Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643067

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643067

Aluminum Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

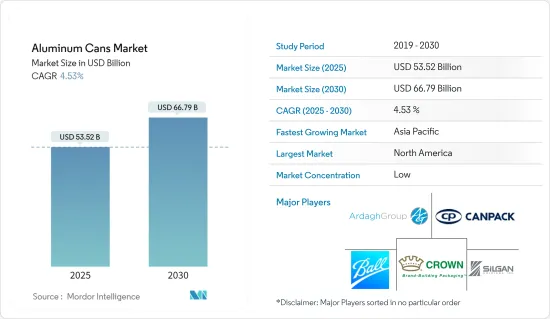

The Aluminum Cans Market size is estimated at USD 53.52 billion in 2025, and is expected to reach USD 66.79 billion by 2030, at a CAGR of 4.53% during the forecast period (2025-2030).

Key Highlights

- Aluminum cans offer long-term food quality preservation benefits. They deliver nearly 100% protection against light, oxygen, moisture, and other contaminants. They do not rust and are corrosion-resistant, providing one of the most extended shelf lives of any packaging. Additionally, designers, engineers, and manufacturers leverage aluminum's diverse physical properties. Compared to many metals, aluminum has a lighter weight per volume, making it easier to handle and more cost-effective to ship. This fuels the usage of aluminum cans in the market.

- The food and beverage industry's increasing adoption of aluminum cans stems from their protective nature, sustainability benefits, and consumer ease. This trend is set to persist, given that manufacturers and consumers alike are increasingly acknowledging the advantages of aluminum packaging. Notably, aluminum stands out as the most recyclable material globally, boasting a nearly 100% recyclability rate. Moreover, aluminum retains its integrity through multiple recycling cycles, making it a highly sustainable choice. The environmental benefits are significant, such as recycling aluminum conserves energy, reduces millions of tons of greenhouse gas emissions, and decreases the demand for transportation fuel. Manufacturing aluminum cans from recycled materials consumes significantly less energy than producing new cans, driving the adoption of recyclable aluminum cans.

- Aluminum cans stand out in recycling, undergoing a closed-loop process where they are recycled repeatedly. In contrast, glass and plastic, once recycled, often transform into products that are either not recyclable or have low chances of being recycled again. Aluminum cans outshine their counterparts by being infinitely recyclable, primarily to create fresh cans. Moreover, aluminum boasts premium qualities that set it apart in packaging. Its distinct physical attributes not only pave the way for new brand launches but also facilitate the expansion of existing brands into untapped markets, propelling the demand for aluminum can packaging in the food and beverage industry.

- However, aluminum can packaging faces high competition from alternative packaging solutions. Plastic, paper, and glass packaging solutions are the alternative packaging options available. Also, the increasing importance of e-commerce worldwide is expected to influence the overall packaging industry. Moreover, incremental enhancements in plastic packaging are posing a threat to the market, which can primarily be attributed to the popularity of plastics, such as polyethylene terephthalate (PET), as substitutes. PET plastics threaten to displace aluminum can solutions in the food and beverage industry.

- The global economy was significantly affected by the COVID-19 pandemic. Industries faced substantial challenges from supply chain disruptions and government-mandated lockdowns. The war between Russia and Ukraine also triggered economic sanctions against multiple nations, escalating commodity prices and straining supply chains, which reverberated through global markets and led to trade disruptions. This caused European aluminum firms to scale back production due to metal shortages. With the war intensifying these shortages for European manufacturers reliant on Russian supplies, commodity traders registered low profits by shipping aluminum from China. Furthermore, Europe witnessed a notable surge in energy costs, directly impacting the production volume of aluminum cans in the market.

Aluminum Cans Market Trends

The Beverages Segment is Expected to Drive the Market

- The younger population and people who live alone are consuming more canned beverages. These users have less time and are budget-restrained, opting for products with premium costs and higher convenience. Changing lifestyles in developing countries worldwide and the growing rate of urbanization are resulting in consumers opting for canned beverages. Additionally, with the shrinking size of the family and changing lifestyle patterns, the declining amount of time spent on cooking at home, and the collaboration of beverage companies with food chains are supporting the demand for can packaging worldwide.

- Aluminum cans are most widely used for beverages, with the most notable trend of canned wine, cocktails, hard beverages, and soft beverages being packaged in metal, driven by the need for portability in the market. The usage of metal cans in the beverage industry can be widely classified into alcoholic and non-alcoholic drinks based on the nature of the beverage. Alcoholic drinks, such as beer, have historically used metal cans, while other kinds of liquor, like wine, traditionally served in glass bottles, are increasingly adopting metal cans.

- Cans have surged in popularity with millennials and Gen Z due to their portability and user-friendly nature. Moreover, manufacturers are increasingly opting for can packaging, given its appeal to the younger demographic. For instance, in January 2024, Redbull reported that the company sold 12.1 billion cans worldwide in 2023, a significant increase from the previous years, underscoring the future demand and increasing trend of can usage in the beverage segment.

- Beverage companies worldwide are broadening their portfolio by offering canned beverages to showcase their premium products, supporting segmental growth. For instance, in April 2024, Coca-Cola's Smartwater launched sleekly designed aluminum cans and announced that Smartwater Original and Smartwater Alkaline with antioxidants would be available across the United States in single 12-oz. cans.

- Aluminum is highly corrosion resistant, effectively shielding beverages from sunlight and oxygen, minimizing the risk of contamination. This renders aluminum cans ideal for packaging acidic or carbonated drinks, including beer, wine, and soda, without compromising their initial quality. Furthermore, aluminum's superior cold-conducting properties ensure that beverages chill rapidly and remain colder for extended periods compared to alternative packaging materials, supporting the demand for canned drinks in the market.

North America is Expected to Hold a Significant Market Share

- North America accounts for the largest revenue share due to growing concerns regarding using and consuming sustainable packaging materials. There has been steady growth in products such as sodas, energy drinks, sparkling waters, and, increasingly, craft brew beers. Aluminum cans are among the most sustainable beverage packages and are infinitely recyclable. They also chill quickly, provide a superior metal canvas to print, and offer protection for the flavor and integrity of beverages.

- In February 2024, Every Can Counts, a program advocating for drink can recycling, announced its expansion into the United States. Every Can Counts US would be a collaborative effort between key players in the market, including Ardagh Metal Packaging, CANPACK, Crown Holdings, and Envases, representing the manufacturers, and Constellium, Kaiser Aluminum, Novelis, and Tri-Arrows Aluminum, the aluminum suppliers. These partners would promote responsible disposal of empty drink cans through recycling, bolstering the adoption and recyclability of aluminum cans.

- The demand for aerosol cans is anticipated to rise with the personal care industry's expansion in the United States. The growth of the personal care industry is primarily related to consumers' increased disposable income and ability to purchase luxury goods. Aerosols are utilized in several personal care products. Thus, the market is projected to profit from their increased sales.

- Higher demand for deodorants and antiperspirants led to the installation of an increasing number of production lines in North America over the past few years. North America accounts for a significant share of the aluminum cans market due to the growing demand from the personal care industry, which spans products of various types, such as deodorants, antiperspirants, hair mousses, hair sprays, and shaving mousses.

- The government of Canada assisted its businesses. The government claimed that it was vital to foster a strong and lasting economic recovery by investing in innovation, which could allow the country to achieve its potential for low-carbon growth. The government is expected to invest heavily in helping Canada's aluminum cans market eliminate greenhouse gas emissions. According to the government, zero-carbon aluminum smelting would help meet Canada's economic and climate change objectives.

Aluminum Cans Industry Overview

The aluminum cans market is highly fragmented, owing to the presence of various global and local players. Some major players include Ball Corporation, Crown Holdings Inc., Silgan Holdings Inc., CAN-PACK SA, and Ardagh Group SA. To be competitive in the market, vendors collaborate, prioritize, and expand their businesses based on product portfolio, differentiation, and pricing.

- May 2024: Ball Corporation, a global sustainable packaging solutions provider, partnered with CavinKare, a player in the dairy sector, to innovate dairy packaging. Their collaboration includes using the two-piece aluminum cans from Ball Corporation under its packaging approach, designed for CavinKare's renowned milkshakes, which would support its market presence in the aluminum cans market.

- August 2023: Crown Holdings Inc. acquired Helvetia Packaging AG, a beverage can manufacturing facility in Saarlouis, Germany. This strategic move marked the company's entry into the German market and bolstered its European beverage can platform, adding an annual capacity of around one billion units. The rising awareness of sustainability and aluminum's recyclability amplify beverage cans' appeal across the alcoholic and non-alcoholic drink segments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 69547

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Recyclability Rates of Aluminum Cans

- 5.1.2 Increasing Demand for Canned Foods driven by Cost and Convenience-related Advantages

- 5.2 Market Restraints

- 5.2.1 Availability of Alternative Packaging Solutions

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Slim

- 6.1.2 Sleek

- 6.1.3 Standard

- 6.1.4 Other Types

- 6.2 By End-user Industry

- 6.2.1 Beverage

- 6.2.2 Food

- 6.2.3 Aerosol

- 6.2.4 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Thailand

- 6.3.3.6 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ball Corporation

- 7.1.2 Ardagh Group S.A.

- 7.1.3 Crown Holdings Inc.

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 CAN-PACK SA

- 7.1.6 CCL Container Inc. (CCL Industries Inc.)

- 7.1.7 Tecnocap Group

- 7.1.8 Saudi Arabia Packaging Industry WLL (SAPIN)

- 7.1.9 Massilly Holding SAS

- 7.1.10 CPMC HOLDINGS Limited (COFCO Group)

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.