PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642941

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642941

United States Small Kitchen Appliances - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

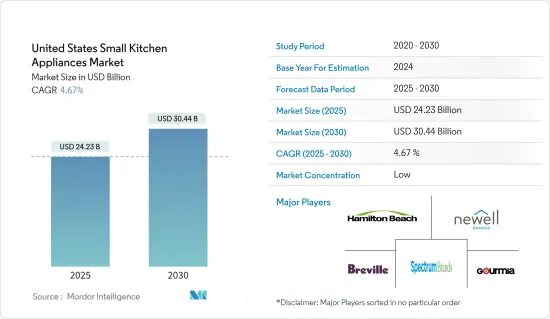

The United States Small Kitchen Appliances Market size is estimated at USD 24.23 billion in 2025, and is expected to reach USD 30.44 billion by 2030, at a CAGR of 4.67% during the forecast period (2025-2030).

Shifting consumer buying patterns, particularly the rising trend of purchasing houseware online, present both opportunities and uncertainties for the growth of the small appliance category and its retailers. Industry leaders are prioritizing innovation to cater to the evolving tastes of consumers in the studied market. Online sales of small kitchen appliances are on the rise this year. In the United States, sales of small kitchen appliances saw a significant boost, driven by a surge of e-commerce platforms providing enticing deals and discounts. With many companies rolling out new small kitchen appliances, the market is poised for further growth.

The US small kitchen appliances market has experienced significant growth over the past few years. Increasing disposable incomes, a growing interest in home cooking, and the convenience offered by online shopping have contributed to this upward trend. Consumers are increasingly seeking innovative and multifunctional appliances that can simplify their cooking processes and save time. Additionally, the market has seen a rise in demand for energy-efficient and smart kitchen appliances. Manufacturers are responding by introducing products that integrate advanced technologies, such as IoT and AI, to enhance user experience. Such trends are expected to continue, driving the market's growth during the forecast period.

United States Small Kitchen Appliances Market Trends

Growing Preference for Small Kitchen Appliances Among Millennials is Driving the Market

Eco-conscious millennials prefer small-space appliances because they consume less energy than their full-sized counterparts. These compact appliances, ranging from 18 to 28 inches wide, include refrigerators, ranges, exhaust hoods, dishwashers, built-in coffee makers, and washers and dryers. As millennials increasingly opt for multi-functional appliances or upgrade from traditional models, the trend of small kitchen appliances has gained significant traction. Consequently, this rising preference among US millennials is a primary driver for the market in focus. Technological advancements, especially in voice control and artificial intelligence, have elevated the significance of AI-enabled kitchen appliances, positioning them as central control hubs for connected homes. Devices like Alexa, Siri, and OK Google, which can command kitchen appliances, are poised to revolutionize the market.

Modern coffee machines are swiftly overtaking traditional ones, catering to today's fast-paced consumers with quicker and more convenient brews. The instant pot stands out by merging the functionalities of a pressure cooker, slow cooker, rice cooker, and more into one device.

Rising Disposable Income is Driving the Demand for Small Kitchen Appliances

As household incomes rise, consumers increasingly invest in appliances that boost convenience and efficiency in food preparation. Innovations like smart technology and cordless options further bolster this trend, aligning with the fast-paced lifestyles of modern households. The demand is also fueled by a preference for multifunctional appliances that streamline meal preparation. Additionally, evolving family dynamics, especially the surge in dual-income households, have heightened reliance on small kitchen appliances for daily cooking. With both partners juggling work commitments, there is a pivot toward appliances that simplify kitchen tasks.

Key drivers for the surging demand for smart kitchen appliances encompass rising internet penetration, an uptick in mobile device availability, advancements in wireless communication, the advent of cloud services, a push for energy-efficient technologies, and broader IoT advancements. Furthermore, the escalating appetite for smart home devices has naturally increased the demand for smart kitchen tools. The realm of smart speaker technology is witnessing rapid evolution, with daily introductions of new specifications and innovations.

United States Small Kitchen Appliances Industry Overview

The report covers major international players operating in the US small kitchen appliance market. The market is fragmented, with no players holding a major share of the market. Some of the key players in the market are Hamilton Beach Brands Holding Company, Newell Brands, Spectrum Brands, Breville Group Limited, and Gourmia. However, with technological advancement and product innovation, midsize to smaller companies are increasing their market presence by securing new contracts and tapping new markets. Companies are adopting a sustainable approach to production, integrating technology with appliances and nearshore manufacturing are the major trends witnessed in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Disposable Income and Urbanization are Driving the Market

- 4.2.2 Rising Residential Real Estate is Driving the Demand for Small Appliances

- 4.3 Market Restraints

- 4.3.1 Changing Customer Preferences can Restraint the Growth of the Market

- 4.4 Market Opportunities

- 4.4.1 Growth in Smart Home and Kitchen Appliances

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights into Latest Technological Innovations and Recent Trends in the Market

- 4.7 Insights on Government Regulations in the Industry

- 4.8 Impact of the COVID-19 Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Products

- 5.1.1 Coffee Makers

- 5.1.2 Food Processors

- 5.1.3 Toasters

- 5.1.4 Grills and Roasters

- 5.1.5 Tea Makers/Electric Kettles

- 5.1.6 Other Small Kitchen Appliances

- 5.2 By Distribution Channel

- 5.2.1 Multi-brand Stores

- 5.2.2 Specialty Stores

- 5.2.3 Online

- 5.2.4 Other Distribution Channels

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Hamilton Beach Brands Holding Company

- 6.2.2 Newell Brands

- 6.2.3 Spectrum Brands

- 6.2.4 Breville Group Limited

- 6.2.5 Gourmia

- 6.2.6 Smeg SpA

- 6.2.7 Electrolux AB

- 6.2.8 Whirlpool Corporation

- 6.2.9 Cuisinart

- 6.2.10 Panasonic Corporation*

7 FUTURE MARKET TRENDS

8 ABOUT US