PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644333

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644333

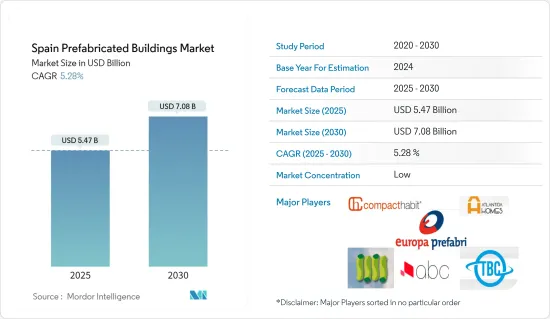

Spain Prefabricated Buildings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Spain Prefabricated Buildings Market size is estimated at USD 5.47 billion in 2025, and is expected to reach USD 7.08 billion by 2030, at a CAGR of 5.28% during the forecast period (2025-2030).

Due to the ongoing housing crisis, the government intends to invest in addressing the affordable housing crisis during the forecast period. In its 20,000 Housing Plan, the Ministry of Transport, Mobility, and Urban Agenda aim to increase the supply of public housing for rent.

Key Highlights

- Currently, public housing stock accounts for only 2.5% of total housing in Spain, with approximately 642,500 floors. Under this plan, the government intends to increase this to 8% by 2030. To accomplish this, the Ministry has contributed about USD 62 million, which, combined with the contributions of the Autonomous Communities and City Councils, totals USD 370 million.

- With the housing crisis kicking in, the government plans to invest huge funds to overcome the affordable housing crisis during the forecast period. The Ministry of Transport, Mobility, and Urban Agenda, in its 20,000 housing plan, aim to increase the public housing stock for affordable rent.

- Improvements in consumer and investor confidence will boost industrial output. The administration's efforts to improve local connectivity through advancing transportation framework and affordable residential construction market will support sector growth during the forecast period. The prefabricated sector in Spain is expected to expand during the forecast period, owing to the government's emphasis on infrastructure. The modular and prefabricated construction industries are expected to grow further in the coming years, aided by increased road and rail infrastructure.

- Regardless of the building, the price of a prefabricated house in Spain depends on the quality and finish. One of the advantages of industrialized construction is a shorter construction period. Traditional building methods are entirely different. With prefabricated buildings, by standardizing the processes and manufacturing the parts in a controlled environment construction period becomes shorter, with the consequent savings in indirect costs.

Spain Prefabricated Buildings Market Trends

Increase in investment among infrastructural sector

- One major driver is the government's commitment to improving the country's infrastructure to support economic development and attract foreign investment. Spain has been investing in various sectors such as transportation, energy, telecommunications, and urban development.

- In the transportation sector, Spain has been focusing on expanding and upgrading its road network, railways, and airports. This includes the development of high-speed rail networks like the AVE, which connects major cities and improves connectivity across the country. The government has also been investing in expanding and modernizing airports to accommodate the growing number of tourists and business travelers.

- In terms of energy infrastructure, Spain has been investing in renewable energy projects, particularly in wind and solar power. The country has set ambitious targets for renewable energy generation and has been attracting investments in this sector. This not only helps in reducing carbon emissions but also creates job opportunities and contributes to sustainable development.

- The telecommunications sector in Spain has also witnessed significant investments. The government has been promoting the deployment of high-speed internet networks, including fiber-optic connections, to improve connectivity and support the digital economy. This has led to increased investments from both domestic and international companies in the telecommunications sector.

- Urban development is another area where Spain has been investing heavily. Major cities like Madrid and Barcelona have seen significant investments in infrastructure projects such as the construction of new buildings, public spaces, and transportation hubs. These investments aim to enhance the quality of life for residents and attract more tourists and businesses to the cities.

- Overall, the increasing investments in Spain's infrastructural sector are driven by the government's commitment to economic growth, sustainability, and improving the quality of life for its citizens. These investments not only create job opportunities but also contribute to the country's overall development and attractiveness as an investment destination.

- The value of the products imported into Spain from 2003 to 2007 increased to 101 million euros, and from 2007 to 2012, it decreased to 36 million euros. In 2022, the value of the products increased to 65 million euros, and it reached 65 million euros in 2021.

Rise in demand for residential prefab buildings

- One of the main reasons behind the increasing demand for prefab buildings is the speed of construction. Since the components of these buildings are manufactured in a controlled factory environment, the construction process is much faster compared to traditional on-site construction. This can be a significant advantage, especially in areas where there is a need for quick housing solutions or when time is of the essence.

- Another factor contributing to the rise in demand is the cost-effectiveness of prefab buildings. The streamlined manufacturing process and bulk purchasing of materials often result in cost savings, making prefab buildings more affordable for homeowners and developers. Additionally, the reduced construction time can also lead to cost savings in terms of labor and financing.

- Sustainability is also a driving force behind the popularity of prefab buildings. Many prefab structures are designed with energy efficiency in mind, incorporating features such as insulation, energy-efficient windows, and renewable energy systems. Additionally, the controlled factory environment allows for better waste management and recycling of materials, reducing the environmental impact of construction.

Spain Prefabricated Buildings Industry Overview

Spain's prefabricated buildings market is fragmented and highly competitive with a few players occupying the major share. The major players are Europa Prefabri, ABC Modular, Pacadar Group, Atlantida Homes, Turboconstroi and many more.

Europa Prefabri is a Spanish company leader in the innovative sector of the prefabricated construction industry. The company designs, manufactures and assembles prefabricated modular buildings famous for their performance in terms of rapidity, reduction of costs, flexibility, modularity, transport, sustainable development and recycling, comfort, resistance and security.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights on Supply Chain/Value Chain Analysis of the Prefabricated Buildings Industry

- 4.4 Brief on Different Structures Used in the Prefabricated Buildings Industry

- 4.5 Cost Structure Analysis of the Prefabricated Buildings Industry

- 4.6 Impact of COVID 19

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.2 Restraints

- 5.3 Opportunitites

- 5.4 Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers / Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 Material Type

- 6.1.1 Concrete

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Timber

- 6.1.5 Other Material Types

- 6.2 Application

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Other Applications ( Industrial, Institutional, and Infrastructure)

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Europa Prefabri

- 7.2.2 ABC Modular

- 7.2.3 Pacadar Group

- 7.2.4 Atlantida Homes

- 7.2.5 Turboconstroi

- 7.2.6 Armodul

- 7.2.7 Cualimetal

- 7.2.8 Compacthabit

- 7.2.9 Casas Mundiales

- 7.2.10 Mader House

- 7.2.11 Prefabri Steel *

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX

- 9.1 Marcroeconomic Indicators (GDP breakdown by sector, Contribution of construction to economy, etc.)

- 9.2 Key Production , Consumption,Exports & import statistics of construction Materials