PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642949

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642949

UK Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

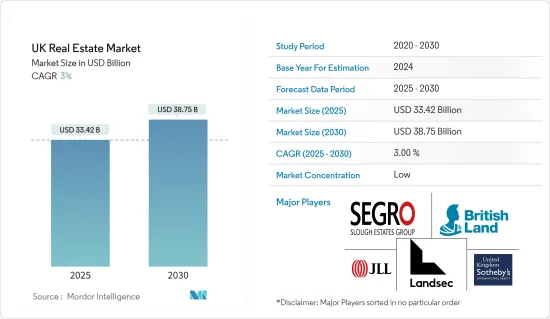

The UK Real Estate Market size is estimated at USD 33.42 billion in 2025, and is expected to reach USD 38.75 billion by 2030, at a CAGR of 3% during the forecast period (2025-2030).

The UK real estate market is undergoing significant changes, driven by economic dynamics, policy shifts, and evolving consumer preferences. As housing demand surges, especially in regions beyond London, builders are intensifying their construction activities. There's a pronounced push for affordable housing in suburban locales, prompting major developers to extend their operations beyond the capital. Concurrently, the commercial real estate arena is gravitating towards sustainability, with firms increasingly favoring eco-friendly office spaces to cater to the rising demand for green buildings. These trends are redefining both the residential and commercial property landscapes in the UK.

Highlighting this transformation, Taylor Wimpey has upped its 2024 housing completion targets, anticipating a notable uptick in homebuilding, especially in suburban and regional locales. This adjustment is spurred by favorable national planning reforms and a hopeful outlook on declining interest rates, bolstering confidence in housing growth outside London. On the commercial front, British Land is pivoting towards sustainable office spaces, directly addressing tenant demands for green, energy-efficient buildings and the sector's responsibility to align with the UK's ambitious climate goals.

In the luxury segment, demand remains strong in locales like Mayfair and Knightsbridge, driven by high-net-worth individuals. Mace's EUR 2 billion (USD 2.1 billion) luxury project in Mayfair, with properties starting at EUR 35 million (USD 36.77 million), underscores the segment's resilience. This market continues to allure both domestic and international buyers, highlighting the lasting allure of prime central London real estate. The rising demand for luxury homes, alongside heightened sustainability efforts in both residential and commercial sectors, paints a vibrant picture of the 2024 real estate landscape.

UK Real Estate Market Trends

The Shift in the UK Commercial Real Estate Market Towards Sustainability and Urban Logistics

The UK commercial real estate market is shifting towards sustainability and urban logistics. Stricter environmental regulations and urban population growth are driving changes in occupier preferences and investor strategies. Rising energy efficiency standards and limited urban industrial land are accelerating this trend, emphasizing adaptability and resilience.

Sustainability is a key focus. Developers and landlords must meet tighter Minimum Energy Efficiency Standards (MEES), requiring commercial properties to achieve an EPC rating of C or higher by 2028. An October 2024 report highlighted surging demand for "grade A" logistics spaces with strong sustainability credentials, reflecting occupiers' eco-conscious priorities.

Urban logistics is also shaping the market. Growing urban populations and limited industrial land are intensifying logistics land use. A September 2024 analysis noted satellite towns near London as cost-effective options for occupiers, offering affordable rents and urban accessibility.

Speculative developments have declined in 2024, with only 22 million sq ft expected to complete, down from 33.2 million sq ft in 2023. Rising construction costs and economic uncertainties are key factors. However, urban logistics projects, including warehouses and distribution centers, continue to attract investors seeking long-term value growth.

Growth in Valuation and Appraisal Services Amid Market Volatility

In the UK real estate market, the valuation and appraisal services segment is experiencing significant growth, fueled by an increasing demand for precise property assessments. The ongoing uncertainties related to inflation, fluctuating interest rates, and evolving market dynamics have heightened the reliance on professional valuation services, which are now critical in supporting informed investment and lending decisions.

Institutional investors, in particular, are driving this demand as they reassess their portfolios to adapt to market changes. In November 2024, the demand for valuation services surged due to increased variability in commercial property prices, especially within the retail and office segments. This development highlights a broader trend where investors are increasingly depending on appraisals to effectively navigate the complexities of fluctuating asset values and mitigate associated risks.

Additionally, a marked rise in transaction volumes has further strengthened this segment. By October 2024, commercial property sales had notably increased, with the logistics sector standing out as a key area of activity. Investors are actively competing for high-quality, sustainable assets, driving the need for timely and accurate appraisals. These appraisals play a pivotal role in streamlining transaction processes and ensuring that investment decisions are backed by reliable data.

The influence of regulatory compliance on valuations has also become a critical factor. With the introduction of stricter environmental and energy efficiency standards, sustainability metrics are now an integral part of valuation processes. By September 2024, property owners were increasingly seeking detailed assessments to evaluate refurbishment costs required to meet these regulatory benchmarks. This shift underscores the growing importance of aligning property valuations with evolving compliance requirements to maintain market competitiveness.

UK Real Estate Industry Overview

The UK real estate services market is fragmented in nature due to the presence of both international and local players. Some of the prominent players in the industry are Knight Frank, Savills Ltd, Interserve, and regional players like Atalian Servest Ltd, Notting Hill Genesis, etc. Mortgage rates have been on the rise for the past year, and coupled with the current cost of living crisis, many people have stayed away from the property market, resulting in fewer transactions and an end to a two-year cycle of 20% price growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Economic Scenario

- 4.2 Real Estate Buying Trends - Socioeconomic and Demographic Insights

- 4.3 Government Initiatives and Regulatory Aspects for Real Estate Sector

- 4.4 Insights into Existing and Upcoming Projects

- 4.5 Insight into Interest Rate Regime for General Economy and Real Estate Lending

- 4.6 Insights into Capital Market Penetration and REIT Presence in Real Estate

- 4.7 Insights into Rental Yields in Real Estate Segment

- 4.8 Insights into Public-Private Partnerships in Real Estate

- 4.9 Insights into Real Estate Tech and Startups Active in Real Estate Segment (Brokerage, Social Media, Facility Management, and Property Management)

- 4.10 Impact of Geopolitics and Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Improvements in Infrastructure and New Development

- 5.2.2 Population Growth and Demographic Changes

- 5.3 Market Restraints

- 5.3.1 Housing Shortages

- 5.3.2 Increasing Awareness towards Environmental Issues

- 5.4 Market Opportunities

- 5.4.1 Technological Advancements

- 5.5 Porter's Five Forces Analysis

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Buyers/Consumers

- 5.5.3 Bargaining Power of Suppliers

- 5.5.4 Threat of Substitute Products

- 5.5.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 Property type

- 6.1.1 Residential

- 6.1.2 Commercial

- 6.1.3 Other Property Types

- 6.2 Service

- 6.2.1 Property Management

- 6.2.2 Valuation

- 6.2.3 Other Services

7 COMPETITIVE LANDSCAPE

- 7.1 Overview

- 7.2 Company Profiles

- 7.2.1 Derwent London

- 7.2.2 Bridgewater Housing Association Ltd

- 7.2.3 Sanctuary Housing Association

- 7.2.4 Capital & Counties Properties PLC

- 7.2.5 British Land

- 7.2.6 Berkeley Group Holdings PLC

- 7.2.7 Home REIT

- 7.2.8 Rightmove

- 7.2.9 Shaftesbury PLC

- 7.2.10 Tritax Big Box Reit PLC

- 7.2.11 Unite Group PLC

- 7.2.12 Wayhome*

- 7.3 Other Companies

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX