PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644873

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644873

China Automotive Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

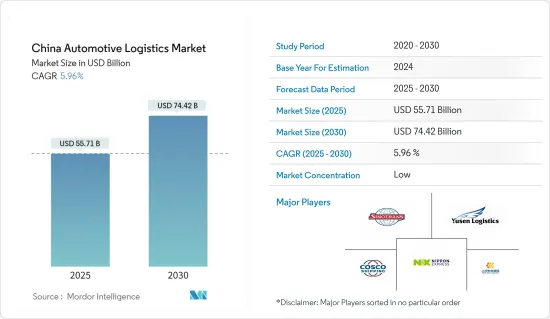

The China Automotive Logistics Market size is estimated at USD 55.71 billion in 2025, and is expected to reach USD 74.42 billion by 2030, at a CAGR of 5.96% during the forecast period (2025-2030).

Key Highlights

- China's automotive industry underwent substantial shifts which in response, the Chinese government has implemented measures to rejuvenate automobile consumption. These measures include providing fiscal and taxation support, accelerating the elimination of obsolete diesel trucks, and optimizing second-hand vehicle trading channels. Additionally, the government has introduced subsidies for new energy vehicles and invested in infrastructure development to support the automotive sector, such initiatives will keep the market afloat.

- China remains the world's largest vehicle market, leading in both annual sales and manufacturing output. Projections indicate that domestic production will hit 35 million vehicles by 2025. Furthermore, bolstered by a global surge in interest for electric vehicles, Chinese automobile sales overseas have seen notable growth. In October, signs of improvement emerged in China's manufacturing sector, highlighted by a 1 percentage point uptick in the Caixin China General Manufacturing Purchasing Managers' Index (PMI), reaching 50.3, as reported by Global Times.

- The swift growth of the electric vehicle market plays a pivotal role in this industry's trajectory. With its dominant stance in the electric vehicle arena, China has recorded a pronounced uptick in vehicle exports. Enhancements in logistics infrastructure, marked by upgraded warehouse facilities and specialized transport corridors, have been instrumental. The government's supportive policies, which include subsidies for electric vehicle manufacturers and investments in charging infrastructure, have further fueled this growth.

- To navigate the complexities of vehicle transportation and parts handling, companies are increasingly turning to AI and IoT technologies, aiming to optimize logistics and boost efficiency. For instance, from the begining of 2024, SAIC Motor Corporation, one of the largest automotive manufacturers, has rolled out an automated warehousing system integrated with IoT sensors and AI algorithms. As a result, the integration of AI and IoT is becoming a standard practice in the industry, driving further advancements and setting new benchmarks for efficiency and reliability.

- This growing automotive sector, increasing vehicle sales, and exports are expected to drive the country's automotive logistics market.

China Automotive Logistics Market Trends

Chinese Investment in NEVs (New Energy Vehicles) Driving the Market Growth

The 2024 J.D. Power China New Energy Vehicle - Automotive Performance, Execution and Layout (NEV-APEAL) Study underscores a pivotal trend in the automotive logistics market: the steady ascent of New Energy Vehicles (NEVs) in China. Chinese NEVs have achieved an average NEV-APEAL score of 789 out of 1000, marking a notable 13-point rise from 2023. This consistent upward trend signals an increasing consumer acceptance and satisfaction with NEVs, subsequently fueling the demand for streamlined logistics solutions.

The swift growth of the NEV sector is reshaping associated industrial chains, with a pronounced focus on the battery sector. Power batteries play a pivotal role in influencing a vehicle's battery life, safety, and overall cost. Chinese manufacturers have shown a clear preference for lithium Iron Phosphate (LFP) batteries, setting themselves apart from the Western markets that lean towards Lithium Nickel Manganese Cobalt (NMC) batteries. By April 2024, new passenger cars achieved a retail penetration rate exceeding 50%, a milestone previously held by traditional petrol vehicles. This shift not only highlights the burgeoning dominance of NEVs in the market but also accentuates the escalating demand for specialized logistics services to facilitate their distribution.

The surging NEV market is amplifying the demand for customized transport and handling services within the automotive logistics domain. This burgeoning demand is not just expanding the supply chain but is also catalyzing infrastructure development and promoting sustainable logistics practices. As logistics firms pivot to address these evolving demands, they unlock fresh revenue streams, simultaneously playing a pivotal role in the transformation of China's automotive landscape.

In conclusion, the rapid advancement of NEVs in China is not only reshaping the logistics market but also driving significant changes in the automotive sector. The increasing consumer acceptance and the shift towards sustainable practices present both challenges and opportunities for logistics companies, ultimately contributing to the evolution of the entire automotive ecosystem.

Warehousing Segment Fuels Growth in the Market

Various service segments are fueling market growth. With the expansion of China's automotive industry, the warehouse segment has become pivotal in the overall supply chain. In response to increasing goods volumes, companies are significantly investing in expanding their warehouse capacities.

Moreover, with the rise of e-commerce and increased vehicle production, automotive manufacturers are seeking robust warehousing solutions to manage fluctuating inventory levels. For example, in 2024, Yusen Logistics expanded its warehousing operations in China, integrating automated storage and retrieval systems to enhance inventory management and minimize handling times.

Furthermore, there's a growing adoption of advanced inventory management systems leveraging IoT technology for real-time stock monitoring. For instance, COSCO Shipping has deployed smart inventory management solutions, enabling precise tracking of automotive components throughout its network.

In conclusion, the growth of China's automotive industry is significantly driven by advancements in transportation, warehousing, and inventory management services. These innovations are essential in meeting the increasing demands for efficiency and reliability in the market.

China Automotive Logistics Industry Overview

The Chinese automotive logistics market is highly fragmented and competitive, with the presence of several local automotive logistics companies in the country apart from international firms. International players like DHL and Nippon Express compete with local players like SAIC Anji Logistics and Yusen Logistics. And many other players including China Ocean Shipping (Group) Company (COSCO), HYCX Group, Sinotrans Limited, etc.

Players in the automotive sector are tailoring a diverse array of services by integrating cutting-edge technologies. For instance, Recently in 2024, Shenzhen's updtaed with AI-integrated factories, the supply chain - the backbone of any manufacturing setup - has undergone a significant transformation. With the help of advanced analytics, these factories can now accurately predict raw material needs, optimize inventory levels, and ensure timely procurement. This not only minimizes holding costs but also reduces wastage.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Drivers

- 4.2.1 Growing New Energy Vehicles Sales

- 4.2.2 Government Initiatives and Support

- 4.3 Market Restraints

- 4.3.1 Trade War between China and the United States

- 4.3.2 Supply Chain Disruptions

- 4.4 Market Opportunities

- 4.4.1 Digital Transformation

- 4.4.2 Expansion into Emerging Markets

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Industry Value Chain Analysis

- 4.7 Government Regulations and Initiatives

- 4.8 Overview of China's Automotive Industry (Overview, Development and Trends, Statistics, etc.)

- 4.9 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Finished Vehicle

- 5.1.2 Auto Component

- 5.2 By Service

- 5.2.1 Transportation

- 5.2.2 Warehousing, Distribution, and Inventory Management

- 5.2.3 Other Services

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 China Ocean Shipping (Group) Company

- 6.2.2 SAIC Anji Logistics

- 6.2.3 BLG Logistics

- 6.2.4 HYCX Group

- 6.2.5 Yusen Logistics Co. Ltd

- 6.2.6 DHL

- 6.2.7 Nippon Express

- 6.2.8 GEODIS

- 6.2.9 Sinotrans Co. Ltd

- 6.2.10 DHL Supply Chain

- 6.2.11 Apex Group*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution by Activity, Transport and Storage Sector-contribution to Economy, etc.)

- 8.2 Trade Statistics: Imports and Exports

- 8.3 External Trade Statistics related to the Automotive Sector