Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642122

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642122

Transformer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 125 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

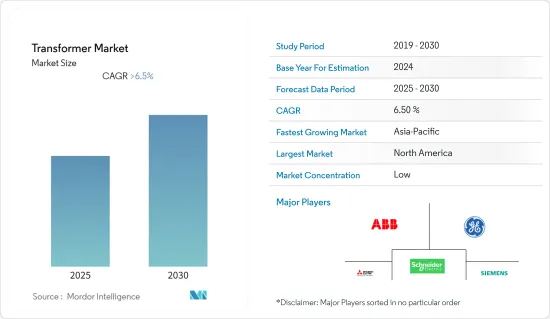

The Transformer Market is expected to register a CAGR of greater than 6.5% during the forecast period.

The outbreak of COVID-19 negatively impacted the market. Currently, the market has reached pre-pandemic levels.

Key Highlights

- The transformers market is mainly driven by the growing power demand in line with the increasing population and a global inclination toward renewable-based power generation and related adjustments in the transmission infrastructure.

- However, challenges like high initial costs are expected to hamper the market growth in the near future.

- Technological innovations like smart transformers for smart grids create opportunities for the transformers market. Smart transformers operate independently to regulate voltage, monitor and manage the power demand fluctuations, and provide feedback in a power supply system. The utility can also have remote access to smart transformers.

- The Asia-Pacific region is expected to dominate the market over the coming years due to growing power demand in rural and semi-urban areas.

Transformer Market Trends

Distribution Transformers Expected to Dominate the Market

- The final voltage transition in the electrical power distribution system is carried out by distribution transformers (DTs). DTs are used to lower the distribution lines' voltage, which is often up to 36 kV, to the level that the client uses.

- In many nations, the expansion of electricity transmission and distribution projects has led to a steady rise in transformer capacity recently. For instance, the distribution network in Mexico's transformer capacity reached 1,14,807 MVA in 2021. The expansion of many other countries' transmission networks resulted in the extensive use of distribution transformers.

- In addition to meeting the need for power during peak hours, utility companies are building distribution voltage regulators to enhance power consumption during off-peak hours. For instance, a distributor of discrete semiconductor components, Diotec Semiconductor, and Mouser Electronics Inc. formed a distribution deal in June 2022 by the contract. Mouser will provide customers with a selection of voltage regulators, rectifiers, FETs, and diodes from Diotec Semiconductor for commercial and industrial applications.

- In April 2021, Italy-based power company Enel announced plans to enter the power distribution business in the US. The company has planned to invest around USD 19.52 billion in distribution networks over the next two years and USD 72.23 billion by 2030.

- Such developments strongly favor high market growth of distribution transformers over the near future.

Asia-Pacific Region Expected to Dominate the Market

- In recent years, many Asian countries have witnessed a continuous expansion in power distribution networks to provide access to power-deprived communities and develop the existing power infrastructure in semi-urban areas.

- The countries with the highest power demand are China and India. The electricity consumption in India in 2021 was around 1191 TWh, whereas that of China was 6752 TWh. The nations plan to expand their electricity networks even more over the coming years.

- In January 2022, Madhya Pradesh Poorv Kshetra Vidyut Vitaran Co Ltd. launched a new tender for the supply of a digital 3-phase distribution transformer for the state power distribution grid of Madhya Pradesh.

- As of May 2022, according to the Central Electricity Authority (CEA), India had a total installed renewable capacity of 159.94 GW. The country is poised to achieve its target of 175 GW of renewable capacity by 2022. In November 2021, the Indian government announced a new non-fossil energy capacity target of 500 GW by 2030.

- In January 2022, the State Grid of China announced the construction of 13 UHV lines (10 AC and 3 DC), having a transformation capacity of 340 million kVA and a total investment of USD 55 billion.

- Owing to such developments, Asia-Pacific is expected to hold the highest share in the transformers market during the forecast period.

Transformer Industry Overview

The global transformer market is fragmented. Some of the major companies include (in no particular order) Siemens AG, ABB Ltd, General Electric Company, Mitsubishi Electric Corporation, and Schneider Electric, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 66746

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products & Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Power Rating

- 5.1.1 Large

- 5.1.2 Medium

- 5.1.3 Small

- 5.2 Cooling Type

- 5.2.1 Air-cooled

- 5.2.2 Oil-cooled

- 5.3 Transformer Type

- 5.3.1 Power Transformer

- 5.3.2 Distribution Transformer

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Asia-Pacific

- 5.4.3 Europe

- 5.4.4 South America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens AG

- 6.3.2 ABB Ltd

- 6.3.3 General Electric Company

- 6.3.4 CG Power and Industrial Solutions Ltd

- 6.3.5 Hyundai Electric & Energy Systems Co. Ltd

- 6.3.6 Toshiba Corp.

- 6.3.7 Hyosung Corp.

- 6.3.8 Bharat Heavy Electricals Limited

- 6.3.9 Schneider Electric SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.