Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644924

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644924

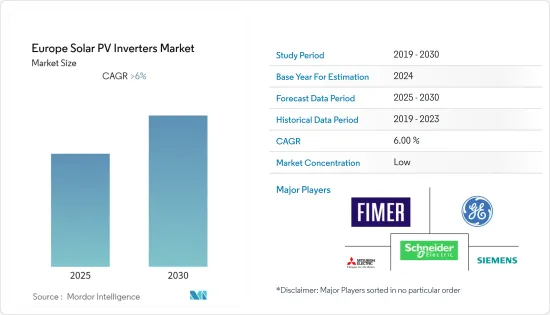

Europe Solar PV Inverters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Europe Solar PV Inverters Market is expected to register a CAGR of greater than 6% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Over the short term, the European solar PV inverters market is expected to grow due to the factors such as government initiatives to expand the solar power market and investment in electrification using solar energy.

- On the other hand, the competition from other renewables is anticipated to threaten market growth in the coming years.

- Nevertheless, the technological developments in the solar PV inverters industry are predicted to create ample opportunities for the market. For example, in March 2022, Delta, the Taiwanese solar inverters maker, introduced a new inverter series that can achieve maximum efficiency of 98.7% and a European efficiency rating of 98.5%. It was unveiled at the Solar Solutions International Event 2022 in the Netherlands.

- Germany is expected to witness significant growth due to the high demand for solar PV installations in the residential and utility-scale sectors.

Europe Solar PV Inverters Market Trends

Central Inverters Expected to Dominate the Market

- A central inverter is a large grid feeder. It is often used in solar photovoltaic systems with rated outputs over 100 kWp. Typically, floor or ground-mounted inverters convert DC power collected from a solar array into AC power for grid connection. These devices range in capacity from around 50 kW to 1 MW and can be used indoors or outdoors.

- A central inverter typically has a maximum input voltage of 1,000 V. Certain central inverters already have a 1,500 V input voltage. These inverters allow PV arrays based on a maximum voltage of 1,500 V, requiring fewer BOS (balance of system) components.

- Moreover, in 2021, the solar PV installed capacity in the European region was recorded as 647.61 GW, in which the maximum installations were of central inverters. The capacity is expected to increase even more in the future due to the government initiatives like the establishment of the Solar Photovoltaic Industry Alliance by the European Commission in October 2022 to scale up manufacturing technologies of innovative solar photovoltaic products and components.

- Furthermore, technological developments are also expected to drive the market. For example, in January 2022, Sungrow launched its new '1+X' central modular inverter with an output capacity of 1.1 MW at the World Future Energy Summit in Abu Dhabi. This 1+X modular inverter can be combined into eight units to reach a power of 8.8 MW and features a DC/ESS interface for connecting energy storage systems (ESS).

- Such developments are forecasted to drive the central solar PV inverters market in the coming years.

Germany Expected to Dominate the Market

- Germany is the largest solar photovoltaic market in Europe regarding installed capacity, which justifies it being one of the front runners in energy and climate security across the world. The country has witnessed significant developments in the solar PV market. It is likely to continue to do so due to a combination of self-consumption with attractive feed-in premiums, especially for medium- to large-scale commercial systems ranging from 40 kW to 750 kW.

- The major driver for the country's solar inverters market has been the FiT scheme, which has made it lucrative for homeowners as well as small businesses to opt for solar power.

- The cumulative solar photovoltaic installed capacity in Germany has witnessed significant growth. The solar PV installed capacity was 58.4 GW in 2021 and 53.7 GW in 2020. There has been 9.1% year-on-year growth in 2021 compared to the previous year. The market is expected to expand due to the upcoming projects implemented by the government and private investors.

- For example, in May 2022, Germany's Federal Network Agency, the Bundesnetzagentur, concluded the third rooftop PV tender with an average price of EUR 0.0853/kWh. The agency reviewed 171 bids with a total capacity of 212 MW and selected 163 projects totaling 204 MW. The final prices ranged between EUR 0.07 /kWh and EUR 0.0891/kWh.

- In addition, in April 2022, the German Federal Network Agency announced that the agency had selected 201 proposals with a combined output of 1.084 GW under the solar auction, up from 510.34 MW in July 2021. The bids in the round ranged from EUR 0.040 to EUR 0.055 per kWh. The volume-weighted average price stood at EUR 0.0519 (USD 0.057) per kWh, up from EUR 0.050 per kWh in the previous round.

- Owing to such developments, the country is expected to have the highest share in the solar PV inverters market in the near future.

Europe Solar PV Inverters Industry Overview

The European solar PV inverters market is fragmented in nature. Some of the key players in the market (in no particular order) include Fimer SpA, Schneider Electric SE, Mitsubishi Electric Corporation, General Electric Company, and Siemens AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93176

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Central Inverters

- 5.1.2 String Inverters

- 5.1.3 Micro Inverters

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial & Industrial

- 5.2.3 Utility-scale

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 United Kingdom

- 5.3.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Fimer SpA

- 6.3.2 Siemens AG

- 6.3.3 Mitsubishi Electric Corporation

- 6.3.4 General Electric Company

- 6.3.5 Schneider Electric SE

- 6.3.6 SMA Solar Technology AG

- 6.3.7 Omron Corporation

- 6.3.8 Delta Energy Systems Inc.

- 6.3.9 Huawei Technologies Co Ltd.

- 6.3.10 KACO New Energy GmBH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.