PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644443

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644443

Indonesia Rigid Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

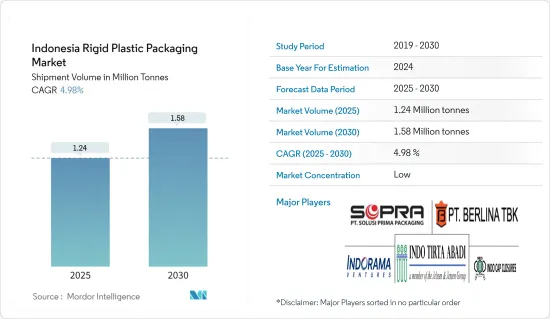

The Indonesia Rigid Plastic Packaging Market size in terms of shipment volume is expected to grow from 1.24 million tonnes in 2025 to 1.58 million tonnes by 2030, at a CAGR of 4.98% during the forecast period (2025-2030).

The Indonesian rigid plastic packaging market now operates differently as a result of the evolution and adoption of plastic packaging. Although Indonesia's downstream rigid plastic packaging market is highly developed, its reliance on imported raw materials has limited its growth potential.

Key Highlights

- Indonesia's industrial sector has been pivotal in bolstering the nation's economic growth. Over the past few years, this sector has seen a notable uptick in both production volume and value. Key drivers of this include government incentives for investors, a business-friendly environment, technological advancements, and a skilled workforce. The rigid plastics packaging market in Indonesia is poised for continued growth in the coming years, fueled by surging consumer spending.

- Plastic packaging is more popular with consumers than other types of packaging because plastic is lightweight and easy to handle. Even large manufacturers prefer plastic packaging solutions due to their low production costs. In addition, the emergence of polymers such as polyethylene terephthalate (PET) and high-density polyethylene (HDPE) has expanded the applications of plastic packaging. The demand for PET bottles is increasing across various industries.

- Indonesia's pivotal role in Asia's expansive consumer market is underscored by a steady influx of investments in packaging materials, aligning with the rising demand for premium packaging across the region. For instance, in January 2023, BASF expanded its production capacity for polymer dispersions at its Merak facility in Indonesia.

- In Indonesia, the demand for rigid plastic packaging is on the rise. Rigid plastic packaging is used in various sectors, including industrial, retail, and healthcare. Due to its excellent barrier qualities, lengthy shelf life, and durability, plastic packaging has seen substantial growth in the healthcare sector.

- Various manufacturers in the country prefer rigid plastic packaging as it is a cost-effective solution to protect food and beverages during delivery from farm to table and preserve food over longer durations. These packages also support innovations through different forms and shapes and are lighter in weight.

- However, changing regulatory standards, fluctuating raw material costs, increasing waste volumes, and rising environmental waste regulations are expected to hinder market growth during the forecast period. This is also expected to encourage companies to develop new products that are potentially disruptive and reduce the current risks in the market.

Indonesia Rigid Plastic Packaging Market Trends

Polyethylene Terephthalate (PET) is Expected to Witness Significant Growth

- The demand for PET from the packaging industry is increasing in Indonesia. Superior barrier properties, high tensile strength, better surface finish, and low cost allow PET to be an ideal product for numerous plastic packaging applications.

- The introduction of PET allows weight reductions of up to 90% compared to glass, enabling a more economical transportation process. PET plastic bottles are now replacing heavy and fragile glass bottles to provide reusable packaging for mineral water and other beverages.

- In the rigid plastic packaging market, PET is used to manufacture microwavable food trays and plastic bottles for soft drinks, water, juices, sports drinks, beer, mouthwash, ketchup, salad dressings, and food jars. There is a growing demand for PET bottles from various end-user industries, such as home care, beverages, and personal care. The growth can be attributed to consumer preference and the properties of PET, such as its lightweight nature and high recycling rate.

- In order to comply with requirements and establish a closed-loop recycling cycle, regional market vendors are also concentrating on making PET single-use packaging more recyclable. Growth opportunities for PET single-use packaging are anticipated due to the growing emphasis on recycling these materials.

- Driven by rising demand for milk-based drinks, manufacturers are producing lightweight and transparent plastic bottles. This not only enhances product visibility but also addresses concerns about cost-effectiveness and sustainability. Notably, PET bottles, being lightweight, cut down transportation costs and are easier for consumers to handle, making them the preferred choice for milk packaging.

- As per Statistics Indonesia data published in June 2023, in 2022, Indonesian dairy cow establishments produced nearly 130 million liters of milk, marking an increase from 2020. During the study period, Indonesia's production volume for these products remained relatively stable. Consistent milk production across the country may increase the demand for PET bottles for milk packaging in the upcoming years.

The Food Segment is Expected to Hold a Significant Market Share

- Rigid plastic packaging, including plastic bottles and containers, continues to be popular in food packaging applications. Containers are used to pack consumer goods, and HDPE and LDPE are used for the packaging.

- Indonesia's food industry employs a range of rigid plastic packaging options. Indonesians are becoming more interested in eating organic food, leading to stores stocking and exporting more organic produce. One of the primary end uses of packaging in Indonesia is food. However, Indonesia has long imported many processed and essential food components.

- Some materials used for making bottles and container products include polyethylene terephthalate (PET) and polypropylene (PP). PP is blow-molded to produce crates, bottles, and pots. PP thin-walled containers are standard across the country and used for food packaging.

- The Indonesian government introduced a new food contact packaging legislation to update the domestic packaging standards and align them with international standards, such as those used by the US FDA (Food and Drug Association) and EU food legislation. The revised regulation covers domestic and imported food packaging across five packaging categories, including rigid plastics.

- Owing to the growing opportunities in the Indonesian food industry, several international players are constantly investing in the market, creating more avenues for rigid plastic manufacturers to innovate and launch plastic food packaging options. According to the Statistics Indonesia report published in February 2024, in 2023, foreign direct investment in Indonesia's food industry reached around USD 2.26 billion, marking an increase from USD 1.59 billion in 2020.

Indonesia Rigid Plastic Packaging Industry Overview

The rigid plastic packaging market in Indonesia is fragmented. Numerous manufacturing companies operate in the country, leading to high fragmentation. Market players are trying to maintain dominance by investing in R&D, incorporating new technology into their products, and delivering improved consumer products. Strategic alliances, agreements, mergers, and partnerships are a few of the strategies employed.

- July 2024: PT ALBA Tridi, a key plastic flakes supplier, announced the establishment of a cutting-edge rPET facility, echoing the government's push to balance and champion green investments. This facility, marking Central Java's inaugural food-grade rPET producer, is poised to bolster the regional economy and uplift local micro, small, and medium enterprises.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Trade Scenario

- 4.4.1 Trade Analysis (Top 5 Import-Export Countries)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong Demand From the Food and Beverage Packaging Industry

- 5.2 Market Restraints

- 5.2.1 Competition From Flexible Plastic Packaging

6 MARKET SEGMENTATION

- 6.1 By Resin Type

- 6.1.1 Polyethylene (PE)

- 6.1.1.1 Low-Density Polyethylene (LDPE) & Linear Low-Density Polyethylene (LLDPE)

- 6.1.1.2 High Density Polyethylene (HDPE)

- 6.1.2 Polyethylene terephthalate (PET)

- 6.1.3 Polypropylene (PP)

- 6.1.4 Polystyrene (PS) and Expanded polystyrene (EPS)

- 6.1.5 Polyvinyl chloride (PVC)

- 6.1.6 Other Resin Types

- 6.1.1 Polyethylene (PE)

- 6.2 By Product Type

- 6.2.1 Bottles and Jars

- 6.2.2 Trays and Containers

- 6.2.3 Caps and Closures

- 6.2.4 Intermediate Bulk Containers (IBCs)

- 6.2.5 Drums

- 6.2.6 Pallets

- 6.2.7 Other Product Types

- 6.3 By End-use Industries

- 6.3.1 Food

- 6.3.1.1 Candy & Confectionery

- 6.3.1.2 Frozen Foods

- 6.3.1.3 Fresh Produce

- 6.3.1.4 Dairy Products

- 6.3.1.5 Dry Foods

- 6.3.1.6 Meat, Poultry, And Seafood

- 6.3.1.7 Pet Food

- 6.3.1.8 Other Food Products

- 6.3.2 Foodservice

- 6.3.3 Beverage

- 6.3.4 Healthcare

- 6.3.5 Cosmetics and Personal Care

- 6.3.6 Industrial

- 6.3.7 Building and Construction

- 6.3.8 Automotive

- 6.3.9 Other End User Industries

- 6.3.1 Food

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 PT. Berlina Tbk

- 7.1.2 PT Indo Tirta Abadi

- 7.1.3 PT.Solusi Prima Packaging

- 7.1.4 PT. Indorama Ventures Indonesia

- 7.1.5 Indo Cap Closures

- 7.1.6 PT. Hasil Raya Industries

- 7.1.7 PT. Hokkan Deltapack Industri

- 7.1.8 PT Rheem Indonesia

- 7.1.9 PT. Neilsen

- 7.1.10 PT. Namasindo Plus

- 7.2 Heat Map Analysis

- 7.3 Competitor Analysis - Emerging vs. Established Players

8 RECYCLING & SUSTAINABILITY LANDSCAPE

9 FUTURE OUTLOOK