Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644405

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644405

US Mobile Virtual Network Operator (MVNO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

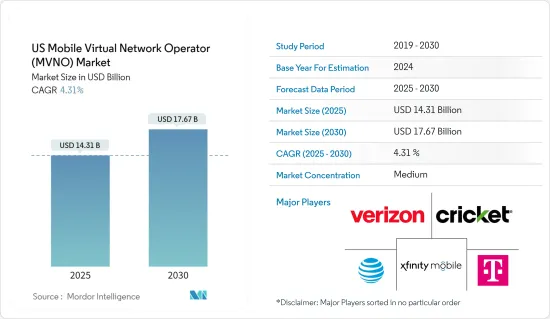

The US Mobile Virtual Network Operator Market size is estimated at USD 14.31 billion in 2025, and is expected to reach USD 17.67 billion by 2030, at a CAGR of 4.31% during the forecast period (2025-2030).

Key Highlights

- Mobile virtual network operators (MVNOs) offer mobile communication services by leasing network access from established mobile network operators (MNOs) rather than owning physical infrastructure like cell towers and network equipment. 5G MVNO technology, known for its superior data speeds, minimal latency, and heightened connectivity, offers MVNOs a robust foundation to expand their services beyond traditional voice and data. This has led to the emergence of Enterprise MVNOs, with sectors like logistics, manufacturing, and healthcare spearheading the trend by establishing and managing their private networks.

- Similarly, eSIM technology benefits MVNOs and mobile operators. With eSIM, MVNOs can easily swap carriers on a single device without a physical SIM card. This can significantly reduce the cost and time required to activate new mobile services. eSIM also allows MVNOs to offer new flexible services, such as temporary local operator connectivity or specialized services for specific verticals, such as the Internet of connected devices. For instance, in March 2024, Vodafone Idea, a major telecom operator known by its short form VI, launched services for its prepaid users.

- Artificial intelligence can potentially benefit MVNOs in several ways. One potential application is to improve customer personalization and next-best actions through the use of AI and machine learning algorithms. This could help MVNOs tailor their services to individual customer preferences and needs, leading to increased customer satisfaction and loyalty. Additionally, AI could help optimize wireless resource allocation, which is particularly important in the highly competitive and regulated telecom industry where MVNOs operate. AI algorithms could also predict maintenance needs and automate certain processes, such as customer service chatbots. Overall, AI has the potential to enable MVNOs to improve their efficiency, reduce costs, and enhance the customer experience. Trends like these are expected to drive the studied market.

- As the country embraces digital transformation, trends like the rise of connected devices, machine-to-machine communication, cloud computing, the Internet of Things (IoT), Industry 4.0, and edge computing underscore the urgent need for high-speed, efficient networks. In response, MVNOs are increasingly focusing on IoT, M2M, and global connectivity. These MVNOs are set to enhance connectivity solutions, seamlessly integrating them with devices and services spanning vehicles, medical instruments, wearables, and industrial machinery.

- Rising government pressure and increasing competition are forcing telecom vendors to reduce tariff prices to stay in the market. Thus, the telecom sector is becoming highly price sensitive. Most MVNOs leverage the low-cost model to gain customers. This market has a low profit margin because MVNOs offer consumers cheaper rates by renting spectrum from major carriers. They function as wholesalers who purchase bandwidth in large quantities from extensive carrier networks and sell at a discount to consumers.

US Mobile Virtual Network Operator (MVNO) Market Trends

The Reseller Segment is Expected to Hold a Significant Share in the Market

- Resellers act as intermediaries, selling services from a provider or operator while adhering to a standard service-level agreement (SLA). The overall service provider or operator issues a single bill. A reseller MVNO can operate under its own brand or co-brand with an MNO. Typically, these branded resellers come with established brand distribution channels or a substantial existing customer base, which they can leverage for sales. The mobile reseller model caters to companies aiming to offer customized mobile communication tariffs to their clientele. In contrast, the branded reseller model suits companies looking to enhance their brand with mobile communication services.

- Resellers are typically the most readily accepted type of MVNO by mobile network operators (MNOs), as MNOs retain control over most processes. This model allows MVNOs the potential to offer their own value-added services (VAS). With limited liability, this market segment presents fewer risks for MVNOs, but it also curtails revenue opportunities due to the lack of operational control. In this model, MVNOs partner with MNOs without holding any assets. This means they do not own the client, the infrastructure, or the SIM, nor do they have the ability to set prices. However, MVNOs do maintain control over distribution and branding functionalities.

- Reseller MVNOs benefit from quicker market entry and lower startup costs, as they rely on network operators to manage most infrastructure needs. However, these resellers still bear the expenses for marketing, sales, and distribution. With the increasing adoption of 4G and 5G technologies, the reseller model is poised to seize significant opportunities in the coming years. For example, Venn Mobile, a newly launched MVNO, operates under Teltik, a reseller aligned with T-Mobile's business strategy. Venn Mobile offers a monthly plan priced at USD 30, featuring unlimited talk, text, data, and a 50GB mobile hotspot allowance.

- Additionally, technological advancements have also played a crucial role. The proliferation of smartphones and the increasing mobile internet penetration have created fertile ground for MVNOs to offer innovative data-centric services. Also, the rollout of 4G and the anticipated expansion of 5G networks provide opportunities for reseller MVNOs to deliver high-speed data services without heavy infrastructure investments. Such initiatives are driving the market positively. According to VIAVISION, as of 2023, 5G network access was available in 503 cities in the United States, the most of any country globally.

- The latest wave of MVNOs is prioritizing the launch and upkeep of unique service capabilities. These capabilities blend a cloud-centric approach, API-driven communication service integration, and predominantly web-based self-care options, all while relying minimally on traditional communications infrastructure. By adopting lean and agile business processes, these MVNOs are not only competing with established operators but are also enhancing customer satisfaction and introducing price differentiation. They are leveraging PaaS for functions like billing, CRM integration, product catalog management, rating, invoicing, and bill formatting. This choice is strategic because these applications operate without direct end-user intervention and benefit from asynchronous background processing.

The Consumer Segment is Expected to Hold a Significant Share in the Market

- One of the main factors driving the growth of MVNOs in the United States is the increasing demand for low-cost mobile services. Many consumers in the country are price-sensitive and are looking for affordable alternatives to traditional mobile operators. MVNOs have responded to this demand by offering competitive pricing and flexible plans catering to different segments.

- Another factor contributing to the growth of MVNOs in the United States is the increasing availability of mobile internet services. According to the report by GSMA, by 2025, the United States is expected to have 252 million 5G connections. Further, by 2030, 5G connections are expected to account for 95% of all US connections. As the demand increases, more consumers seek affordable and reliable mobile internet services. MVNOs have responded to this demand by offering various plans and packages catering to different needs and budgets. Hence, consumers actively seek MVNO services in the country, which drives the demand.

- Further, the growth of MVNOs in the country is also driven by the increasing demand for data services. As more consumers in the United States use their mobile devices to access the internet, social media, and streaming services, MVNOs are responding by offering a range of data plans and packages that cater to different needs and budgets. According to Ericsson, there were an estimated 314.75 million 5G mobile subscriptions in North America in 2024, which is predicted to increase to 432.91 million by 2029.

- Consumers increasingly prioritize brands that cater directly to their needs for internet connectivity. In response, MVNOs tailor packages with varied data quality of service and 5G options, aligning closely with customer demands. This strategic move is expected to drive the growth of the market. Additionally, the diverse pricing strategies adopted by MVNOs are projected to further bolster the consumer segment's expansion during the forecast period.

- The demand for connected devices has surged as industries undergo radical technological transformations. The IoT and automotive sectors are leading the charge, presenting substantial opportunities for MVNOs. All four major telecom operators in the United States have invested heavily in developing IoT and NB-IoT infrastructures, with Verizon investing approximately USD 1 billion. The MVNO landscape is on the brink of a significant shift, especially with tech giants like Google making their foray into the market. These tech giants are leveraging the MVNO model to enhance the value of their current offerings.

US Mobile Virtual Network Operator Industry Overview

The US MVNO market is semi-consolidated, with major players like Verizon Communications Inc., AT&T Corporation, T-Mobile USA Inc., Cricket Wireless LLC, and Xfinity Mobile (Comcast Corporation). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- July 2024: Mediacom Communications rolled out its new mobile product in all its markets, partnering with Verizon as its MVNO. This launch follows Mediacom's two-month testing phase, during which it trialed the mobile service with its employees and selected Reach for back-office provisioning and billing. Despite being a member of the National Content & Technology Cooperative (NCTC), Mediacom chose to pursue its mobile venture independently, bypassing the co-op's existing agreements with Reach and AT&T.

- April 2024: Cape, a trailblazer in privacy-centric mobile services, secured USD 61 million in funding, spearheaded by A* and Andreessen Horowitz. Other contributors to this financing round include XYZ Ventures, ex/ante, Costanoa Ventures, Point72 Ventures, Forward Deployed VC, and Karman Ventures. With this influx of capital, Cape aims to establish a nationwide mobile network. This network promises premium wireless coverage while uniquely ensuring the confidentiality of personal identifiers, such as names, numbers, and locations. This funding announcement coincides with heightened concerns from top US officials regarding the cybersecurity lapses of major telecommunications carriers, which potentially expose them to foreign threats.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 71593

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 The Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Mobile Network Subscribers and the Growing Penetration of Data Users

- 5.1.2 Rising Demand for Efficient Cellular Networks

- 5.2 Market Challenges

- 5.2.1 Fragmented Nature of the Market

6 MARKET SEGMENTATION

- 6.1 By Operating Model

- 6.1.1 Reseller

- 6.1.2 Service Operator

- 6.1.3 Full MVNO

- 6.1.4 Other Operational Models

- 6.2 By Subscriber

- 6.2.1 Business

- 6.2.2 Consumer

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Verizon Communications Inc.

- 7.1.2 AT&T Corporation

- 7.1.3 T-Mobile USA Inc.

- 7.1.4 Cricket Wireless LLC

- 7.1.5 Xfinity Mobile (Comcast Corporation)

- 7.1.6 DISH Network LLC (Boost Mobile LLC)

- 7.1.7 TracFone Wireless Inc. (Straight Talk)

- 7.1.8 Republic Wireless Inc.

- 7.1.9 FreedomPop Inc.

- 7.1.10 Consumer Cellular Inc.

8 VENDOR MARKET SHARE

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.