Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643175

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643175

India Battery Energy Storage Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 95 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

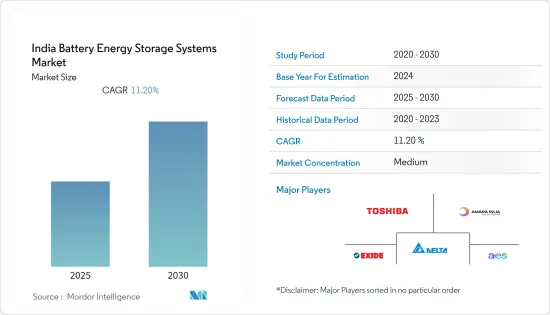

The India Battery Energy Storage Systems Market is expected to register a CAGR of 11.2% during the forecast period.

Key Highlights

- Over the medium term, factors such as declining prices of lithium-ion batteries and government initiatives to promote energy storage deployment are likely to drive the India battery energy storage systems market in the forecast period.

- On the other hand, the uncertainty in the rules governing energy storage operations and ownership will likely hinder the growth of the India battery energy storage systems (BESS) market in the studied period.

- Nevertheless, technological advancements in new battery technologies to store energy and India's target to reach around 500 GW of renewable capacity by 2030 will likely create lucrative growth opportunities for the India BESS market during the forecast period.

India Battery Energy Storage Systems Market Trends

Lithium-ion Battery Segment Expected to Dominate the Market

- Lithium-ion batteries witness high demand in renewable power projects. Many renewable industry experts believe that the growth of renewables in India is incomplete without energy storage systems, and lithium batteries offer the most cost-effective integration.

- Lithium solar batteries are a rechargeable energy storage solution that can be paired with a solar power system to store excess solar power. India's installed solar energy capacity stood at around 61.97 GW as of 30th November 2022, and the government planned many projects to reach its ambitious target of increasing its share to 100 GW by 2022. But due to the intermittency of solar power supply, many private players have planned solar plus energy storage projects to ensure a continuous power supply to the grid.

- In June 2023, Tata Group subsidiary Agratas Energy Storage Solutions Private Limited signed an agreement with the Gujarat government to set up India's first gigafactory for Lithium-Ion batteries in the state. The company is expected to invest USD 1.57 billion initially to set up a 20-gigawatt (GW) unit.

- Tata Power Solar Systems Limited (Tata Power Solar) bagged a solar plus storage project from Solar Energy Corporation of India Ltd (SECI) in Chattisgarh. The project includes EPC services for a 100 MW solar power plant with a utility-scale Battery Energy Storage System (BESS) of 120 MWh capacity. The total outlay of the project was approximately USD 115 million. It is likely to get commissioned in the second half of 2023.

- Moreover, The Ramagiri Solar-Wind-Hybrid project, integrated with battery energy storage systems, is a perfect example of energy storage development in India. Located in Anantapur, Andhra Pradesh, the project is owned by the Solar Energy Corporation of India (SECI). It is currently under construction and is expected to be completed by 2022.

- Due to such developments, the lithium-ion battery segment is expected to hold the largest market share during the forecast period.

Government Initiatives Expected to Drive the Market

- The Indian battery energy storage market will likely be further driven by supportive government policies and initiatives to ease technological implementation.

- The power capacity additions in India were not as per the expectations of the Indian government. Thus, the government is trying to boost the sector by including various thermal and renewable projects. The installed Renewable energy capacity (including large hydro) has increased from 76.37 GW in March 2014 to 167.75 GW in December 2022, i.e., an increase of around 2.20 times.

- According to Central Electricity Authority, in FY 2022-23, the country's total renewable energy generation accounted for 203,552 million units (MU), with an annual growth rate of 19% compared to the previous year.

- Out of the total renewable installed capacity, India's installed battery energy storage capacity was around 20MW as of 2021, and the required capacity is estimated to be about 38 GW by 2030. Several projects have been planned to integrate energy storage systems in renewable power projects by the Indian government and affiliated entities.

- In October 2022, The United States Department of Energy (DOE) and India's Ministry of Power (MoP) established the Energy Storage Task Force to facilitate an ongoing and meaningful dialogue between government officials, industry representatives, and other stakeholders from both countries to help scale up and accelerate deployment of energy storage technologies to facilitate the transition to a clean energy future.

- Owing to these developments, government policies are expected to be the most significant market drivers during the forecast period.

India Battery Energy Storage Systems Industry Overview

India's battery energy storage systems market is moderately fragmented. Some of the major players in the market (in no particular order) include Toshiba Corporation, AES Corporation, Exide Industries Ltd, Delta Electronics Inc., and Amara Raja Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 70157

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecasts in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Declining Cost of Energy Storage Technologies

- 4.5.1.2 Government Initiatives to Promote Energy Storage Deployment

- 4.5.2 Restraints

- 4.5.2.1 Uncertainty in the Rules Governing Energy Storage Operations and Ownership

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-acid

- 5.1.3 Flow

- 5.1.4 Other Battery Types

- 5.2 Connection Type

- 5.2.1 On-grid

- 5.2.2 Off-grid

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 AES Corporation

- 6.3.2 Exide Industries Ltd.

- 6.3.3 Delta Electronics Inc.

- 6.3.4 Toshiba Corporation

- 6.3.5 Amara Raja Group

- 6.3.6 Panasonic Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 India's Target to Reach Around 500 GW of Renewable Capacity by 2030

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.