PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644493

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644493

India Roofing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

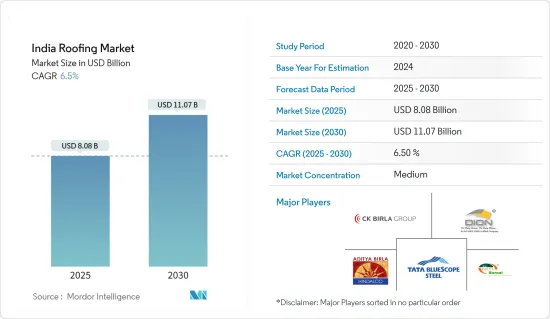

The India Roofing Market size is estimated at USD 8.08 billion in 2025, and is expected to reach USD 11.07 billion by 2030, at a CAGR of 6.5% during the forecast period (2025-2030).

The Indian roofing market is experiencing robust growth, propelled by swift urbanization, industrial growth, and extensive infrastructure projects. As the government prioritizes initiatives like smart cities, airports, and highways, the demand for premium roofing solutions surges across residential, commercial, and industrial domains. In response, manufacturers are rolling out innovative, durable, and energy-efficient products tailored to diverse market demands.

In India, rising income levels are prompting consumers to shift from traditional roofing materials to more reliable alternatives, significantly driving market growth. Polycarbonate roofing sheets, favored for their easy installation in industrial and large-scale commercial buildings, are becoming increasingly popular. These sheets are weather-resistant, come in various textures and designs, and boast low maintenance costs. Beyond traditional uses, they're also employed in skylights, swimming pools, walkways, and display signboards. The versatility and durability of polycarbonate roofing sheets make them a preferred choice for various applications, contributing to their growing demand in the market.

According to an industry report, technological innovations, especially the emergence of new roofing technologies, are set to propel the growth of the roofing market in India. Notably, green roofing stands out, offering benefits like rainwater absorption, insulation, and enhanced aesthetic appeal. Green roofing systems not only improve energy efficiency but also contribute to urban biodiversity and reduce the urban heat island effect. Furthermore, the market is expected to gain momentum during the forecast period, thanks to the seamless installation of roofing components and upgrades to existing infrastructure, facilitated by advanced machinery. The integration of cutting-edge machinery ensures precision and efficiency in roofing projects, further driving market expansion.

India Roofing Market Trends

Booming Construction and Urban Development in India: FDI Growth and Future Projections

The real estate segment includes residential properties, offices, retail spaces, hotels, and leisure parks. In contrast, the urban development segment covers areas such as water supply, sanitation, urban transport, schools, and healthcare. As per industry reports from 2023, India's population was expected to reach 1.64 billion by 2047, with an estimated 51% residing in urban centers. From April 2000 to March 2024, the construction (infrastructure) sector attracted foreign direct investment (FDI) inflows totaling USD 33.91 billion, making it one of the top recipients of FDI in the country.

Under the automatic route, 100% FDI is permitted in completed projects for the operations and management of townships, malls, shopping complexes, and business constructions. Similarly, 100% FDI is also allowed for urban infrastructures, including urban transport, water supply, sewerage, and sewage treatment, all under the automatic route.

Projections indicate that by 2047, more than half of India's populace will reside in urban locales, amplifying the demand for residential, commercial, and infrastructural projects. Furthermore, the Indian government's favorable policies, such as permitting 100% Foreign Direct Investment (FDI) through the automatic route, enhance the allure of these sectors for global investors. With a steady influx of FDI into both infrastructure and real estate, India's construction landscape is primed for ongoing expansion and burgeoning opportunities.

Government-Driven Growth in Affordable Housing: A Key Catalyst for the Roofing Market in India

As reported by an industry-leading financial platform, the 2022 national budget underscored the government's commitment to the housing sector, allocating INR 50,000 crore (USD 6111.43 billion) to the Ministry of Housing and Urban Development (MoHUA) and establishing a USD 3.5 billion fund to expedite stalled housing projects. With urbanization in India projected to rise from 33% to over 40% by 2030, Invest India estimates a demand for an additional 25 million mid-range and affordable housing units.

In 2023, under the Pradhan Mantri Awas Yojana (PMAY), also known as The Prime Minister's Housing Plan, India saw the completion of 5.4 million houses in urban areas. However, in 2020, the demand for housing among the urban poor was estimated at around 11 million housing complexes.

The government's commitment is evident through substantial financial investments and programs like PMAY, underscoring its determination to address the housing shortage. As urbanization accelerates and the demand for mid-range and affordable housing intensifies, the sector emerges as a lucrative avenue for investment and development. Yet, to truly cater to the housing needs of India's burgeoning urban populace, sustained efforts are essential to bridge the existing deficit.

India Roofing Industry Overview

Leading companies, including Saint-Gobain, Mongia Roofing, JSW Steel, Boral Roofing, Etex, and Visaka Industries, hold a dominant position in the market, boasting both national and international reach. These companies have established themselves as key players by consistently delivering high-quality roofing solutions and expanding their market presence.

Diverse roofing materials, including metal roofing, asphalt shingles, clay tiles, concrete roofing, bituminous membranes, and green roofing solutions, drive the market. Each material offers unique benefits, such as durability, cost-effectiveness, and environmental sustainability, catering to the varied preferences and needs of consumers.

The roofing market exhibits high fragmentation, accommodating both large-scale manufacturers and local suppliers. These players cater to a spectrum of segments, ranging from premium to budget-friendly roofing materials. This fragmentation allows for a competitive landscape where innovation and customer-centric solutions thrive, ensuring that consumers have access to a wide range of options to meet their specific requirements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Innovations in the Roofing Sector

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Impact of Government Regulations and Initiatives taken in the Construction Industry

- 4.5 Review and Commentary on the Extent of Government Infrastructure Development Schemes

- 4.6 Impact of Geopolitics and Pandemics on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Disposable Income and Middle-Class Expansion

- 5.1.2 Increased Awareness of Roofing Solutions

- 5.2 Market Restraints

- 5.2.1 The presence of counterfeit or substandard roofing materials in the market poses a significant challenge

- 5.2.2 The roofing industry faces a shortage of skilled labor

- 5.3 Market Opportunities

- 5.3.1 Rapid Urbanization and Construction Boom

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Sector

- 6.1.1 Commercial Construction

- 6.1.2 Residential Construction

- 6.1.3 Industrial Construction

- 6.2 By Material

- 6.2.1 Bituminous

- 6.2.2 Tiles

- 6.2.3 Metal

- 6.2.4 Other Materials

- 6.3 By Roofing Type

- 6.3.1 Flat Roof

- 6.3.2 Slope Roof

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Tata Bluescope Steel

- 7.1.2 CK Birla Group

- 7.1.3 Hindalco Ind Ltd

- 7.1.4 Bansal Roofing Products Limited

- 7.1.5 Dion Incorporation

- 7.1.6 Everest Industries Limited

- 7.1.7 Moon Pvc Roofing

- 7.1.8 Aqua Star

- 7.1.9 Indian Roofing Industries Pvt. Ltd

- 7.1.10 Metecno India Pvt. Limited*

- 7.2 Other Companies

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX