PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644510

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644510

Japan Office Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

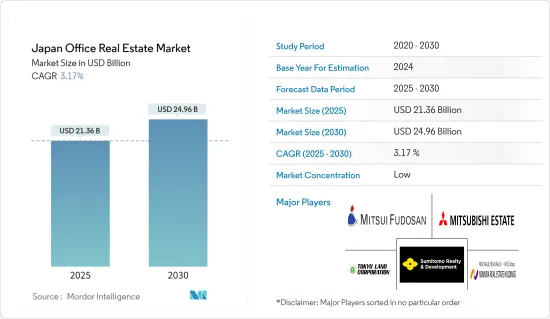

The Japan Office Real Estate Market size is estimated at USD 21.36 billion in 2025, and is expected to reach USD 24.96 billion by 2030, at a CAGR of 3.17% during the forecast period (2025-2030).

Key Highlights

- International investors had driven Japan's office building market on track to become net sellers for the first time in 2023 as falling rents and rising interest rates dimmed its appeal. Government policies and investment regulations are among the most critical factors contributing to Japan's office real estate market growth. The government implements various measures to stimulate office real estate investment, such as tax incentives and deregulation, boosting market growth.

- In the first nine months of 2023, foreign investors' sales of Japanese real estate more than doubled during the year to USD 7.1 billion, while their purchases fell about 20%.

- All-grade regional offices have seen some diverging trends. It was mild in Osaka and Sendai. Corrections in rents, while Nagoya, Fukuoka, and Sapporo saw marginal increments over the past year. On the other hand, Tokyo experienced a 5.5% year-on-year decrease in all grade rents, suggesting that the overall performance has been better compared to regional markets.

- The Grade vacancy rate for the second quarter of 2023 increased by 0.3 pp qoq to 4.9%, mainly due to new supply coming on stream with significant vacancies. Although vacant space in new supply was equivalent to 0.7% of total stock, the continuing absorption of space in existing buildings ensured the overall increase in vacancy rate was limited to 0.3 pp. All-grade rents fell by 0.2% q-o-q on the back of the continued lowering of asking rents in buildings with prolonged vacancies.

- As the economy gets better, it is expected that most people will want to work in offices in regional cities in 2022 or 2023, depending on the city. On the other hand, the quantity of new supply is likely to influence the rate of increase. Compared to other cities, the additional office space anticipated for completion over the next three years in Yokohama, Kanazawa, and Fukuoka is higher.

Japan Office Real Estate Market Trends

Rise in Start-ups Driving the Market

The Japanese entrepreneurial scene is changing at pace. It is becoming an international hub for start-ups thanks to a new influx of capital. The Local Ecosystem foresees a surge in funding, International Cooperation, and Opportunities for Entrepreneurship due to government incentives and an ambitious five-year plan, including visa reforms and tax relief.

According to an industry report, 61 new investment funds with a total capital of 217 billion dollars, approximately USD 1.5 billion, were created during the 1st half of 2023. Within this were seven private startup funds, each exceeding the 10 billion mark (roughly USD 70 million).

In Japan, there is a new and fast-emerging opportunity at this stage of development. The startups have raised over JPY 5 billion, approximately USD 36 million, and in some cases more than JPY 10 billion, about USD 72 million, to consolidate their position in the Japanese market or expand into other countries. Large national venture capital firms, pension funds, and corporates frequently fund the growth phase. At this stage, though, international growth equity funds have become a significant player, and the trend is projected to continue.

Tokyo is Dominating the Office Market

With some marginal quarterly rental growth, the Tokyo office market appears to remain broadly stable. The vacancy rate remains low and stable; most new significant developments have been absorbed with limited problems. In the quarter of 2023, grade A office rents continued to increase moderately, while rental decreases for grade B offices were negligible. Due to the increased choice of offices and more advantageous leasing options such as extended periods of free rent, a number of companies have already consolidated their premises in recent times. Modern offices in central areas with good transport links were among the main beneficiaries, although relocation rates appear to have recovered substantially.

In the third quarter of 2023, the average rent remained stable across the C5W's constituent wards, with little change in the rents recorded during the quarter. The largest rental increments were in Shibuya and Shinjuku, where rents increased by 0.4% QoQ and 0.3% QoQ, respectively, while Minato rents increased by 0.1% QoQ

The Grade A office market has stabilized recently, and rental increases have begun to moderate. Average rents in the central five wards (C5W) contracted by a moderate 0.7% over the quarter Q1/2023 to JPY32,549 (USD 216) per tsubo, an annual decline of 2.2%.

There is an ample supply in 2023, especially in the Toranomon area of Minato. Azabudai Hills and Toranomon Hills Station Tower, the two significant developments by Mori Building, are leading the bulk supply for the year. A large project in 2023 is Sakura Stage Shibuya Tower, which appears to be more than half pre-leased and should perform well, given its stationfront location in the famous Shibuya market.

Between 2023 and 2026, the submarkets Shibaura, Hamamatsucho, Yaesu, and Nihonbashi will see a moderate amount of supply spread over the years, which should be manageable overall. However, the years beyond will feature several largescale developments in the two submarkets, including Torch Tower and the redeveloped World Trade Center, both in 2027, which will add a sizable amount of office space to the market. These new projects could be well received given that they will become landmarks in their prime locations.

Japan Office Real Estate Industry Overview

There are global and regional players in the Japanese office real estate market and a lot of competition. Companies are gearing up to meet future needs, and many are entering the market for further opportunities. Some significant players are Mitsui Fudosan, Mitsubishi Estate, Sumitomo Realty & Development, Tokyu Land Corporation, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Rental Prices of Office Spaces

- 4.3 Market Restraints

- 4.3.1 Remote Work and Hybrid Models

- 4.4 Market Opportunites

- 4.4.1 The demand for flexible office spaces, including co-working spaces and serviced offices, has been growing

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Government Regulations and Initiatives

- 4.8 Technological Trends

- 4.9 Insights into Rental Yields in the Office Real Estate Segment

- 4.10 Insights into the Key Office Real Estate Industry Metrics (Supply, Rentals, Prices, Occupancy (%)/Vacancy (%))

- 4.11 Insights into Office Real Estate Construction Costs

- 4.12 Insights into Office Real Estate Investment

- 4.13 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Key Cities

- 5.1.1 Tokyo

- 5.1.2 Kyoto

- 5.1.3 Rest of Japan

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Mitsui Fudosan

- 6.2.2 Mitsubishi Estate Co.

- 6.2.3 Sumitomo Realty & Development

- 6.2.4 Tokyu Land Corporation

- 6.2.5 Nomura Real Estate Holdings

- 6.2.6 Hulic

- 6.2.7 Tokyo Tatemono

- 6.2.8 Mori Trust

- 6.2.9 Mori Building

- 6.2.10 Nakano Corporation*

- 6.3 Other Comapnies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX