Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642171

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642171

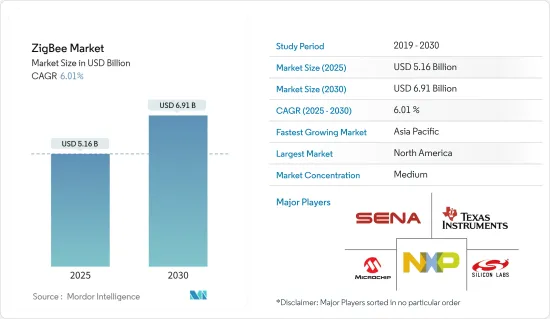

ZigBee - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The ZigBee Market size is estimated at USD 5.16 billion in 2025, and is expected to reach USD 6.91 billion by 2030, at a CAGR of 6.01% during the forecast period (2025-2030).

Key Highlights

- The surge in smart home device adoption globally is set to propel the demand for ZigBee-enabled devices in the coming years. With the smart home market expanding at a rapid pace, the need for smart consumer electronics and appliances that seamlessly integrate with home networks is on the rise. Utilizing the ZigBee protocol allows users to remotely control a range of home appliances, from lighting and HVAC systems to safety equipment, bolstering energy efficiency and curbing power wastage.

- Due to the expanding trend toward smart device adoption, the growing consumer electronics sector is predicted to boost the implementation of ZigBee-based communication services used for monitoring and controlling devices based on IEEE 802.15.4 throughout emerging countries.

- With significant advancements, the market is expected to be driven by growing demand for the ZigBee wireless network deployment on a large scale using low-cost, low-power solutions that can run for years on inexpensive batteries for a variety of monitoring and control applications across smart energy/smart grid and building automation systems.

- The acceptance of smart sensor technologies increases in connection, and breakthroughs in cloud computing have all aided in the acceptance and expansion of Industrial IoT. This trend is also predicted to increase ZigBee adoption in tiny industrial settings where manufacturing gadgets must interact over short distances. ZigBee is based on the 802.15.4 protocol, although security is not effectively handled by ZigBee developers. This vulnerability has piqued the interest of many information security professionals, who are investigating the security capabilities of the 802.15.4 protocol and the implementation of ZigBee radios in IoT devices.

- According to Ericsson Mobility report 2023, the Massive IoT technologies NB-IoT and Cat-M supporting wide-area use cases involving large numbers of low-complexity, low-cost devices with long battery lives and low-to-medium throughput continue to be rolled out across the world. Globally, 128 service providers have deployed or commercially launched NB-IoT networks, 60 have launched Cat-M, and 45 have deployed both technologies. The total number of cellular IoT connections is forecasted to reach around 3 billion at the end of 2023. The growth of massive IoT technologies is enhanced by added capabilities in the networks, enabling massive IoT to co-exist with 4G and 5G in frequency division duplex (FDD) bands via spectrum sharing.

ZigBee Market Trends

The Residential Automation Segment is Expected to Hold a Significant Share of the Market

- As the burden on available resources increases owing to urban population growth, there is a need for resource monitoring. As the Internet of Things (IoT) can gather data from sensors embedded in smart devices, it serves as the foundation for digital services that can aid in developing smart cities. IoT has given rise to many linked smart gadgets that are quickly becoming indispensable in modern households. The World Bank expects smart cities to contribute around 60% of global GDP by 2025.

- Smart buildings can also be linked to a smart grid, allowing smart building components and the electric grid to interact. This technology allows for more effective energy distribution, proactive maintenance, and swifter power outage resolution. The increased use of connected devices has resulted in the adoption of ZigBee, which aids in the proliferation of smart hubs. Amazon Echo, Google Home, Insteon Hub Pro, Samsung SmartThings, and Wink Hub are examples of smart home hubs.

- In addition, Tuya, a global vendor of tailored IoT platforms, provides a smart home automation hub. The technology will be equipped with Pegasus technology, which enables multiple smart home devices and comes with a Gigabit router and ZigBee gateway. Apart from platform and technology vendors, appliance manufacturers are incorporating ZigBee technology in their offerings. For example, XAL, an electronics manufacturing company whose major offerings are lighting systems, is increasingly offering ZigBee open communication standards along with DALI in its offerings.

- Furthermore, the Internet of Things (IoT) is rapidly becoming a reality, fueled by the rising significance of smart home gadgets and a surging consumer appetite for automation, aiming at both convenience and energy efficiency. The concept of connected living is taking center stage, primarily due to its capacity to bolster home residents' security. Notably, technological strides are spurring the uptake of these smart devices, which have a diverse array of applications within the connected home framework.

- Further, according to the US Census Bureau, the number of housing units in the United States has been growing Y-o-Y, and there were approximately 144 million homes in the past year. Further, in August 2023, approximately 114,200 home constructions started in the United States. Such a rise in residential construction is expected to create an opportunity for the studied market to grow. According to the 2024 State of Digital Nomads, London was the most visited city by digital nomads as of March 2024, accounting for roughly 2.3% of trips by digital nomads across the world. Such developments toward digital nomads are expected to drive the market studied.

North America is Expected to Account for the Most Significant Share in the Market

- North America is one of the prominent markets, owing to the growing need for advanced technology by numerous end-user industry players in the region. Additionally, the evolution of high-speed networking technologies in the area is aiding the market's growth. The retail sector is embracing domotics and automation for smart homes. It has a home automation system that controls the lights, entertainment system, appliances, and house climate. For instance, Philips Lighting Holding BV offers Hue, a smart lighting system that can see when residents are in the room and adjust lighting as needed.

- The IT and telecommunications sector is poised to dominate the market, driven by a rising appetite for network hardware integrating the ZigBee protocol. Silicon Labs' chips in products like Samsung's Smart Hub and Google's Wi-Fi router support BLE and ZigBee Pro. Furthermore, the ZigBee Alliance's "All Hubs Initiative" aims to bolster reliability, interoperability, and security across ecosystems. Adding to this momentum, D-Link unveiled its newest solutions featuring ZigBee technology.

- ZigBee's residential automation segment is expected to hold significant demand. An increasing number of vendors are incorporating technology into their offerings and forming alliances with other vendors. Further, according to the US Census Bureau, in August 2023, approximately 114,200 home constructions started in the United States. Such huge construction of new residents in the country would create an opportunity for the market studied to grow.

- The increasing use of IoT in healthcare is helping optimize operations. It offers vital solutions, such as remote monitoring. The usage of these solutions in the sector assists in providing better patient care. The solutions also empower physicians to deliver superlative care by increasing patients' engagement. Governments across the world are increasingly spending on healthcare to make sure that the healthcare benefits reach even the remotest places. This technology enables the healthcare systems to work efficiently. For instance, according to the OECD, the US government spent 16.9% of its GDP on healthcare.

- Further, the advancements of ZigBee would propel the adoption in the region. For instance, in ZigBee 3.0, the ZigBee Cluster Library (ZCL) contains all available clusters and thus provides a complete toolbox from which all devices take their clusters and associated functionality. The ZigBee 3.0 software stack incorporates a 'base device' that provides consistent behavior for commissioning nodes into a network. Further, ZigBee 3.0 supports the increasing scale and complexity of different wireless networks and muddles through large local networks of over 250 nodes. Additionally, ZigBee 3.0 provides enhanced network security.

ZigBee Industry Overview

The ZigBee market is semi-consolidated and consists of a few major players. In terms of market share, several players dominate the industry. However, as communication technology advances throughout the connection medium, new firms are strengthening their market presence and expanding their corporate footprint across emerging nations.

- April 2024: NXP Semiconductors introduces two cutting-edge multiprotocol wireless microcontroller units (MCUs) under its latest MCX W series. These MCUs support a range of protocols, including Matter, Thread, ZigBee, and Bluetooth Low Energy (BLE). The MCX W72x is the pioneer wireless MCU featuring Bluetooth Channel Sounding. NXP is specifically tailoring these offerings for industrial IoT applications. These additions complement NXP's recent releases in the form of the MCX A and MCX N series. Moreover, they leverage NXP's FRDM development platform, which is built on the MCX portfolio's architecture, core, peripherals, and user-friendly MCUXpresso developer experience.

- September 2023: Daikin Australia introduced the new Stylish Controller, available in white (BRC1H63W) and black (BRC1H63K) finishes, equipped with ZigBee 3.0 protocol. This enhancement allows seamless connectivity with a variety of Daikin's wireless sensors. The upgraded model boasts additional features, including an off-timer, a weekly schedule timer, and an improved user interface. Users can easily pair the controller with Bluetooth devices directly from the home screen using the dedicated Daikin App. The controller's ZigBee 3.0 compatibility broadens its connectivity options, supporting a range of wireless sensors. Daikin offers four sensor types: a CO2 sensor (CO2ZB1), a temperature and humidity sensor (H24428), a motion sensor (H74426), and a door/window sensor (DWZB1-CE).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 67134

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Connected Devices Across Industrial Automation and Smart Homes

- 5.1.2 Rising Trend of Low Cost with High Performance Equipment Across IoT Ecosystem

- 5.2 Market Challenges

- 5.2.1 Complexity in the Manufacturing of Networking Equipment With ZigBee Standards

- 5.3 Technology Snapshot

- 5.3.1 Zigbee Mesh Network

- 5.3.2 Zigbee 3.0

- 5.3.3 ZigBee RF4CE

- 5.3.4 ZigBee PRO

- 5.3.5 ZigBee IP

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 IT and Telecommunication

- 6.1.2 Residential Automation

- 6.1.3 Industrial Automation

- 6.1.4 Healthcare

- 6.1.5 Retail

- 6.1.6 Other End-user Industries

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 Italy

- 6.2.2.4 France

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 South Korea

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Mexico

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Texas Instruments Incorporated

- 8.1.2 NXP Semiconductors NV

- 8.1.3 Microchip Technology Inc.

- 8.1.4 Silicon Laboratories Inc

- 8.1.5 Digi International Inc.

- 8.1.6 Sena Technologies Inc.

- 8.1.7 Nordic Semiconductor ASA

- 8.1.8 Qualcomm Technologies Inc.

- 8.1.9 Semiconductor Components Industries LLC (ON Semiconductor)

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.