PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644270

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644270

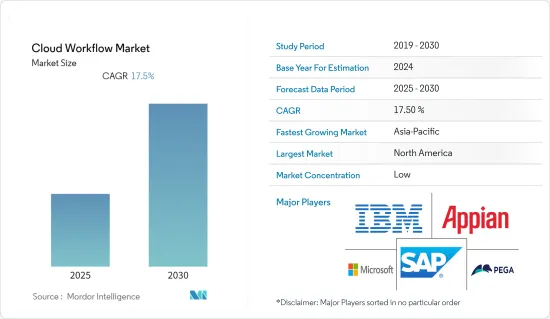

Cloud Workflow - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Cloud Workflow Market is expected to register a CAGR of 17.5% during the forecast period.

Key Highlights

- SMEs are quickly moving their conventional on-premises solutions to the cloud. The market for cloud-based workflow solutions has seen an improvement in the use of cloud-based workflow solutions by SMEs and large businesses due to the option of adopting them.

- Another factor anticipated to contribute to the market's growth is the rising use of cloud services by the government vertical to automate workflow processes, analyze data, increase productivity, and enhance efficiency.

- As businesses want to support a remote workforce, there has been a surge in the use of SaaS solutions. The industry is also predicted to benefit from the usage of digital payment, online shopping, and OTT streaming services.

- The market for cloud workflows has been expanding significantly. However, the scarcity of a secure cloud and the absence of a secure cloud may limit market expansion. In addition, factors including the growing emphasis on digital transformation projects and the adoption of AI technology provide the market with considerable prospects.

- Many businesses were forced to switch to a globally remote workforce as a result of COVID-19's introduction. As more businesses switch from conventional workflow processes to cloud workflow solutions, the market for cloud workflow is predicted to soar both during and after the epidemic.

Cloud Workflow Market Trends

Growing Adoption of Cloud Based Solutions Drive the Market Growth

- Because of the increased need for optimized corporate operations, the cloud workflow market is growing pace. Organizations are burdened with repetitive work procedures that reduce productivity and increase the time it takes to complete business operations; as a result, they are increasingly considering transforming modern cloud workflows to simplify business processes and assist management in making effective decisions. Processes were traditionally carried out manually, which took a long time and money and was prone to errors due to the manual work involved. Businesses can automate processes due to cloud workflow solutions, resulting in enhanced productivity.

- Cloud computing offers enterprises flexibility when their requirements change and the ability to scale down operations and storage facilities as needed. Furthermore, the pay-per-use pricing strategy allows large organizations and SMEs to leverage cloud computing solutions benefits.

- SMEs are rapidly moving from their traditional on-premises solutions to the cloud. With the choice of using workflow solutions on the cloud, the Cloud workflow market has witnessed an increase in the deployment of cloud-based workflow solutions by SMEs and large enterprises.

- However, technology is becoming increasingly important in numerous industries, including BFSI, Telecommunications and IT, Retail and E-Commerce, Government, and Healthcare. Several businesses have been increasingly adopting cloud technologies to maintain effective organizational functioning.

- Furthermore, when firms migrate from conventional workflow to cloud-based workflow procedures, the cost of operating and maintaining IT systems in a company is reduced, which propels the growth of the cloud workflow market.

North America is Expected to Register the Largest Market

- North America considers a significant chunk of the cloud workflow market. It is one of the most forward-looking regions in terms of cloud adoption. It forms developed economies such as the United States and Canada. Besides, North America accounts for the largest market share due to the growing adoption of the latest technologies, growing investments in digital transformation, and expanding gross domestic product (GDP) in North American countries.

- A survey by Cisco stated that 69% of the IT decision-makers support BYOD as a real interest in workplace policy as it saves operators time. In the United States' IT sector, it was anticipated that in the past three years, BYOD adoption saw 44.42%. With the expanding number of mobile workers in businesses and workplaces, there has been a consequent increase in the data generated and managed. This will encourage the cloud workflow market's growth over the forecast period.

- Countries in the region, such as America and Canada, are quickly advancing in technological transformation. The expanding adoption of cloud computing amongst companies and mounting competition are anticipated to propel the market. It is expected to hold the highest market size due to the new selection of workflow management technology, the residence of top players, and the globalization of cloud services in the region. Furthermore, this region is significantly developed regarding technologies and their application deployments.

- Through research and development, some of the notable players in the region have been able to further the technology. Google inaugurated its first Google Cloud Platform (GCP) field in Canada, with decreased rates for Google Cloud Storage infrequent access and cold storage classes and its nearline storage features for users in the region.

- Small and mid-size enterprises (SMEs) in the US often have IT requirements that are unique in themselves. In most cases, they require powerful, integrated tools without the complexity of larger corporations' solutions. In such instances, cloud ERP is a classic SaaS solution that is simple, affordable, and scalable. It is designed to meet SMEs' growing business needs and retain their competitiveness.

Cloud Workflow Industry Overview

The cloud workflow market is fragmented, owing to the presence of significant players such as SAP SE, Pegasystems Inc., IBM Corporation, Microsoft Corporation, and Appian Corporation, among others. The companies are making partnerships, mergers, acquisitions, innovations, and investments to retain their market position.

In January 2023, CenTrak launched WorkflowRT, a scalable, cloud-based platform that automates workflow and communications to lessen the load of manual paperwork necessary during each phase of clinical treatment. Teams may monitor crucial patient flow data using the platform's built-in reporting to spot anomalies or bottlenecks. Healthcare facilities have demonstrated decreased patient wait times, greater time spent with patients, and higher staff and patient satisfaction by utilizing historical analytics to encourage operational improvements.

In July 2022, Sage, one of the leading players in accounting, finance, human resources, and payroll solutions for small and medium-sized businesses (SMBs) announced an expanded partnership with Microsoft. The partnership aims to incorporate Microsoft Business Products, such as Microsoft 365 and Microsoft Teams, as integrated services in Sage products and the Sage Digital Network.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Cloud

- 5.1.2 Increased Adoption of Cloud-Based Workflows Among SMEs

- 5.2 Market Restraints

- 5.2.1 Absence of Secure Cloud

6 MARKET SEGMENTATION

- 6.1 By Cloud Type

- 6.1.1 Public Cloud

- 6.1.2 Private Cloud

- 6.1.3 Hybrid Cloud

- 6.2 By Organization Size

- 6.2.1 Small and Medium-Sized Enterprises (SMEs)

- 6.2.2 Large Enterprises

- 6.3 By End-User Vertical

- 6.3.1 BFSI

- 6.3.2 Telecommunications and IT

- 6.3.3 Retail and E-Commerce

- 6.3.4 Government

- 6.3.5 Healthcare

- 6.3.6 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 Pegasystems Inc.

- 7.1.3 IBM Corporation

- 7.1.4 Microsoft Corporation

- 7.1.5 Appian Corporation

- 7.1.6 Ricoh Company Ltd

- 7.1.7 Micro Focus International PLC

- 7.1.8 K2 Software Inc.

- 7.1.9 Nintex UK Ltd

- 7.1.10 Viavi Solutions

- 7.1.11 BP Logix Inc.

- 7.1.12 Kissflow Inc.

- 7.1.13 Cavintek Software Private Limited

- 7.1.14 Integrify Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET