PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644947

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644947

Global Prefab Wood Building - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

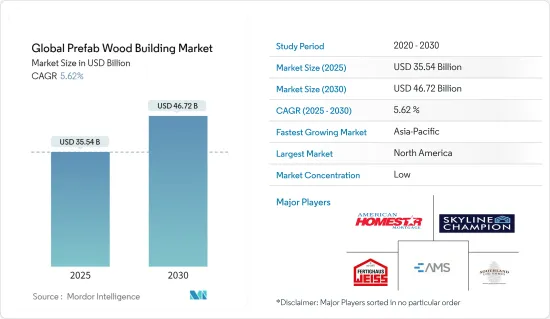

The Global Prefab Wood Building Market size is estimated at USD 35.54 billion in 2025, and is expected to reach USD 46.72 billion by 2030, at a CAGR of 5.62% during the forecast period (2025-2030).

Key Highlights

- Architects worldwide are increasingly turning to post and beam and glued-laminated timbers, making prefabricated wooden buildings some of the quickest and easiest to construct. Despite being an annual, wood continues to sequester carbon dioxide even after being cut. This characteristic makes wood not just a construction material but a potent ally in the fight against climate change.

- Construction activities and building operations are responsible for over 40% of the carbon emissions fueling global warming. Simultaneously, 1.6 billion people reside in inadequate housing, with a staggering 100 million lacking shelter altogether. Both in Australia and worldwide, the housing crisis remains a pressing, unresolved challenge. Yet, prefabricated building technology emerges as a beacon of hope, offering solutions to this dual dilemma.

- The wood frame system enjoys widespread adoption in nations like the United States, Japan, and Germany. Highlighting this trend, the Parkside Carvoeira building in Florianopolis, recognized by ARch Daily, proudly holds the title of Brazil's tallest wood frame building.

- Canadian Wood, hailing from sustainably managed forests in British Columbia (B.C.), stands as a trusted supplier of wooden products in the Indian market. With options like Spruce-Pine-Fir (SPF), Douglas-fir, Western Hemlock, Western Red Cedar, and Yellow Cedar, turning any vision into reality becomes feasible.

- While the demand for prefabricated conventional homes has surged, log homes have emerged as a significant and growing segment of the industry. In the late 1990s, log homes constituted roughly 7% of all custom homes in the U.S., and exports of these prefabricated log homes witnessed a notable uptick. Much like modular homes, log dwellings have seen a rise in affluence. However, they consume 10% to 20% more wood than traditionally constructed houses, making their preferred wood increasingly scarce.

Global Prefab Wood Building Market Trends

Canada Leads the Charge in Prefab Wood Building Market

The prefab wood building market in Canada is on the rise, driven predominantly by the growing adoption of advanced panel systems. Leading this charge are materials such as Cross-Laminated Timber (CLT), Nail-Laminated Timber (NLT), Dowel-Laminated Timber (DLT), and Glue-Laminated Timber (GLT) columns and beams. Renowned for their sustainability and structural integrity, these materials have swiftly become the preferred choice for builders and architects across the country.

Consider the Red Deer Polytechnic Student Residence in Red Deer, Alberta, spotlighted by Construction Business in October 2024. This Canadian residential endeavor, executed via an integrated project delivery (IPD) model, utilized a collaborative 'Choosing by Advantages' (CBA) approach. The team evaluated concrete, steel, wood, and composite systems to determine the best structural fit. The outcome was a five-storey midrise hybrid building, featuring glue-laminated timber (GLT) posts and beams as its structural backbone, GLT panels for the floor and roof, and dimensional lumber for load-bearing walls, shearwalls, and interior partitions. This deliberate selection underscored the growing significance of prefab wood solutions in Canadian construction, delivering maximum benefits at minimal costs.

In Vancouver, British Columbia, another hybrid project, Vienna House, is underscoring the prominence of prefab wood systems in the Canadian market. As reported by Construction Business in October 2024, this project is set to be a near zero-emissions rental apartment community. By choosing Cross-Laminated Timber (CLT) over GLT, Vienna House is integrating CLT floor and ceiling panels with prefabricated light frame wall construction. The design not only champions eco-friendliness but also incorporates seismic reinforcing tension rods in the shearwall system, acknowledging its high seismic zone location. Once finalized, Vienna House will offer 123 units, including 56 family units, catering to a diverse range from shelter and low-income to average market rentals. This initiative underscores the versatility and efficiency of prefab wood systems in meeting varied construction demands within Canada.

In conclusion, the prefab wood building market in Canada is evolving rapidly, with advanced panel systems like CLT and GLT playing a pivotal role. These materials not only bolster structural efficiency but also align with Canada's sustainability objectives, making them integral to modern construction practices. Projects such as the Red Deer Polytechnic Student Residence and Vienna House highlight the adaptability, cost-effectiveness, and environmental consciousness of prefab wood systems, driving the market's growth across Canada in 2024 and beyond.

