PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643047

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643047

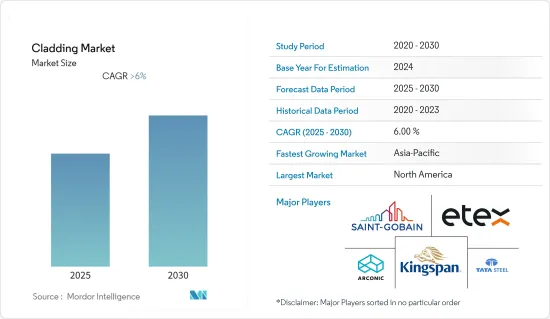

Cladding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Cladding Market is expected to register a CAGR of greater than 6% during the forecast period.

The cladding systems market is witnessing robust growth, fueled by material innovations, a surge in demand for energy-efficient solutions, and stricter safety standards. This momentum is evident in the broad embrace of cutting-edge cladding materials and technologies, championing sustainability and bolstering building performance across sectors, from residential to commercial.

Aluminum composite panels (ACPs), a type of composite material, are gaining traction for their durability, lightweight nature, and cost efficiency. Leading manufacturer STACBOND reports a surge in demand for its ACPs, particularly in ventilated facades. These facades, now a staple in sustainable construction, promise up to a 30% reduction in energy consumption, boosting efficiency and aiding in green certifications like LEED as of November 2024. The increasing adoption of ACPs is also attributed to their versatility in design, allowing architects and builders to achieve both functional and aesthetic objectives. Furthermore, there's a growing trend towards integrating smart cladding systems.

In July 2024, Sto SE & Co. unveiled a nanotechnology-driven self-cleaning facade, designed to repel dirt and slash maintenance costs, aligning with modern buildings' sustainability and aesthetic aspirations. This innovation not only reduces operational expenses but also enhances the lifespan of the cladding system, making it a preferred choice for long-term investments.

Heightened fire safety concerns are propelling the demand for advanced cladding systems, especially in retrofitting high-rise residential buildings. The 2024 renovation of the Grenfell Tower in the UK highlights the critical need for fire-resistant cladding. Such upgrades not only adhere to stringent fire safety regulations but also address the urban demand for non-combustible materials. The market is witnessing a shift towards materials like mineral-based panels and fire-rated aluminum composites, which offer enhanced safety without compromising on design flexibility.

Meanwhile, in the Asia-Pacific, swift urbanization is spurring a quest for affordable, durable cladding. As part of India's Smart Cities Mission, unveiled in November 2024, new urban developments will feature energy-efficient cladding, targeting reduced energy consumption and bolstered sustainability in expanding cities. This initiative underscores the growing emphasis on integrating advanced cladding systems into urban planning to meet the dual objectives of energy efficiency and environmental responsibility.

Cladding Market Trends

Rising Demand for Flat-Rolled Carbon Steel in the Cladding Market

The rising demand for flat-rolled carbon steel in cladding systems is driven by sustainability, infrastructure expansion, and the need for high-performance construction materials. As global construction grows, flat-rolled carbon steel is valued for its durability, cost-effectiveness, and aesthetics.

Emerging markets, especially China, are fueling demand due to rapid urbanization and infrastructure development. In China, the construction sector's strong steel demand highlights flat-rolled products as key components in cladding systems. Ongoing investments in public infrastructure and residential developments are fueling a significant surge in demand for flat steel. Industry reports from 2024 indicates that the construction sector, a major consumer of steel, is witnessing a steady increase in the use of flat-rolled carbon steel. This growth aligns with China's ambitious construction goals, which include large-scale infrastructure projects and urban housing developments, further driving the demand for flat steel products.

Steelmakers are ramping up their production of high-strength steel products, like flat-rolled carbon steel, to cater to construction projects that prioritize durability. Responding to this surge in demand, Nippon Steel has rolled out specialized offerings, notably ZAM(R)-EX. This high-strength steel, tailored for cladding applications, boasts enhanced corrosion resistance, making it a top choice for outdoor settings where longevity is paramount. Nippon Steel's 2023 debut of ZAM(R)-EX underscores the industry's pivot towards premium steel products, especially for modern cladding systems in construction.

Furthermore, advancements in steel production technology are driving the demand for flat-rolled carbon steel. The industry's transition to sustainable methods, particularly the adoption of electric arc furnaces (EAF), is accelerating. EAF technology enables the production of high-quality steel while reducing environmental impact compared to traditional methods. This trend is particularly significant in the cladding systems market, where demand for sustainable and durable materials is on the rise. As per 2024 industry reports, steel producers are increasingly adopting EAF processes to comply with regulatory requirements and address the growing demand for eco-friendly building materials.

Growing Preferences for Durb

Globally, the demand for durable and resilient wall cladding materials is increasing, particularly in residential construction. This growth is driven by environmental concerns and the need for materials that can withstand extreme weather, require minimal maintenance, and support sustainable building practices. Consequently, major players in the construction and materials sector are innovating to meet the rising preference for long-lasting, low-maintenance cladding systems.

In response to the growing demand for sustainable building solutions, industry leaders like James Hardie are developing products aimed at reducing carbon footprints. For instance, James Hardie introduced its low-carbon cement technology across North America in FY24. Additionally, their Hardie(R) Artisan Lap Siding was named Green Builder's 2024 Sustainable Product of the Year in April 2024, highlighting its climate resilience and durability. These efforts align with a broader industry trend toward incorporating sustainable materials in residential construction, addressing environmental concerns while meeting consumer expectations for eco-friendly housing solutions.

In addition to sustainability, fiber cement cladding is gaining popularity due to its strength and fire resistance. James Hardie's fiber cement siding products have seen increased adoption in wildfire-prone regions. For instance, in FY24, the Panorama Home project in Colorado utilized fiber cement cladding to mitigate wildfire risks, as reported in August 2024. Furthermore, Ash Grove Cement, in collaboration with James Hardie, is piloting recycling solutions for cladding production to reduce waste and enhance product sustainability. These advancements in material science are enabling the residential construction sector to address the growing demand for durable, low-maintenance, and environmentally responsible building solutions.

Cladding Industry Overview

The cladding market is competitive in nature, with various regional players present in the market. Very few companies are present at the global level. Some of the major players in the cladding market are Arconic Inc., Tata Steel Ltd., Etex Group, Compagnie de Saint-Gobain SA., and Kingspan Group, among others. Players are innovating new cladding materials in order to meet the different demands in the market. For instance, Saint-Gobain S.A. is innovating in the cladding material segment with flat glass and high-performance materials. The interior solutions comprise insulation and gypsum products, whereas the exterior solutions consist of pipes, industrial mortars, and exterior products. Companies are adopting acquisition and merger strategies to gain market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge for Energy-Efficient Building Solutions

- 4.2.2 Demand for Self-Cleaning Facade Systems

- 4.3 Market Restraints

- 4.3.1 High Upfront Costs of Advanced Cladding Materials

- 4.3.2 Challenges in Meeting Regulatory Compliance and Fire Safety Standards

- 4.4 Market Opportunities

- 4.4.1 Integration of Photovoltanic (PV) Systems

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Trends in the Construction and Cladding Market

- 4.8 Insights on Technological Disruptions in the Market

- 4.9 Insights on Government Regulations in the Market

- 4.10 Insights on Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Metal

- 5.1.2 Terracotta

- 5.1.3 Fiber Cement

- 5.1.4 Concrete

- 5.1.5 Ceramics

- 5.1.6 Wood

- 5.1.7 Vinyl

- 5.1.8 Other Materials

- 5.2 By Component Type

- 5.2.1 Wall

- 5.2.2 Roofs

- 5.2.3 Windows and Doors

- 5.2.4 Other Component Types

- 5.3 By Application

- 5.3.1 Residential

- 5.3.2 Non-residential

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 South Korea

- 5.4.3.4 Japan

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of the Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Megers and Acquisitions

- 6.3 Company Profiles

- 6.3.1 Arconic

- 6.3.2 Tata Steel Ltd

- 6.3.3 Compagnie de Saint Gobain SA

- 6.3.4 Etex Group

- 6.3.5 Kingspan Group

- 6.3.6 James Hardie Industries PLC

- 6.3.7 Boral Limited

- 6.3.8 CSR Building Products

- 6.3.9 Nichiha Corporation

- 6.3.10 Cembrit Holding AS

- 6.3.11 DowDuPont*

- 6.4 Other Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX