PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644326

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644326

Germany Commercial Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

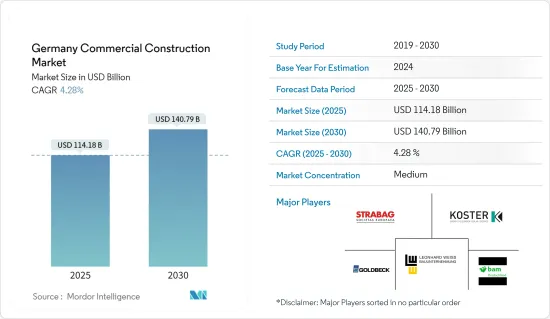

The Germany Commercial Construction Market size is estimated at USD 114.18 billion in 2025, and is expected to reach USD 140.79 billion by 2030, at a CAGR of 4.28% during the forecast period (2025-2030).

Germany's commercial construction market is undergoing a significant transformation, driven by a focus on sustainable and smart urban development. High-profile projects such as EDGE Hafencity in Hamburg exemplify this shift, integrating advanced green technologies, energy-efficient systems, and intelligent design. Completed in March 2024, EDGE Hafencity incorporates eco-friendly features like real-time energy tracking and green spaces and holds DGNB certification, establishing new benchmarks in sustainable construction and urban planning.

Urban renewal and infrastructure modernization remain strategic priorities. As part of a comprehensive initiative, 40 primary train routes are slated for renewal by 2030, beginning with the Riedbahn route between Frankfurt and Mannheim in June 2024. This large-scale project is enhancing urban connectivity and unlocking commercial development opportunities around transport hubs. Similarly, Deka Immobilien's acquisition of the Sudkreuz Offices in Berlin highlights the integration of sustainability within urban mixed-use developments. Located in the Schoneberger Linse, this project targets LEED Gold certification, underscoring a commitment to long-term, environmentally responsible growth.

The adoption of smart technology in commercial buildings is accelerating. BAUER Elektroanlagen's implementation of ABB smart building technologies in April 2024 reflects this trend. The company's focus on achieving energy self-sufficiency aligns with the industry's shift toward energy-efficient, automated systems that reduce operational costs while enhancing sustainability. These initiatives, combined with ongoing infrastructure advancements, demonstrate Germany's commitment to fostering innovative, sustainable commercial spaces. By integrating smart technology with urban development, Germany is shaping a forward-looking construction landscape for the years ahead.

Germany Commercial Construction Market Trends

Surge in Hotel Construction in Germany

Germany's hotel construction sector is demonstrating robust growth, driving the expansion of Europe's hospitality industry. Key urban centers, particularly Dusseldorf, are experiencing increased demand for new hotel properties. This growth is underpinned by Germany's strong tourism sector, expanding business activities, and rising international investments. As of Q1 2024, Germany remains a pivotal player in Europe's hotel development pipeline, with 178 active projects projected to deliver 31,839 new rooms. The sector's expansion is attributed to a resurgence in travel demand post-pandemic and favorable economic conditions.

Germany's hotel development in 2024 is characterized by a notable shift towards luxury and upscale projects. Dusseldorf, a leading city in this trend, has over 4,448 rooms under development. This reflects a broader industry movement toward high-end accommodations, with upscale and upper-upscale hotels dominating the pipeline in major German cities. Analysts observe that the growing presence of international brands is reinforcing Germany's position as a global hospitality hub.

Aligned with this growth trajectory, Europe's hotel construction pipeline, significantly supported by Germany's contributions, has reached record levels in recent years. Additionally, there has been a substantial increase in renovation and conversion projects, highlighting efforts to modernize older properties to contemporary standards. This dual strategy of expanding new builds and revitalizing existing assets positions Germany's hotel market for sustained growth.

Growing Commercial Construction in Stuttgart Driven by Automotive and Tech Sectors

Stuttgart, a key player in Germany's commercial construction market, is experiencing robust infrastructure development. This growth is primarily driven by Stuttgart's strategic importance in the automotive and technology sectors. As a global hub for automotive leaders such as Mercedes-Benz and Porsche, the city is witnessing increased demand for modern office spaces, research facilities, and innovation hubs to support the expansion of these industries.

In 2024, the city's flourishing automotive and tech sectors are propelling the development of advanced office buildings and research centers. Businesses are investing in high-tech office spaces with cutting-edge facilities to drive innovation. For example, in March 2024, Porsche is constructing the Porsche Digital Campus to support its expanding digital and technology operations. The campus will house hundreds of new employees and is expected to play a critical role in Porsche's digital transformation strategy.

Stuttgart is also emerging as a leader in sustainable commercial construction, with developers increasingly focusing on eco-friendly buildings. The rising demand for sustainable infrastructure is driving this trend. In February 2024, the Stuttgart 21 project, a major urban redevelopment initiative, is enhancing the city's transportation network while creating commercial spaces around the railway station. This project emphasizes sustainable development, incorporating energy-efficient designs and green spaces into new office buildings, hotels, and retail areas.

These developments underscore Stuttgart's growing significance in Germany's commercial construction market, driven by the expansion of its automotive and tech sectors and its commitment to sustainability and innovation. The city is well-positioned for continued growth in commercial real estate, reflecting broader trends in Germany's evolving construction industry.

Germany Commercial Construction Industry Overview

The German commercial construction market is highly competitive despite the significant local and international players having created a competitive environment. Still, the market opens opportunities for small and medium players due to increasing govt investments in the industry. The German commercial construction market presents opportunities for growth during the forecast period, which is expected to drive market competition further. Prominent players competing with others for a significant share leave the German construction market with no observable levels of consolidation.

A few key players in the market include Leonhard Weiss GmbH, Koster GmbH, Klbl GmbH, BAM Deutschland, and AUG. PRIEN Bauunternehmung (GmbH & Co. KG) and Strabag AG.

Government regulations make it easy for any local, national, or multinational player to enter the market and create its share easily.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Government Regulations

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Overview of Commercial Construction Market in Germany

- 4.6 Brief on Construction Costs (average cost, office and retail space, per sq feet)

- 4.7 Insights into the newly office space completions (sq. feet)

- 4.8 Impact of Geopolitics and Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Rising Commercial Property Development

- 5.1.2 Rapid Digitalization of Commercial Construction

- 5.2 Restraints

- 5.2.1 Emerging Safety and Labour Issues

- 5.2.2 Rise in Cost of Construction

- 5.3 Opportunities

- 5.3.1 Increasing Focus on Sustainable Buildings

- 5.3.2 Surge in Development of Smart Cities

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Offices

- 6.1.2 Retail

- 6.1.3 Hospitality

- 6.1.4 Industrial

- 6.1.5 Others

- 6.2 By Cities

- 6.2.1 Berlin

- 6.2.2 Frankfurt

- 6.2.3 Munich

- 6.2.4 Other Cities

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Leonhard Weiss GmbH & Co. KG

- 7.2.2 Koster GmbH

- 7.2.3 Klbl GmbH

- 7.2.4 BAM Deutschland

- 7.2.5 AUG. PRIEN Bauunternehmung (GmbH & Co. KG)

- 7.2.6 Strabag AG

- 7.2.7 Goldbeck Ost GmbH Niederlassung Sachsen-Plauen

- 7.2.8 Dechant hoch- und ingenieurbau gmbh

- 7.2.9 Gottlob Brodbeck GmbH & Co. KG

- 7.2.10 Josef Pfaffinger Bauunternehmung GmbH*

- 7.3 Other Companies

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX