PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851919

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851919

Wallpaper - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

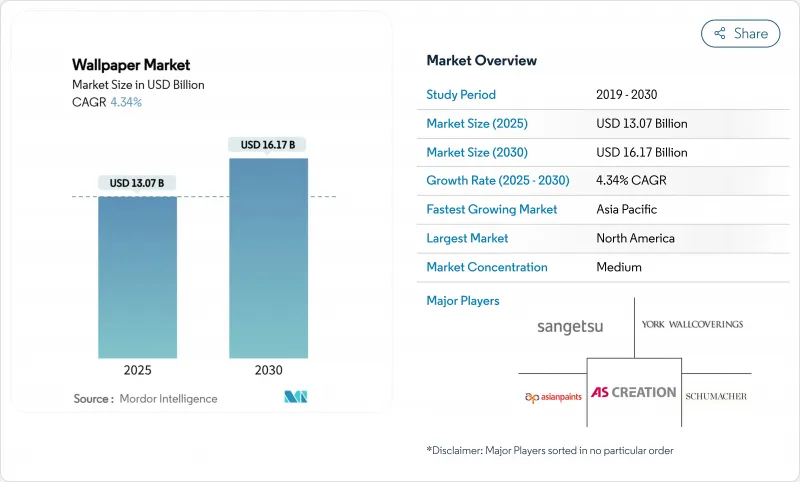

The global wallpaper market size reached USD 13.07 billion in 2025 and is forecast to touch USD 16.17 billion by 2030, advancing at a 4.34% CAGR during the period.

Demand expands as digital printing, antimicrobial coatings, and peel-and-stick substrates converge with surging residential renovation activity, intensified hospitality refresh cycles, and rising interior-aesthetic expectations among mid-income households. Commercial installations currently lead because hotel construction pipelines in the GCC and ASEAN continue to specify premium, durable wallcoverings that withstand rigorous maintenance schedules. Residential adoption accelerates as Southeast Asian governments subsidize affordable housing programs and North American homeowners opt for personalized decor over routine repainting. Supply chains face vinyl-chloride price swings and tariff hikes, yet manufacturers defend margins through vertical integration, long-term resin contracts, and innovation in non-vinyl substrates. Competitive differentiation now hinges on omnichannel distribution, sustainability credentials, and the speed with which on-demand printing can translate design concepts into finished rolls.

Global Wallpaper Market Trends and Insights

Surge in Demand for Digitally-Printed Personalised Decor in North America and Europe

On-demand digital printing liberates designers from plate-making and minimum-run constraints, enabling serialized patterns, tactile 3D textures up to 2 mm, and fast prototyping that shortens design-to-installation cycles. Roland DG and Panasonic Housing Solutions unveiled DIMENSE technology that produces sculpted surfaces without extra embossing passes, widening creative scope and cost efficiency. Luxury paint maker Benjamin Moore collaborated with The Alpha Workshops to hand-paint wallpapers retailing at USD 125 per yard, proof that customization supports 40-60% price premiums. European stalwarts such as Sanderson Design Group chase this segment with heritage-meets-digital launches that sell for ¥13,900-¥35,100 per roll, validating affluent willingness to pay for unique stories Sanderson. Ecommerce accelerates uptake: Graham & Brown's B2B portal reached 90% client adoption in just 12 weeks, cutting order friction and inventory risk. These gains lift manufacturer margins and position digital workflows as the default mode for bespoke residential and boutique commercial projects.

Rapid Mid-Income Urban Housing Boom in Southeast Asia

Indonesia reported construction representing 10.23% of GDP in Q1 2024 while Vietnam initiated over 600,000 social housing units during H1 2025, setting a long-tail demand curve for mid-priced wallcoverings that balance aesthetics with affordability. Government programs such as Indonesia's One Million House plan and Qatar-backed financing channels lift first-time buyers' purchasing power, steering them toward branded yet cost-effective decor choices. Asian Development Bank forecasts 4.5% regional GDP growth for 2025, underpinning discretionary renovation spending. International producers answer with regional plants that dodge tariffs and shorten lead times, while local brands exploit import substitution incentives. Millennials' online buying habits drive traffic to digital customization platforms, further intensifying the pull on digitally printed offerings.

Easy Availability of Substitutes in the Market

Paints, decorative panels, and digital displays constantly upgrade value propositions, eroding wallpaper's share where maintenance simplicity or interactive content holds sway. Sherwin-Williams Paint Shield introduces microbicidal functions directly into paint, killing 99.9% of bacteria in 2 hours and capturing budgets once reserved for specialty wallcoverings. Textured paints, wall decals, and living-plant walls fulfil biophilic design briefs, while modular panel systems allow offices to reconfigure spaces overnight. The broadening substitute set compels wallpaper producers to stress tactile depth, material circularity, and installation efficiency.

Other drivers and restraints analyzed in the detailed report include:

- Hospitality Refresh Cycles Driving Premium Commercial Wallpaper in GCC and ASEAN

- Retail Visual-Merchandising Shift to Peel-and-Stick Vinyl in the U.S.

- Vinyl-Chloride Price Volatility Compressing Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-woven products opened 2025 with a 6.06% CAGR outlook, eclipsing overall wallpaper market growth as breathable, dimensionally stable substrates simplify installation and removal tasks. Premium installers champion the category because dry-strippable properties cut labour by up to 30%. Vinyl retained 32.43% wallpaper market share in 2024 thanks to hospital-grade durability and cost competitiveness, yet environmental scrutiny intensifies calls for bio-PVC, recycled PET, and solvent-free inks. Paper-based lines contract, surviving mostly in heritage residences where authenticity tops maintenance ease. Fabric surface coverings serve niche luxury spaces, offering tactile warmth and built-in acoustic dampening. Borastapeter's Viared facility illustrates technical diversity, running surface, gravure, screen, and digital presses under one roof to match each material's printability.

Non-woven momentum intersects sustainability regulation, prompting marketing pivots toward FSC-certified fibres and water-based adhesives. The segment's agility allows quick adoption of antimicrobial chemistries or peel-and-stick adhesives, widening end-use scope from rental apartments to pediatric clinics. Vinyl innovators respond with phthalate-free formulations and energy-saving emboss cures to defend share. Emerging composites such as metallic foils or glass fibre reinforced sheets target functional niches demanding fire retardancy or electromagnetic shielding.

Digital technologies captured 58.42% of production in 2024 and are adding 7.32% annually, transforming the wallpaper market into a make-to-order paradigm. Inkjet heads paired with UV-curable chemistries deliver immediate curing and vibrant colour saturation on diverse substrates, while latex systems comply with low-VOC codes. Canon's guidance confirms that digital eliminates plates, enabling batch sizes from a single customised roll to mid-volume hospitality orders without setup penalties. Screen printing retains pockets where rich ink laydown and special effects are still unrivalled, particularly for heritage damasks. Flexography holds ground in long-run commercial corridors where precision repeatability justifies cylinder investments. Hybrid lines emerge, integrating single-pass digital units ahead of conventional stations so bespoke motifs overlay mass-printed bases.

Rapid proofing loops and AI colour-matching software compress concept-to-market timelines from months to days, letting designers react to viral trends. Cost advantages extend beyond inventory: digital short-run capabilities reduce working capital and shrink obsolete stock write-offs. Meanwhile, UV-LED lamp efficiencies drop energy bills, helping printers meet carbon-neutral targets. Octink's 50-year trajectory shows legacy shops can retrofit for digital without surrendering printcraft heritage.

The Wallpaper Market Report is Segmented by Wallpaper Type (Vinyl, Non-Woven, Paper-Based, Fabric, Other), Printing Technology (Digital, Screen, Flexographic, Other), End User (Residential, Commercial), Distribution Channel (Direct Sales, Indirect Sales), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led 2024 shipments on the back of established renovation culture and early adoption of digital-print workflows. The U.S. peel-and-stick craze, fuelled by flexible retail concepts, bolsters forecast demand despite raw-material cost swings. Canada's construction-materials market expects 4.5-5.5% growth through 2026, adding institutional projects to the addressable base. Mexico emerges as a near-shoring hub, providing cost-efficient production for premium U.S. brands looking to mitigate Asian freight volatility. York Wallcoverings consolidates regional leadership after acquiring independent surface-print operations, strengthening local supply chains.

Europe preserves a strong pricing premium through design heritage and stringent eco-regulation. Germany and Italy push solvent-free print mandates, prompting accelerated adoption of water-based inks. United Kingdom interiors celebrate artisanal revival, evident in Sanderson's wool-inspired Orwell Weaves and Country Woodland launches. Southern markets such as Spain emphasise UV-stable outdoor wall applications to complement hospitality terraces. Eastern Europe's demand fluctuates with currency swings, though renovation subsidies in Poland and Czechia cushion volume declines. Circular-economy directives drive producers to certify cradle-to-cradle substrates and pilot take-back schemes.

Asia-Pacific records the steepest volume climb; Indonesia plans to deliver three million homes yearly while Vietnam's social housing targets add hundreds of thousands of units. China's domestic appetite strengthens alongside export output, sustaining mega-scale lines that benefit from economies of scope. India's decorative coatings leader Asian Paints leverages omnichannel reach to cross-sell wallpaper bundles under its services arm. Mature markets Japan and South Korea favour high-function products: Sangetsu's recycled-PET glass films meet low-carbon building codes while offering UV heat-shielding. Australia pivots to fire-retardant wall fabrics for bushfire-vulnerable regions, enriching the functional niche. Collectively, the region's 2,074-project hospitality pipeline through Q1 2025 guarantees sustained contract volumes.

- Sangetsu Corporation

- York Wall Coverings Inc.

- A.S. Creation Tapeten AG

- Brewster Home Fashion LLC

- Grandeco Wallfashion Group

- Erismann & Cie. GmbH

- Sanderson Design Group PLC

- Tapetenfabrik Gebr. Rasch GmbH & Co. KG

- Marshalls Wallcoverings

- Asian Paints Ltd (Nilaya)

- Eximus Wallpaper

- Gratex Industries Ltd

- Graham & Brown Ltd

- Wallquest Inc.

- Adornis Wallpapers

- Arte International

- 4walls

- Omexco NV

- Life n Colors Private Limited

- Komar Products GmbH

- Houfling GmbH (Hohenberger)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Demand for Digitally-Printed Personalised Decor in North America and Europe

- 4.2.2 Rapid Mid-Income Urban Housing Boom in Southeast Asia

- 4.2.3 Hospitality Refresh Cycles Driving Premium Commercial products in GCC and ASEAN

- 4.2.4 Retail Visual-Merchandising Shift to Peel-and-Stick Vinyl in the U.S.

- 4.2.5 Adoption of Antimicrobial Coated Wallcoverings in Healthcare Renovations

- 4.3 Market Restraints

- 4.3.1 Easy Availability of Substitues in the Market

- 4.3.2 Vinyl-Chloride Price Volatility Compressing Margins

- 4.3.3 Shorter Life-span on Exposure to Heat and Moisture

- 4.4 Supply-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Vinyl

- 5.1.2 Non-woven

- 5.1.3 Paper-based

- 5.1.4 Fabric (Silk, Linen, etc.)

- 5.1.5 Other wallapaper Type

- 5.2 By Printing Technology

- 5.2.1 Digital (Inkjet/EP)

- 5.2.2 Screen

- 5.2.3 Flexographic

- 5.2.4 Other Printing Technology

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 -Hospitality

- 5.3.4 - Corporate Office Space

- 5.3.5 -Salons and Spas

- 5.3.6 - Hospitals

- 5.3.7 -Other End User

- 5.4 By Distribution Channel

- 5.4.1 Direct Sales

- 5.4.2 Indirect Sales

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Sangetsu Corporation

- 6.4.2 York Wall Coverings Inc.

- 6.4.3 A.S. Creation Tapeten AG

- 6.4.4 Brewster Home Fashion LLC

- 6.4.5 Grandeco Wallfashion Group

- 6.4.6 Erismann & Cie. GmbH

- 6.4.7 Sanderson Design Group PLC

- 6.4.8 Tapetenfabrik Gebr. Rasch GmbH & Co. KG

- 6.4.9 Marshalls Wallcoverings

- 6.4.10 Asian Paints Ltd (Nilaya)

- 6.4.11 Eximus Wallpaper

- 6.4.12 Gratex Industries Ltd

- 6.4.13 Graham & Brown Ltd

- 6.4.14 Wallquest Inc.

- 6.4.15 Adornis Wallpapers

- 6.4.16 Arte International

- 6.4.17 4walls

- 6.4.18 Omexco NV

- 6.4.19 Life n Colors Private Limited

- 6.4.20 Komar Products GmbH

- 6.4.21 Houfling GmbH (Hohenberger)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment