Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644419

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644419

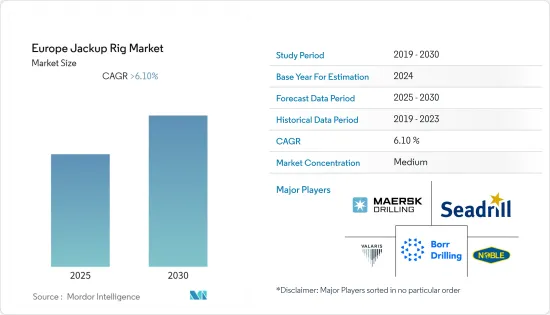

Europe Jackup Rig - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Europe Jackup Rig Market is expected to register a CAGR of greater than 6.1% during the forecast period.

The Europe jack-up market was adversely affected by COVID-19 due to disruptions in the supply chain and oil price crashes. However, the market rebounded in 2021.

Key Highlights

- Factors such as increasing demand for modern new rigs and offshore oil and gas activities will likely drive the European jack-up rig market's growth during the forecast period.

- However, volatile crude oil and gas prices are likely to hinder the market's growth during the forecast period.

- The EU's energy goals call for 32% clean and sustainable power generation by 2030, leaving 68% for other sources like oil and gas.Hence, Europe's offshore exploration and production are expected to have more potential in the market, which, in turn, is likely to provide an opportunity for jackup rig providers in the future.

- Norway is expected to dominate the European jackup rig market over the forecast period.

Europe Jackup Rigs Market Trends

Upcoming Offshore Oil and Gas Activities to Drive the Market

- The majority of oil and gas production in Europe comes from offshore reserves. Most of the production is from the North Sea region, and most of the oil comes from the United Kingdom and Norway. The increasing offshore activities are expected to drive demand for the European jack-up rig market.

- As of January 2022, Europe accounted for 32 offshore rigs. Investment in shallow water resulted in a few discoveries and various fields of development in the shallow water areas of the United Kingdom.

- Besides, in October 2022, the United Kingdom North Sea Transition Authority (NSTA) launched a new offshore oil and gas licensing round, making 898 blocks and part blocks available with over 100 licenses up for grabs. Acreage will be offered in the west of Shetland, the northern, central, and southern North Sea, and the east Irish Sea. The first licenses are expected to be awarded in Q2 2023, which will likely provide ample opportunities for the Europe Jack-up rig market in the future.

- In January 2022, Maersk Drilling was awarded a contract with TotalEnergies E&P Denmark, which will employ the high-efficiency jack-up rig Maersk Reacher for well intervention services in the Danish North Sea. The contract commenced in July 2022, with a duration of 21 months.

- Further, Shelf Drilling received a three-year contract for the Shelf Drilling Resolute jack-up rig and a two-year contract for the Key Manhattan jack-up rig from Eni in the Adriatic Sea offshore Italy. The Shelf Drilling Resourceful rig is scheduled to start work in Q2 2023, while the Key Manhattan rig is anticipated to kick off its new gig in Q4 2023.

- Hence, due to the upcoming offshore oil and gas activities, the market for jackup rigs in Europe is likely to have substantial growth over the forecast period.

Norway is Expected to Dominate the Market

- Norway is leading the market with new oil and gas discoveries, including the giant Johan Sverdrup field. As of January 2022, Norway accounted for 17 offshore rigs, the highest in Europe, which may support the growth of the target market over the forecast period.

- In 2020, there were considerably higher exploration activities in Norway. About 31 exploration wells were drilled, and in 2021, by the end of June, a total of eight oil and gas discoveries were made.

- In 2021, the Norwegian Petroleum Directorate estimated that the undiscovered resources on the Norwegian shelf were at approximately 4 billion standard cubic meters of recoverable oil equivalents, which corresponds to around 47% of the remaining resources on the shelf, which is likely to provide opportunities for the Europe jack-up rig market in the coming years.

- Moreover, in December 2021, Maersk Drilling and Aker BP signed a deal to renew and extend a drilling agreement for a five-year period in a contract valued at around USD 1 billion. The deal includes the provision of the ultra-harsh environment jack-up rigs Maersk Integrator and Maersk Invincible for activities offshore Norway.

- Further, in December 2022, NOV signed contracts with CIMC Raffles to supply a self-propelled wind turbine installation jack-up vessel design for Havfram (an offshore wind services company) based in Norway.

- With such enormous resources and oil and gas activities, Norway's offshore oil and gas industry is likely to grow further, driving the demand for jackup rigs in the country during the forecast period.

Europe Jackup Rigs Industry Overview

The European jack-up rig market is moderately fragmented. Some of the major players in the market include (not in any particular order) Noble Corporation PLC, Maersk Drilling AS, Seadrill Ltd, Borr Drilling Ltd, and Valaris PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 71661

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 United Kingdom

- 5.1.2 Russia

- 5.1.3 Norway

- 5.1.4 Netherlands

- 5.1.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Noble Corporation PLC

- 6.3.2 Maersk Drilling AS

- 6.3.3 Seadrill Ltd

- 6.3.4 Borr Drilling Ltd.

- 6.3.5 KCA DEUTAG Drilling Ltd.

- 6.3.6 Nabors Industries Ltd.

- 6.3.7 Valaris PLC

- 6.3.8 Saipem SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.