Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644619

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644619

E-Commerce - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

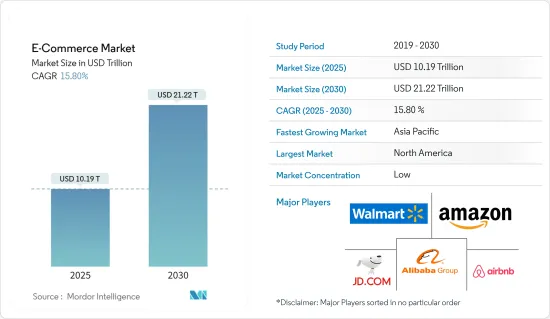

The E-Commerce Market size is estimated at USD 10.19 trillion in 2025, and is expected to reach USD 21.22 trillion by 2030, at a CAGR of 15.8% during the forecast period (2025-2030).

Key Highlights

- As internet penetration rises, so does the global smartphone user population. This expanding user base increasingly engages with various e-commerce avenues, including digital content, financial services, travel and leisure, and e-tailing. Consequently, as internet usage surges, the technical understanding of consumers is anticipated to bolster market growth.

- Due to reduced communication costs and infrastructure, established businesses and major corporations are gravitating toward online platforms. E-commerce not only streamlines client outreach for these organizations but also amplifies their visibility. Furthermore, online marketing tools, including Google and Facebook ads, play a pivotal role in propelling e-commerce.

- Small and medium-sized enterprises (SMEs) are witnessing significant growth, particularly in nations like India, China, South Africa, and Russia. Initiatives such as 'Make in India' and 'Start-up India' have catalyzed a surge in start-ups leveraging the internet marketplace, further fueling market expansion. However, the lack of technical infrastructure in rural regions of countries like India, China, and Brazil may hinder this growth trajectory.

- Additionally, e-commerce merchants are reaping the rewards of the market's global expansion. For example, in November 2023, Shopify merchants celebrated a milestone, with the company announcing a record USD 9.3 billion in sales during the Black Friday-Cyber Monday period, marking a 24% uptick from the prior year.

- Numerous established firms are pivoting to online platforms, aiming to curtail communication and infrastructure costs. E-commerce simplifies audience targeting for these companies and increases the demand for marketing tools like Google and Facebook ads, underscoring their effective adoption.

E-Commerce Market Trends

The Growing Use of Smartphones is Driving E-commerce Sales

- Rising internet penetration and increased smartphone usage are set to bolster the growth of the market. As Internet and mobile phone usage expands, consumer preferences are shifting toward online shopping. With consumers now more dependent on digital devices, mobiles are expected to emerge as the dominant channel for online purchases within the next five years.

- Global smartphone and tablet adoption fuels the expansion of online retail. With advancements like branded shopping apps, 5G connectivity, and social shopping, consumers can effortlessly shop via mobile devices. These advancements empower retailers, enhancing sales, boosting conversions, fostering loyalty, and enabling precise consumer data tracking for targeted marketing.

- However, as technology evolves, many retailers grapple with crafting a cohesive and impactful customer experience across diverse platforms. Leading retailers have rolled out dedicated applications and e-commerce platforms to elevate consumer engagement, while others are optimistic that mobile users will seamlessly transition to their existing e-commerce offerings.

- Brands on various e-commerce platforms are delving into virtual shopping and experimenting with augmented and virtual reality retail. Consumers face no boundaries in the expansive realm of the metaverse, which is a 3D virtual reality. Individuals worldwide can interact with products in this immersive environment, transcending geographical limitations.

Initiatives by the Government Are Expected to Drive the Market

- In the e-commerce market, a key trend is the surge in initiatives from both governments and companies aimed at boosting e-commerce sales. The Union Ministry of India unveiled plans for 'Bharat Craft,' an e-commerce platform inspired by China's Alibaba. This platform aims to empower MSMEs (micro, small, and medium enterprises) in India, facilitating product marketing and sales and propelling the nation's economic growth.