Panel Systems Feuling the Market

With over 1,600 organizations and a workforce exceeding 231,600, the global prefab wood building market is witnessing a slight annual growth rate dip of 1.28%. Yet, in the last five years, the market has welcomed over 300 new companies, each averaging an employment of 18 individuals as reported by Industry Associations.

Prefab wood panel systems, including those used in data centers, are increasingly utilizing materials like cross-laminated timber (CLT), a fire-resistant, prefabricated wood material. For instance, as reported by DCD, October 2024, Microsoft has adopted a combination of wood, steel, and concrete in its data centers, a move projected to reduce the facilities' embodied carbon footprint by 35% compared to traditional steel construction and by 65% compared to standard precast concrete.

While CLT is widely used as a building material globally, its application in the data center sector remains limited. In Sweden, EcoDataCenter and Boden Type are pioneering the use of CLT in their data centers, a trend echoed by several facilities in Iceland. Additionally, Vertiv has introduced its own prefabricated wooden data center module. While EcoDataCenter's construction leans heavily on wood, CLT's offsite prefabrication allows for swifter and safer installation than the corrugated steel prevalent in large commercial structures. Though CLT may elevate material costs by 5-10% over traditional timber, the savings from a shortened construction timeline can offset this premium.

In conclusion, the global prefab wood building market, particularly in the panel systems segment, is evolving with innovative materials like CLT. Despite challenges such as higher material costs, the benefits of reduced construction time, sustainability, and safety are driving its adoption across various sectors, including data centers. This trend highlights the market's potential for growth and its role in advancing eco-friendly construction practices.

Global Prefab Wood Building Industry Overview

The market for prefabricated wood buildings is fragmented, with several local and foreign firms. The competition among these players is intense. Customers want constant improvements and updates in construction, therefore the fast-changing technical environment is predicted to harm providers. To maintain a strong industry presence, companies are changing and refining their distinctive value offering.

Developed nations, including the United States and Western Europe, exhibit pronounced market concentration. In contrast, developing countries like China and India are witnessing the sector's nascent stages. Major corporations leverage economies of scale in both purchasing and marketing. Meanwhile, smaller enterprises carve out their niche by honing in on local markets or offering specialized items.

Some of the major players are Skyline Champion, American Homestar, Southland Log Homes, Fertighaus Weiss, American Modular Systems, Honkarakenne, and Matsushima Rinko.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Urbanization and Population Growth

- 4.2.2 Government Initiatives

- 4.3 Market Restraints

- 4.3.1 High Initial Investment Costs

- 4.3.2 Regulatory Hurdles

- 4.4 Market Oppurtunities

- 4.4.1 Collaborative Stakeholders

- 4.4.2 Improving Supply Chain Efficiency

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Government Regulations and Initiatives

- 4.8 Technological Trends

- 4.9 Brief on Different Structures Used in the Prefabricated Buildings Industry

- 4.10 Cost Structure Analysis of the Prefabricated Buildings Industry

- 4.11 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Panel Systems

- 5.1.1 Cross-laminated timber (CLT) panels

- 5.1.2 Nail-laminated timber (NLT) panels

- 5.1.3 Dowel-laminated timber (DLT) panels

- 5.1.4 Glue-laminated timber (GLT) columns and beams

- 5.2 By Application

- 5.2.1 Single Family Residential

- 5.2.2 Multi-family Residential

- 5.2.3 Office

- 5.2.4 Hospitality

- 5.2.5 Others

6 By Geography

- 6.1 North America

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 6.2 Europe

- 6.2.1 Germany

- 6.2.2 France

- 6.2.3 United Kingdom

- 6.2.4 Italy

- 6.2.5 Spain

- 6.2.6 Russia

- 6.2.7 Rest of Europe

- 6.3 Asia-Pacific

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 India

- 6.3.4 Bangladesh

- 6.3.5 Turkey

- 6.3.6 South Korea

- 6.3.7 Australia

- 6.3.8 Indonesia

- 6.3.9 Rest of Asia-Pacific

- 6.4 Middle East & Africa

- 6.4.1 Egypt

- 6.4.2 South Africa

- 6.4.3 Saudi Arabia

- 6.4.4 Rest of Middle East & Africa

- 6.5 Latin America

- 6.5.1 Brazil

- 6.5.2 Argentina

- 6.5.3 Columbia

- 6.5.4 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Skyline Champion Corporation

- 7.2.2 American Homestar

- 7.2.3 Southland Log Homes

- 7.2.4 Fertighaus Weiss

- 7.2.5 American Modular Systems

- 7.2.6 Palm Harbor Homes Inc

- 7.2.7 Lester Building Systems

- 7.2.8 Bouygues Construction

- 7.2.9 Fleetwood Australia

- 7.2.10 Clayton Homes, Inc.*

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX

- 9.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 9.2 External Trade Statistics - Exports and Imports, by Product

- 9.3 Insights into Key Export Destinations and Import Origin Countries