PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911766

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911766

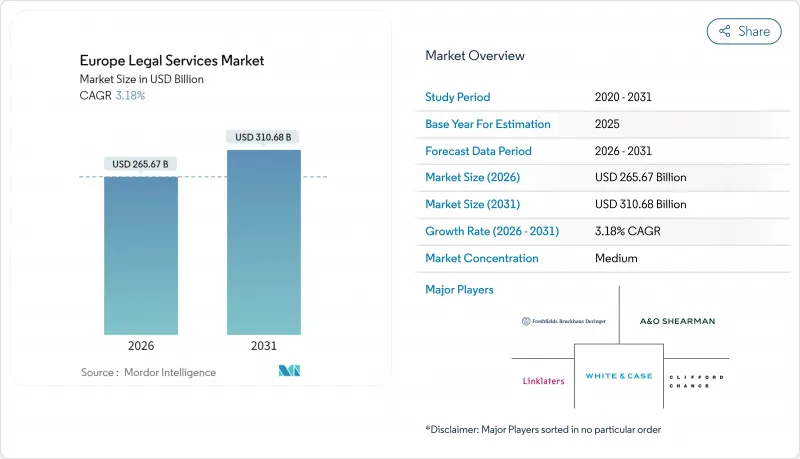

Europe Legal Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe legal services market size in 2026 is estimated at USD 265.67 billion, growing from 2025 value of USD 257.48 billion with 2031 projections showing USD 310.68 billion, growing at 3.18% CAGR over 2026-2031.

Growth stems from a revitalized pipeline of cross-border mergers and acquisitions, escalating ESG-driven mandates, and rapid technology uptake that automates research, discovery, and contract workflows. Post-Brexit regulatory divergence sustains advisory work as organizations balance the United Kingdom and European Union rulebooks, while digital transformation allows firms to deliver routine tasks faster and at lower cost. Alternative legal service providers and the Big Four intensify competitive pressure in commoditized areas, prompting traditional firms to refocus on high-value advocacy and complex compliance assignments. Court backlogs, litigation-funding expansion, and the EU Digital Markets and AI Acts all reinforce demand for specialist counsel, anchoring steady revenue gains across the continent .

Europe Legal Services Market Trends and Insights

Technology Adoption Accelerating E-Discovery and Contract Automation

A large portion of United Kingdom firms already embed artificial-intelligence tools, and around 76% of European practitioners engage generative AI weekly, demonstrating a sharp pivot toward data-driven workflows . Automated platforms cut discovery and contract-drafting hours by up to 50%, letting firms redirect capacity toward strategic counsel. Magic Circle players have organized client-facing AI taskforces; A&O Shearman's working group offers end-to-end advisory on algorithmic risk, signaling a new race for technological differentiation. These advances underpin the 5.07% CAGR in legal research and support services, a trend cemented by firm-wide rollouts of secure generative-AI sandboxes.

Surge in Cross-Border M&A and Private-Equity Activity

Around 90% of private-credit specialists report higher direct-lending deal flow, and sector consolidation is accelerating across financials, healthcare, and renewables. Complex financing structures demand multi-jurisdictional expertise, placing corporate, financial, and commercial law at the core of Europe legal services market growth. Expansion is most pronounced in the United Kingdom and the DACH region, where sophisticated documentation and regulatory filters prolong negotiation cycles but lift overall fee volumes.

Escalating Cybersecurity / Client-Data Breach Risks

Ransomware incidents targeting law firms climbed 60% between 2023 and 2024, exposing sensitive transaction data and driving up cyber-insurance premiums. Mandatory breach-notification timelines under GDPR compound reputational stakes, forcing continuous upgrades of network defences and zero-trust architectures.

Other drivers and restraints analyzed in the detailed report include:

- Post-Brexit UK-EU Regulatory Divergence

- EU Digital Markets & AI Acts Advisory Demand

- Acute Talent Shortage Inflating Billing Rates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large enterprises accounted for 36.12% of the Europe legal services market revenue in 2025, and their complex cross-border mandates underpin premium hourly billing. Multinational compliance programs, sophisticated joint ventures, and antitrust clearance procedures keep demand sticky even during macro-volatility. SMEs post a 4.63% CAGR as they internalize the cost of ESG, data-protection, and employment-law compliance formerly managed in-house. Government and public-sector entities maintain steady project pipelines for procurement litigation, infrastructure concessions, and sovereign bond issuances.

Legal-aid consumers benefit from platform-based triage tools that route minor disputes to fixed-fee providers. Charities, universities, and NGOs engage counsel for donor due diligence and grant compliance reviews amid tightening anti-money laundering and sanctions regimes. This broadening client mix insulates the Europe legal services market from single-sector downturns, reinforcing long-run stability.

Corporate, financial, and commercial law accounted for 30.55% of the Europe legal services market size in 2025, expanding at a 4.18% CAGR as private-equity dry powder fuels leveraged-buyout activity. Banks employ counsel to navigate regulatory capital, margin rules, and green-bond frameworks. Property law revenues rebound as stimulus programs re-ignite housing stock investment, though rising interest costs temper acceleration. Employment practices integrate DEI advisory on ethnicity and disability pay-gap disclosures mandated under EU legislation.

Wills, trusts, and probate work climb steadily alongside intergenerational wealth transfers. Family-law caseloads diversify as cross-border child arrangements rise, demanding Hague Convention expertise. Criminal-law volumes decline in publicly funded segments, but white-collar defence remains buoyant within financial hubs due to regulatory investigations tied to sanctions evasion and market-abuse probes.

The Europe Legal Services Market is Segmented by End User (Legal-Aid Consumers, Private Consumers, and More), by Application (Corporate, Financial and Commercial Law, and More), by Service (Representation, and More), by Mode of Delivery (Traditional In-Person, and More), by Firm Size (Large Law Firms and SME Law Firms) and by Country (United Kingdom, Germany, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Freshfields Bruckhaus Deringer LLP

- Clifford Chance LLP

- Allen Overy Shearman Sterling LLP

- Linklaters LLP

- CMS Legal Services EEIG

- Baker McKenzie

- Hogan Lovells

- DLA Piper

- Dentons

- White & Case LLP

- Eversheds Sutherland

- Bird & Bird

- Pinsent Masons

- Garrigues

- Mannheimer Swartling

- Kinstellar

- Skadden, Arps, Slate, Meagher & Flom LLP (Europe)

- Bryan Cave Leighton Paisner (BCLP)

- Ashurst LLP

- Latham & Watkins LLP (Europe)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technology adoption accelerating e-discovery & contract automation

- 4.2.2 Surge in cross-border M&A and private-equity activity

- 4.2.3 ESG-related compliance complexities

- 4.2.4 Post-Brexit UK-EU regulatory divergence

- 4.2.5 Court backlog & third-party litigation funding growth

- 4.2.6 EU Digital Markets & AI Acts advisory demand

- 4.3 Market Restraints

- 4.3.1 Stringent professional & data-privacy regulations

- 4.3.2 Escalating cybersecurity / client-data breach risks

- 4.3.3 Acute talent shortage inflating billing rates

- 4.3.4 Market-share erosion from ALSP & Big-Four entrants

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By End User

- 5.1.1 Legal-Aid Consumers

- 5.1.2 Private Consumers

- 5.1.3 SMEs

- 5.1.4 Charities and NGOs

- 5.1.5 Large Businesses

- 5.1.6 Government and Public Sector

- 5.2 By Application

- 5.2.1 Corporate, Financial and Commercial Law

- 5.2.2 Personal Injury

- 5.2.3 Commercial and Residential Property

- 5.2.4 Wills, Trusts and Probate

- 5.2.5 Family Law

- 5.2.6 Employment Law

- 5.2.7 Criminal Law

- 5.2.8 Other Applications

- 5.3 By Service

- 5.3.1 Representation

- 5.3.2 Advisory and Consulting

- 5.3.3 Notarial Services

- 5.3.4 Legal Research and Support Services

- 5.4 By Mode of Delivery

- 5.4.1 Traditional In-Person

- 5.4.2 Hybrid (Blended)

- 5.4.3 Fully Digital / Virtual

- 5.5 By Firm Size

- 5.5.1 Large Law Firms

- 5.5.2 SME Law Firms

- 5.6 By Country

- 5.6.1 United Kingdom

- 5.6.2 Germany

- 5.6.3 France

- 5.6.4 Spain

- 5.6.5 Italy

- 5.6.6 Benelux (Belgium, Netherlands, and Luxembourg)

- 5.6.7 Nordics (Sweden, Norway, Denmark, Finland, and Iceland)

- 5.6.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Freshfields Bruckhaus Deringer LLP

- 6.4.2 Clifford Chance LLP

- 6.4.3 Allen Overy Shearman Sterling LLP

- 6.4.4 Linklaters LLP

- 6.4.5 CMS Legal Services EEIG

- 6.4.6 Baker McKenzie

- 6.4.7 Hogan Lovells

- 6.4.8 DLA Piper

- 6.4.9 Dentons

- 6.4.10 White & Case LLP

- 6.4.11 Eversheds Sutherland

- 6.4.12 Bird & Bird

- 6.4.13 Pinsent Masons

- 6.4.14 Garrigues

- 6.4.15 Mannheimer Swartling

- 6.4.16 Kinstellar

- 6.4.17 Skadden, Arps, Slate, Meagher & Flom LLP (Europe)

- 6.4.18 Bryan Cave Leighton Paisner (BCLP)

- 6.4.19 Ashurst LLP

- 6.4.20 Latham & Watkins LLP (Europe)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment