PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644503

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644503

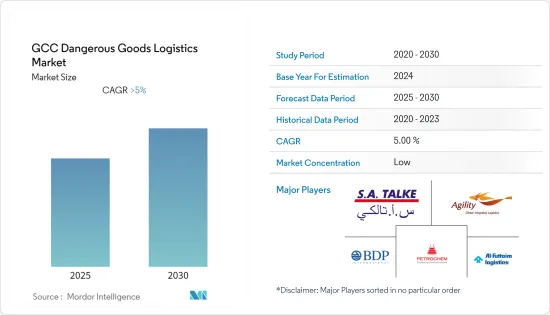

GCC Dangerous Goods Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The GCC Dangerous Goods Logistics Market is expected to register a CAGR of greater than 5% during the forecast period.

The COVID-19 pandemic fueled the growth of the dangerous goods logistics market. The increasing demand for medical oxygen in hospitals has resulted in a greater need for transportation. Furthermore, nuclear medicine, viral samples, healthcare hazardous substances, and clinical waste such as surgical equipment must be transported. Due to the lockdowns caused by the COVID-19 pandemic, the transportation of hazardous goods became easier and faster.

Aside from the fact that the rules for shipping dangerous goods are updated every year, the need to do so is also expected to grow every year. Between the growing need to ship lithium batteries and the already established gas and oil industries in the region, the market for dangerous goods is higher than it has ever been. This will increase the need for UN packaging, training, labels, and placards.

Digitization is the underlying solution to successfully transporting hazardous materials. In transportation operations, a digital supply network acts as a technology platform for inter-business processes and supply chain relationships. It connects suppliers, buyers, shippers, and third-party logistics providers, allowing them to better communicate, collaborate, and conduct business with each other. Manual processes like submitting a purchase order, acknowledging order acceptance, and confirming shipment are automated, with paper or email translated into appropriate formats where the document can be shared with others electronically.

GCC Dangerous Goods Logistics Market Trends

Recovery of Chemical Industry

The chemicals and petrochemicals industry in the GCC is poised for growth, as the regional and global economy is forecast to recover in the aftermath of the COVID-19 outbreak.

According to the Gulf Petrochemicals and Chemicals Association (GPCA), the region's chemicals industry is anticipated to see growth across all key indicators including chemical sales revenue, production output, and international trade on the back of an increase in regional economic activity, supported by a rapid vaccination rollout and the global economic rebound.

In the GCC region, Saudi Arabia dominates the entire region's chemical output, and the Kingdom-based companies are accounting for more than 75 - 80 % of total GCC chemical sales by value. In addition, the increasing oil production in Saudi Arabia also complements the chemical industry growth. Meanwhile, in 2023, the GCC chemical industry planned to invest more than USD 61 billion until 2025 to increase production and sales along with focusing on environmental factors. Thus, the growing chemical industry across the region is expected to drive the logistics industry.

New Investments in the Market

Strong oil and gas prices in 2022 have helped energy producers in the Middle East and North Africa (MENA) area, which is evident in both their profitability and capital spending budgets for the year. In the first half of 2022, contracts for oil and gas worth about USD 14.1 billion were given, with the Saudi Arabian market accounting for almost half of that amount thanks to contracts for the development of the Zuluf oil field. With a USD 82.5 billion capital expenditure budget set aside for 2021-25 by its state company, Qatar, which is also in the spending mood, is in second place. Saudi Aramco and QatarEnergy collectively accounted for nearly 60%, or USD 5.5 billion, of the contracts awarded in the first half of 2022.

Upstream investment has been driven by the need to meet growing domestic and international demand and to replace supplies lost due to the use of up natural resources. As international oil firms shift their portfolios towards gas production, which is viewed as a greener alternative to oil, investment in gas projects has increased during the past five years. The prospects for the Mena region are still stronger than they were two years ago because of the region's oil exporters, particularly the GCC, Iraq, and Algeria, even though the rate of global development is expected to decline in the coming years. Additionally, Mena nations will bear the bulk of future global investments in oil and gas. Over the next five years, the Arab Petroleum Investments Corporation anticipates that investments in Mena energy (oil, gas, petrochemicals, and power) will rise by 9% to more than USD 875 billion.

GCC Dangerous Goods Logistics Industry Overview

The GCC dangerous goods logistics market is fairly fragmented, with significant international firms as well as small and medium-sized local players. To suit market needs and demand, most global logistics businesses include a dangerous goods logistics section. Furthermore, local players are expanding their capabilities in terms of inventory management, service offerings, products handled, and technology. Agility, Petrochem, BDP International, Al Futtaim Logistics, and Talke Group are market participants in the GCC Dangerous Goods Logistics Market.

With the increasingly strict control of dangerous goods logistics, the market studied is gradually eliminating a large number of freight forwarding companies with insufficient professional capabilities and comprehensive resources, leaving fewer freight forwarding companies that can provide professional dangerous goods logistics full-chain services independently.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Snapshot and Digitalization

- 4.3 Regulations and Standards

- 4.4 Industry Value Chain/Supply Chain Analysis

- 4.5 Extent of Containerization in Dangerous Goods Transport Sector

- 4.6 Spotlight on Dangerous Goods Classes

- 4.7 Review and Commentary on Safety Standards and Potential Risk in Hazardous Goods Transport Sector

- 4.8 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Chemical and Refinery Industries Driving Market Growth

- 5.2 Market Restraints

- 5.2.1 Challenges in Cross Boarder Shipping

- 5.3 Market Opportunities

- 5.3.1 Increasing Investments in Market

- 5.4 Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing and Inventory Management

- 6.1.3 Value-added Services

- 6.2 By Country

- 6.2.1 Saudi Arabia

- 6.2.2 United Arab of Emirates

- 6.2.3 Kuwait

- 6.2.4 Qatar

- 6.2.5 Bahrain

- 6.2.6 Oman

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Overall Market Share, Market Concentration and Major Players, and Companies' Comparison Analysis)

- 7.2 Company Profiles

- 7.2.1 Agility

- 7.2.2 BDP INTERNATIONAL

- 7.2.3 Petrochem

- 7.2.4 Al Futtaim - Logistics

- 7.2.5 TALKE Group

- 7.2.6 Bertschi AG

- 7.2.7 GAC

- 7.2.8 AAA Freight Services LLC

- 7.2.9 Hellmann Worldwide Logistics SE & Co

- 7.2.10 Al Ghazal Transport UAE*

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX

- 9.1 Macroeconomic Indicators (GDP Distribution by Activity, Contribution of Transport and Storage Sector to economy)

- 9.2 Key Statistics related to Pharmaceutical Industry

- 9.3 Trade Statistics - Exports and Imports pf Pharmaceutical Products by Product Type and by Country of Destination /Origin