PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644447

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644447

Europe Luxury Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

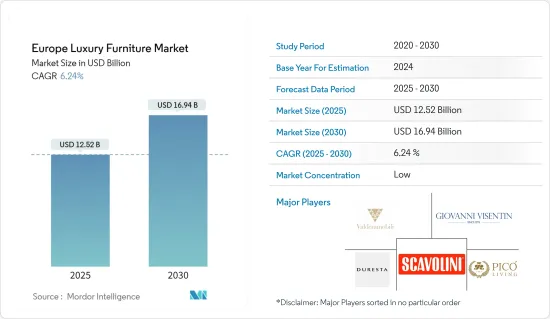

The Europe Luxury Furniture Market size is estimated at USD 12.52 billion in 2025, and is expected to reach USD 16.94 billion by 2030, at a CAGR of 6.24% during the forecast period (2025-2030).

The European luxury furniture sector holds a prominent position globally, excelling not just as a producer but also as a significant consumer and exporter. Europe's furniture production alone commands nearly 40% of the global market.

China's sizable population and growing affluence have fueled a robust demand for furniture, which, in turn, is bolstering the European furniture industry. Consumers' growing inclination to allocate a larger portion of their disposable income to floor coverings and furnishings is fueling this trend. Additionally, factors such as urbanization, real estate growth, robust GDP, and economic stability further contribute to Europe's furniture industry surge.

Europe emerges as a dominant player in the global wooden furniture export market, with its primary markets including the European Union, the United States, Hong Kong, Japan, and Vietnam. Notably, Europe also imports furniture, particularly from countries like Italy and Germany.

Europe's thriving furniture industry is underpinned by its abundant natural resources. A noteworthy development is the rise of furniture malls in Europe, a response to the surging consumer demands.

Europe Luxury Furniture Market Trends

E-commerce Transforming Europe's Luxury Furniture Market

E-commerce's rapid rise has upended the traditional dynamics of Europe's luxury furniture market. Online platforms have become pivotal for both consumers and businesses, reshaping the industry. A key catalyst behind this shift is the convenience and accessibility that e-commerce brings. Shoppers can now peruse a vast array of luxury furniture from their homes, bypassing the need for physical store visits. This newfound convenience has broadened the customer base, even enticing those who hadn't explored luxury furniture before.

For European luxury furniture brands, e-commerce has unlocked a global audience. By establishing an online presence, these brands can now target customers across borders. This market expansion has translated into heightened sales prospects and a wider clientele, fueling growth. Notable examples of European luxury furniture brands capitalizing on e-commerce include Roche Bobois, Poltrona Frau, Vitra, and Fritz Hansen. Moreover, e-commerce has intensified competition, both regionally and globally. Online marketplaces empower customers to compare prices, designs, and reviews, empowering them to make informed purchase decisions.

Italy's Dominance in the Luxury Furniture Sector

Italy dominates the global luxury furniture sector, boasting a plethora of esteemed brands that cater to both domestic and international markets. Renowned for their opulent and top-tier craftsmanship, Italian furniture manufacturers enjoy a global clientele.

Italian luxury furniture brands boast an extensive distribution network, showcasing their products in showrooms, flagship stores, and online platforms. Their diverse offerings span from classic to cutting-edge designs, catering to a wide range of customer preferences. Italy's reputation as a luxury furniture manufacturing hub has solidified its standing as the go-to destination for those seeking premium furniture. The nation's design finesse, artisanal expertise, and unwavering commitment to quality have cemented its leadership in the European luxury furniture market. Italy's allure extends beyond its craftsmanship and design prowess. Its rich cultural heritage and artistic legacy, deeply rooted in cities like Milan, Florence, and Venice, serve as wellsprings of inspiration for luxury furniture designers and manufacturers.

Europe Luxury Furniture Industry Overview

The luxury furniture market in Europe is highly fragmented, with a large number of small and medium-sized companies operating in the market. This is because luxury furniture is often handcrafted and requires specialized skills and expertise, which are typically found in smaller, specialized companies. While there are a few large players in the market, the luxury furniture industry in Europe remains highly fragmented, with a large number of smaller companies and artisans operating in the market.

This fragmentation can make it difficult for new entrants to establish themselves in the market, but it also creates opportunities for niche players who specialize in particular types of luxury furniture or cater to specific segments of the market. Some of the major players in this market are Duresta Upholstery Ltd., Muebles Pico, Valderamobili, Giovanni Visentin, and Scavolini.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Lighting

- 5.1.2 Tables

- 5.1.3 Chairs and Sofas

- 5.1.4 Accessories

- 5.1.5 Bedroom

- 5.1.6 Cabinets

- 5.1.7 Other Product Types

- 5.2 End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 Distribution Channel

- 5.3.1 Home Centers

- 5.3.2 Flagship Stores

- 5.3.3 Specialty Stores

- 5.3.4 Online

- 5.3.5 Other Distribution Channels

- 5.4 Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Spain

- 5.4.5 Russia

- 5.4.6 Italy

- 5.4.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Duresta Upholstery Ltd

- 6.1.2 Muebles Pico

- 6.1.3 Valderamobili

- 6.1.4 Giovanni Visentin

- 6.1.5 Scavolini

- 6.1.6 Laura Ashley Holding PLC

- 6.1.7 Iola Furniture Ltd

- 6.1.8 Nella Vetrina

- 6.1.9 Vimercati

- 6.1.10 Giemme Stile SpA*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER