

- 4.3.2 Shortage of skilled labor

- 4.4 Market Opportunities

- 4.4.1 Rise in government initiatives to enhance Pharmaceutical Warehousing

- 4.4.2 Increasing Pharmaceutical product innovation and Development

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Cold Chain Warehouse

- 5.1.2 Non-Cold Chain Warehouse

- 5.2 By Application

- 5.2.1 Pharmaceutical Factory

- 5.2.2 Pharmacy

- 5.2.3 Hospital

- 5.2.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Nippon Express

- 6.2.2 Bio Pharma Logistics

- 6.2.3 Rhenus SE and Co. KG

- 6.2.4 ADAllen Pharma

- 6.2.5 DB Schenker

- 6.2.6 FedEx Corp.

- 6.2.7 GEODIS SA

- 6.2.8 CEVA Logistics

- 6.2.9 Hellmann Worldwide Logistics SE and Co KG

- 6.2.10 CDS Hackner GmbH

- 6.2.11 Pfenning Logistics

- 6.2.12 GXO Logistics

- 6.2.13 Wagner Group GmbH

- 6.2.14 Kuehne Nagel Management AG

- 6.2.15 United Parcel Service Inc.

- 6.2.16 XPO Logistics Inc.*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy

- 8.3 External Trade Statistics - Exports and Imports by Product and by Country of Destination/Origin