- On a national scale, government entities are refining policies to ensure the e-commerce market's sustainability and prioritize consumer protection. By elevating environmental and social standards, these nations aim to enhance their norms, directly influencing the e-commerce landscape. For instance, stringent regulations could deter companies from entering the e-commerce arena, while more lenient ones might encourage participation.

- Furthermore, initiatives like the Digital India program, Unified Payment Interface (UPI), and GeM, spearheaded by the Indian government, have played a pivotal role in the e-commerce market's recent expansion. With government backing, the e-commerce market is now focusing on localized strategies to penetrate rural markets. This involves strengthening the network of rural distributors and merchants and utilizing local distribution centers as convenient pick-up and drop-off points.

- During the World Economic Forum Annual Meeting in Switzerland, representatives from 22 members of the WTO's joint statement initiative on e-commerce convened to reiterate their dedication to crafting a regulatory framework for the global digital economy.

E-Commerce Industry Overview

In the e-commerce market, many local and worldwide firms have expanded, resulting in fierce competition. Some key players include Amazon.com Inc., Alibaba Group Holding Limited, Walmart Inc., and Costco Wholesale Corporation. Product launches, high expenses on R&D, acquisitions, partnerships, etc., are the growth strategies such companies adopt to sustain the intense competition.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90957

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness- Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Key Market Trends and Share of E-commerce of Total Retail Sector

- 4.4 Impact of Macroeconomic Trends on the E-commerce Sales

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advancements in Technology

- 5.1.2 Initiatives by Government

- 5.1.3 Increasing Consumer Interest towards Convenient Shopping solutions

- 5.2 Market Challenges

- 5.2.1 Low Internet Penetration

- 5.2.2 Increasing Security and Privacy Concerns

- 5.3 Analysis of Key Demographic Trends and Patterns Related to E-commerce Industry in Key Regions (Coverage to include Population, Internet Penetration, E-commerce Penetration, Age & Income etc.)

- 5.4 Analysis of the Key Modes of Transaction in the E-commerce Industry (coverage to include prevalent modes of payment such as cash, card, bank transfer, wallets, etc.)

- 5.5 Analysis of Cross-border E-commerce Industry (Current market value of cross-border & key trends)

- 5.6 Current Positioning of Key Regions in the E-commerce Industry Globally

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 By B2C ecommerce

- 6.1.1.1 Market Size (GMV) Estimates and Forecasts

- 6.1.1.2 By Application

- 6.1.1.2.1 Beauty & Personal Care

- 6.1.1.2.2 Consumer Electronics

- 6.1.1.2.3 Fashion & Apparel

- 6.1.1.2.4 Food & Beverage

- 6.1.1.2.5 Furniture & Home

- 6.1.1.2.6 Other Applications (Toys, DIY, Media, etc.)

- 6.1.2 By B2B ecommerce

- 6.1.2.1 Market Size (GMV) Estimates and Forecasts

- 6.1.1 By B2C ecommerce

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Spain

- 6.2.2.5 Italy

- 6.2.2.6 Belgium

- 6.2.2.7 Netherlands

- 6.2.2.8 Luxembourg

- 6.2.2.9 Denmark

- 6.2.2.10 Finland

- 6.2.2.11 Norway

- 6.2.2.12 Sweden

- 6.2.2.13 Iceland

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 South Korea

- 6.2.3.5 Malaysia

- 6.2.3.6 Hong Kong

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon.com Inc.

- 7.1.2 Alibaba Group Holding Limited

- 7.1.3 Airbnb Inc.

- 7.1.4 Walmart Inc.

- 7.1.5 JD.com Inc.

- 7.1.6 Rakuten Inc.

- 7.1.7 Inter Ikea Systems BV

- 7.1.8 Costco Wholesale Corporation

- 7.1.9 Flipkart

- 7.1.10 Best Buy Co. Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.