PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643106

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643106

Thailand Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

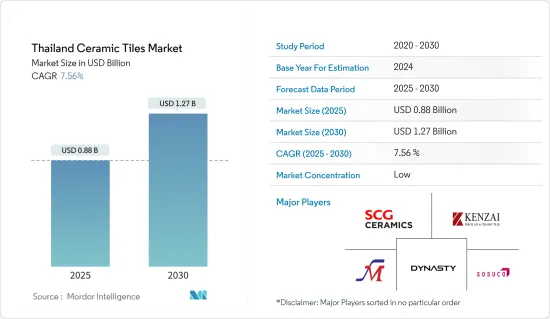

The Thailand Ceramic Tiles Market size is estimated at USD 0.88 billion in 2025, and is expected to reach USD 1.27 billion by 2030, at a CAGR of 7.56% during the forecast period (2025-2030).

Thailand, a key player in the ceramic tile sector, is witnessing a surge in production. This uptick is driven by rising global export demands and the need to meet domestic needs. The country's ceramic tile market is buoyed by a robust construction sector, escalating demand for both residential and commercial infrastructure, and the ongoing urbanization trend. Ceramic tiles, valued for their durability and crack resistance, are extensively used in residential and commercial buildings. Additionally, their water resistance and stain protection are further enhanced by protective coatings. Thailand's ceramic tile sector stands out, with companies actively investing in cutting-edge technologies to drive innovation and production efficiency, all while managing costs.

The ceramics industry in Thailand boasts a rich heritage. Key drivers of ceramic tile demand include a booming construction sector, heightened residential unit expansion, increased consumer spending, and rapid urbanization. In Thailand, ceramic tiles are sought after by homeowners and contractors alike, for projects ranging from condominiums to large-scale developments like office and shopping complexes. Architects and interior designers wield significant influence over consumer choices in the ceramic tile market. Notably, the United States, Australia, Germany, Singapore, and the Netherlands are major foreign markets for Thai glazed ceramic and mosaic tiles. With some of the largest and most innovative tile manufacturers, Thailand is poised to witness a sustained surge in ceramic tile demand in the coming years.

Thailand Ceramic Tiles Market Trends

Rising Imports of Ceramic Tiles in Thailand

- The rising imports of ceramic tiles in Thailand indicate an increasing demand for these products. This could be due to several reasons such as a growing construction industry, rising urbanization, and an increase in disposable income among consumers. Thailand's construction industry has been growing steadily over the past few years, which has led to an increase in demand for building materials such as ceramic tiles.

- Additionally, the country's urbanization rate has been increasing, with more people moving to cities and urban areas. As a result, there is a greater need for the construction and renovation of buildings, which includes the use of ceramic tiles.

- Furthermore, the increase in disposable income among consumers has also contributed to the rise in imports of ceramic tiles in Thailand. As consumers have more money to spend, they are more likely to invest in home renovation projects, which often involve the use of ceramic tiles. Overall, the rising imports of ceramic tiles in Thailand indicate a positive trend for the construction and renovation industry, as well as for the country's overall economic growth.

Residential Sector in Thailand Ceramic Tiles are Driving the Market

The residential sector in Thailand is a pivotal force behind the surging demand for ceramic tiles. These tiles find applications in flooring, wall cladding, and decorative purposes within residential properties. Several factors underscore the residential sector's significance in propelling Thailand's ceramic tiles market.

Firstly, Thailand's rapid urbanization and population growth have spurred a flurry of residential construction activities. This includes the development of buildings, condominiums, and housing projects. As the population swells and urban migration intensifies, the need for ceramic tiles to furnish these new residential units has soared. Ceramic tiles are sought after for their aesthetic appeal and functional durability. They boast resistance to moisture, stains, and wear, making them ideal for high-traffic areas like kitchens, bathrooms, and living spaces.

Furthermore, a rising trend of home renovation and remodeling projects among Thai homeowners is bolstering the demand for ceramic tiles. As homeowners strive to revamp their living spaces, ceramic tiles have become a go-to choice. They not only refresh interior and exterior surfaces but also elevate property values, creating bespoke living environments that mirror their lifestyle preferences.

Thailand Ceramic Tiles Industry Overview

The Thai ceramic tiles market is fragmented and competitive, with the presence of some major players, like SCG Ceramics, Kenzai, and Dynasty Ceramics. International Ceramic tile manufacturers are also gaining prominence in the region, and the local players are constantly trying to innovate their product offerings by enhancing product quality and introducing varied designs to sustain the rising competition in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Insights into market trends/consumer preference analysis

- 4.2 Insights into E commerce trends

- 4.3 Insights into Technological Trends in the industry

- 4.4 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.3 Market Restraints

- 5.4 Opportunities

- 5.5 Industry Value Chain Analysis

- 5.6 Porter's Five Forces Analysis

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Glazed

- 6.1.2 Porcelain

- 6.1.3 Scratch Free

- 6.1.4 Other Products

- 6.2 By Application

- 6.2.1 Floor Tiles

- 6.2.2 Wall Tiles

- 6.2.3 Other Applications

- 6.3 By Construction Type

- 6.3.1 New Construction

- 6.3.2 Replacement and Renovation

- 6.4 By End-User

- 6.4.1 Residential

- 6.4.2 Commercial

7 COMPETITIVE LANDSCAPE

- 7.1 Market Competion Overview

- 7.2 Company Profiles

- 7.2.1 SCG Ceramics

- 7.2.2 Kenzai

- 7.2.3 Stone Mark Ceramics

- 7.2.4 Sosuco Ceramics company Limited

- 7.2.5 Viglacera Thang long Ceramics JSC

- 7.2.6 UMI Group

- 7.2.7 Dynasty Ceramic

- 7.2.8 TT Ceramic Company Limited

- 7.2.9 Tongfa Ceramic Limited

- 7.2.10 Lam Pang Thai Ceramic Company limited

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX

10 ABOUT US