PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642983

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642983

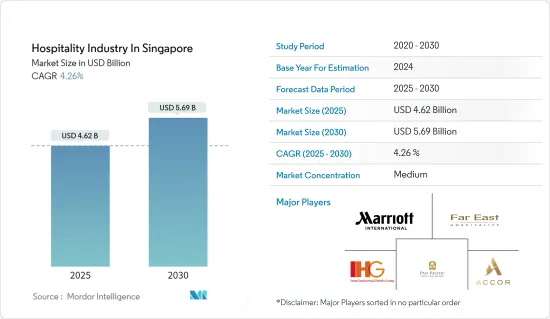

Hospitality Industry In Singapore - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Hospitality Industry In Singapore Market size is estimated at USD 4.62 billion in 2025, and is expected to reach USD 5.69 billion by 2030, at a CAGR of 4.26% during the forecast period (2025-2030).

Over the past ten years, Singapore has witnessed an increase in the number of tourists. A DBS Bank analysis claims there need to be more hotels or other lodging options nationwide to accommodate the increasing number of visitors. Over the past ten years, the average number of tourists to each country has increased by 6%, but the supply of hotel rooms has only increased by 4.2%, particularly in the last four years, which has put pressure on the nation's tourism sector. Singapore has revolutionized the hotel sector by establishing trends in areas such as technology innovation, sustainability, and holistic wellness.

Singapore is preparing itself for a change in consumer demand and emerging travel habits. To advance in the market, companies offering services related to hospitality will need to adopt a holistic health approach. After the pandemic, the Singapore government has actively promoted and launched various tourism initiatives such as a business travel lane that allows corporate and diplomatic travelers to skip quarantine on arrival and the launch of the "Air Travell Pass Program," which will enable tourists to apply to travel to Singapore without undergoing quarantine.

Singapore Hospitality Market Trends

Rising Number of International Visitors are Driving the Market

Singapore has witnessed a steady increase in the number of foreign visitors, with just three brief periods of decline since the last decade. Due to the Singapore Tourism Board's (STB) marketing campaigns to draw tourists from all over the world, the country is expected to see moderate visitor arrivals and healthy growth rates throughout the forecast period, despite growing competition from Indonesia, Vietnam, and Thailand. For example, STB has been successful in attracting visitors from China's Tier-II and Tier-III cities.

Innovative and Package Customization to Attract More Customers

Singapore is a popular vacation spot that has seen a rise in the number of leisure visitors. Over 55% of visitors are there for leisure, with business travel accounting for 11% of all visits. Despite varying occupancy rates over the previous ten years, the area has been registering annual revenue growth per room, which is improving the region's appeal to investors. Wyndham Hotels & Resorts claims that the company is pursuing a new approach that is more intently focused on Singapore's role as a significant hub for business. The company intends to host several group events all year long to meet the basic needs of corporate groups that are moving away from traditional conference settings. It does this by being the one-stop shop for business-related meeting spaces as well as areas for guests to play and unwind.

Singapore Hospitality Industry Overview

Singapore's hospitality market is composed of both domestic and foreign businesses, making it reasonably concentrated. The majority of hotels are positioned in highly sought-after locations for travelers. The area has a strong demand for hotels because there aren't as many available. Investors find the location appealing with the support of government programs. In Singapore, the leading companies are Accor SA, Pan Pacific Hotels Group, Marriott International, Far East Hospitality, and InterContinental Hotels Group Plc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Contribution to the Economy to Generate Income for the Nation

- 4.2.1.2 Rise in Global Tourism

- 4.2.2 Market Restraints

- 4.2.2.1 Long Hours of Working Pattern

- 4.2.2.2 Increasing Competition among Hotels and Other Lodging Options

- 4.2.3 Market Opportunities

- 4.2.3.1 Technological Advancements Striving the Market

- 4.2.1 Market Drivers

- 4.3 Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technological Innovations and Recent Developments in the Hospitality Industry

- 4.6 Impact of COVID-19 on the Hospitality Industry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Chain Hotels

- 5.1.2 Independent Hotels

- 5.2 By Segment

- 5.2.1 Service Apartments

- 5.2.2 Budget and Economy Hotels

- 5.2.3 Mid and Upper mid scale Hotels

- 5.2.4 Luxury Hotels

6 COMPETITIVE INTELLIGENCE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Accor S A

- 6.2.2 Marriott international

- 6.2.3 Far East Hospitality

- 6.2.4 Forward Land

- 6.2.5 InterContinental Hotels Group Plc

- 6.2.6 Pan Pacific Hotels Group

- 6.2.7 Millennium & Copthorne International Limited

- 6.2.8 Hotel 81

- 6.2.9 Shangri-La hotels & resorts

- 6.2.10 Marina Bay Sands*

- 6.3 Loyalty Programs Offered by Major Hotel Brands

7 FUTURE MARKET TRENDS

8 DISCLAIMER